CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Crude Moves Sideways As Focus Remains On Middle East

Amid this, however, what is perhaps the most interesting aspect is the lack of major volatility that has been seen in either Brent or WTI in recent weeks. As the below shows, front WTI has settled into a relatively tight range between $70 - $75bbl since the start of December, having more than erased the brief supply-worry induced pop higher at the beginning of the Israel-Gaza conflict, with very few forays outside of those handles.

At this point it’s important to note that the oil market is notoriously poor at pricing risk related to supply disruption, tending to over-react the moment a potential geopolitical flashpoint erupts, before that pop higher is often given back, and more. Of course, usual caveats around past performance not being a reliable predictor of the future must apply.

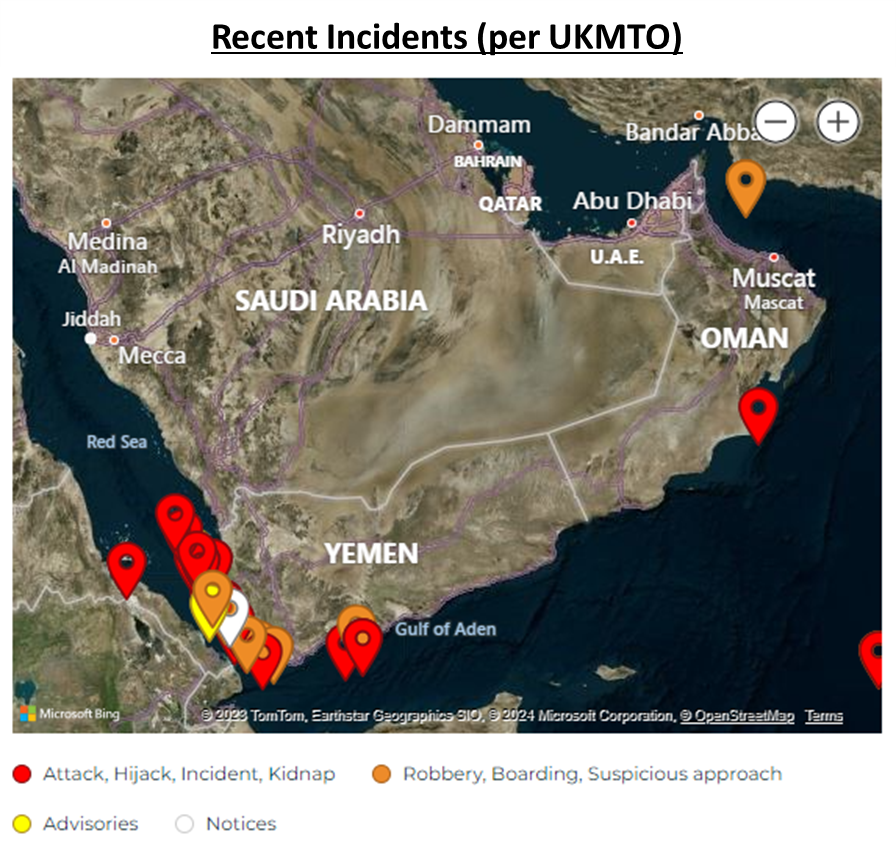

It’s also worth noting that, particularly in this current instance of Middle East tension, the present risks are largely on the ‘wrong’ side of the region to have a significant impact on crude supply. The Levant, firstly, is not a major oil, or gas, producer, hence developments solely pertaining to the Israel-Gaza conflict are unlikely, at this stage, to cause a significant impact on price. Furthermore, the ongoing Houthi attacks on shipping are concentrated primarily on the Red Sea, namely the Bab al-Mandab strait, while apparently targeting mainly bulk carriers, rather than tankers.

There are, however, some tentative signs that look to be emerging which may signal this dynamic beginning to change. For example, last week saw the Iranian Navy seize a tanker carrying Iraqi crude off the coast of Oman, in the Strait of Hormuz. While it has since emerged that the seizure is related to a long-running US-Iran dispute that stretches back to last year, it has nonetheless further raised tensions, this time on the other side of the Middle East.

For crude traders, this latest development is likely to be of much more concern, given the Strait of Hormuz’s status as the world’s most important oil transit chokepoint, seeing around 21mln bpd flow through its waters, equivalent to over 20% of global supply. Hence, it is logical to expect that any further such incidents in this area pose a much greater upside risk to price.

In any case, it would appear that the primary driver of the oil market at present is the demand, not the supply side.

On this note, incoming data seemingly gives little hope for the bulls, with manufacturing PMIs across developed markets remaining substantially below the 50.0 mark in December; recent regional manufacturing surveys in the US pointing to little sign of improvement, including the NY Fed’s index falling to its lowest level since the pandemic; and, last but by no means least, China’s economy continuing to struggle, with signs of a sustained economic recovery remaining incredibly thin on the ground, despite ever-increasing amounts of government stimulus being thrown at the problem.

The balance of risks, then, at the current juncture, from a fundamental point of view, appears to point to the downside. The technical backdrop would also align with this view, with price having failed on two straight days to notch a close above the 50-day moving average, implying that the bears currently have the upper hand.

Nevertheless, as is always the case with geopolitical events, it is important to caution that the situation remains fluid, volatile, and fast-moving. Hence, the need to remain nimble when trading assets impacted by such events is high, with a fixed view – in either direction – unlikely to serve market participants well, until tensions simmer down, and a degree of geopolitical stability returns.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.