CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Despite the coronavirus outbreak and fear of the potential economic fallout, there is a theory that investors are maintaining their core exposure to equity while hedging their risk using gold and US Treasury.

Bullish price action

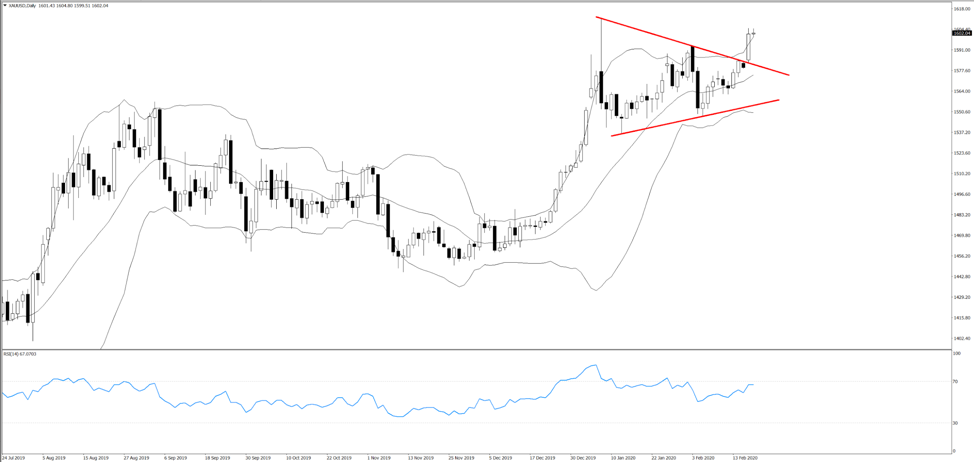

The breakout above the triangle on the daily chart after a multi-week price consolidation strongly suggests a continuation of the rally coming from $1445 last November, with the RSI developing firmly into bullish territory and price running along the top end of the Bollinger Bands. Should the price pull back to test the top band and rebound again, we can confirm the strong support here. The next key level is a 2020 high of $1611, reached on January 8, and a break here will open the door to $1700.

Negative real US Treasury yields

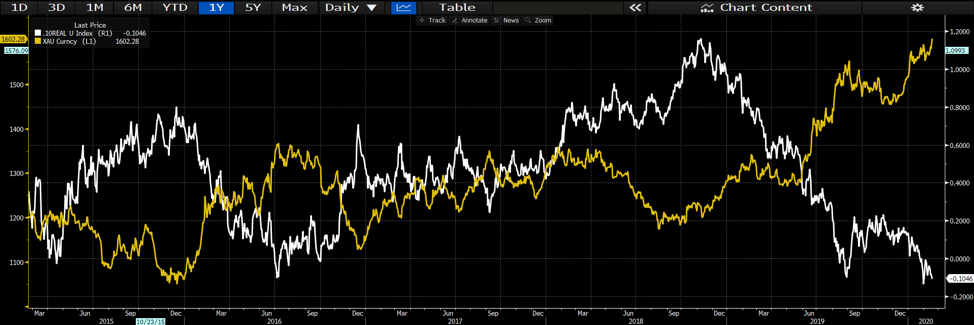

Gold doesn’t generate income, hence a non-yield asset. However, compared to ever lower and ever-greater negative bond yields, holding gold in itself is a kind of ‘yield’ and the opportunity cost is relatively low. Therefore, it’s not hard to understand the chart below, where we see a negative correlation between 10-year ‘real’ (i.e inflation-adjusted) yield (white) and gold price (yellow).

Bloomberg: gold in yellow; 10-year real yield in white

Should we see the 10-year real yield continue to lower, then gold will likely only head higher.

Fed rate policy

Despite the recent upbeat US jobs data, the Fed’s preferred measure of inflation, personal consumption expenditure (PCE) is sitting at 1.6%, below the Fed’s 2% inflation objective. Federal Reserve Chairman Jerome Powell mentioned that the coronavirus poses a risk to global economic growth, and will “very likely be some effects on the United States.”

If the market starts to see real evidence that the measures imposed by the Chinese authorities impact not only Asia and European data, but the US too, threatening the US labor market, then the Fed might come out and reconsider its monetary policy stance future adjustment. The market shows Fed rate cut probability for the March, April and June meetings sitting at 12.6%, 32.5%, and 59.2%, with nearly two cuts expected over the next 12 months. Should the data turn, the market will only increase its expectations of easing and gold will find further support.

Will the trend continue?

For now, the US market is the ideal place to park money and gold is acting as a hedge against economic fragility. Other than profit-taking there are no obvious reasons for a lasting reversal, especially with the market expecting poor data to come from China (Manufacturing and service PMI) and its trading partners like Korea, Taiwan, EU, and the US.

Given the lingering macro uncertainty, gold's appeal as a hedge and diversifier remains the focus. So we expect XAUUSD to stay resilient despite a strong dollar and equities hovering at all-time highs.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.