CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

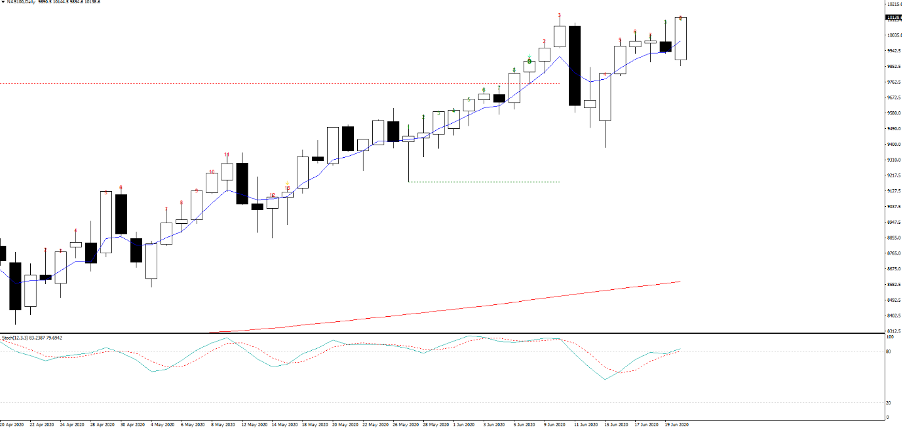

If I look cross-asset it feels like the bulls have just won a small battle here, with equities working fairly well, especially in the small end of town (the Russell 2000 closed +1.1%) while tech worked nicely (the NAS100 +1.2%), with cash volumes somewhat in line with the 30-day average. I continue to look at the chart of the NAS100 and see a thing of beauty – Flip to the daily and see a bullish outside day reversal, although the weekly shows the pure rhythm and flow - it’s one where we’ll look back forget valuation, forget any traditional fundamentals and just hold the thing…less thinking, more profits.

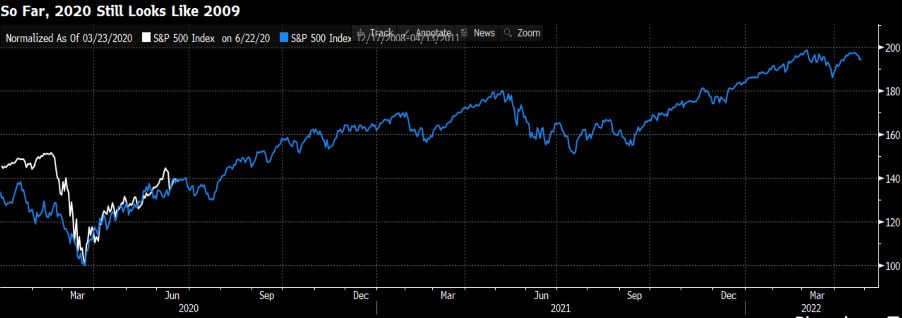

The S&P 500 lagged a touch (+0.6%), held back by financials (-0.5%) and health care (-0.4%), with the outperformance seen in tech, utilities, and consumer names. Everyone loves a spurious overlap of the current tape versus a key period in time, and this from Bloomberg makes me question if what we’re seeing is really a re-run of the move post-2009 – if this continues to track then equities have far more juice in the tank.

Lower equity volatility ahead?

Vols have been offered, with the VIX pushing down 3.38 vols to 31.74%, while on the VIX futures (which is what our price is derived) we see a bearish outside day, and if we see follow-through selling we could see a re-run into 27%. When we consider that the daily implied S&P500 move (higher or lower) portrayed by the VIX index is 2%, then it feels that anecdotally that there are downside risks to the vol index.

Commodities are hot

Our flow in commodities has been strong, with gold getting a strong working over, notably in USD-terms (XAUUSD). We pushed into 1763, although the breakout is not as convincing as I would like to have seen and the 18 May highs are seemingly a tail barrier. It’s hard to be anything but long gold here, especially given the dynamics in the bond market, with 5- and 10-year breakevens (inflation expectations) rising 5bp (0.05%) a piece, and nominal Treasury yields up 1bp across the curve – this has resulted in ‘real’ yields moving lower, and at -79bp (on UST 5yr real) we’re not far from testing the March lows of -84bp.

Real rates are core to markets right now and if yields are going lower then gold will find buyers on weakness and equity will continue to trend.

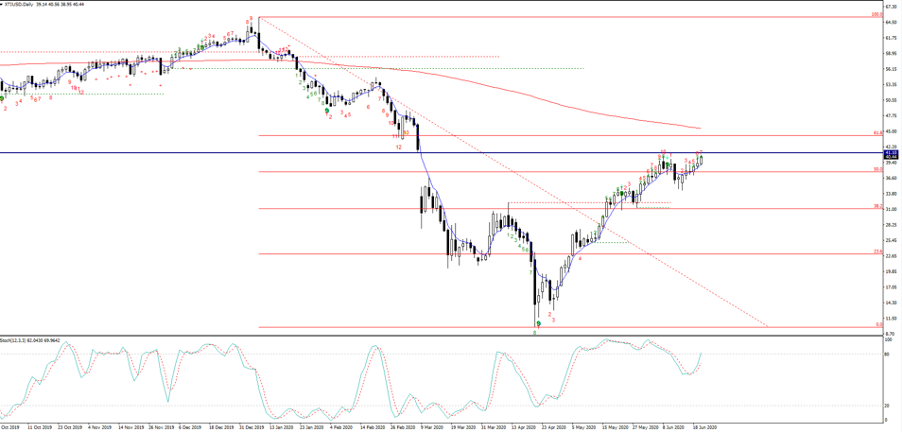

It’s not just gold, but crude has caught a bid and our XTIUSD price (which basically tracks front-month futures) is not just testing the top of its range, but closing the 6 June gap at $41.05. Traders react to behaviour around gaps, it’s a science in trading, but a break here takes us to the 61.8% fibo and 200-Day MA ($44.18 and $45.47).

Copper is now +1.2% at $2.65p/lb – there seems to be a clear message we’re getting from the copper market because the moves I am seeing on the daily look bullish. As suggested yesterday, whatever copper is seeing is not shared by the bond market, which doesn’t seem to be buying the recovery play just yet, with yields unaffected and perhaps that is moving full circle into the risk sentiment.

The secret sauce

Consider this - Commodity prices higher, inflation expectations up (5yr breakevens +5bp at 1.12%, 5y5y forward B/E +4bp at 1.53%, 5y5y swap +4bp at 1.83%), high yield credit 2bp tighter, yet nominal bond yields unnerved. This is where I see the bulls winning a short-term battle.

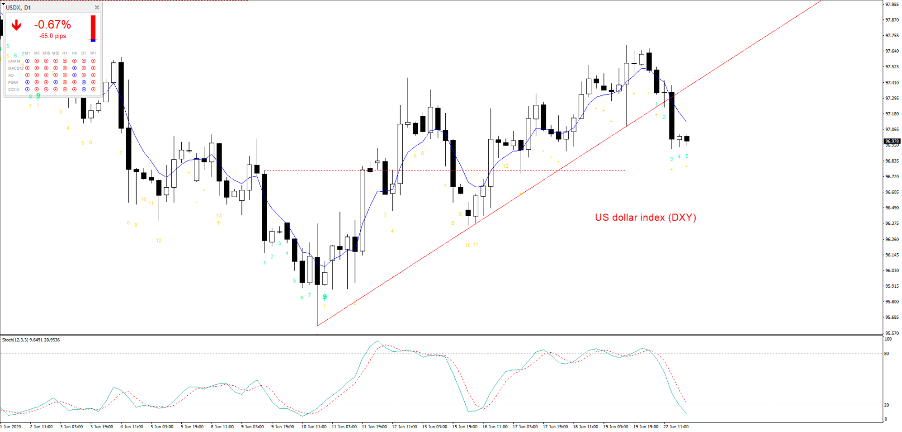

FX moves – the USD sell-off resumes

We can’t leave out FX markets, because the USD is lower by 0.6%, and the dynamics mentioned above have resonated in a bid in risk FX. The lower USD would have fed back into commodity buying and again into lower real yield – it goes full circle. We’ve seen bullish key day reversals in CADJPY, AUDJPY, and EURJPY, so the move to sell JPY shows the bulls are back in the driving seat.

EURUSD stopped shy of printing a bullish outside day, as price failed to make a lower low, but did close firmly above Fridays high – a similar effect. The USDX (USD index) closed through the ST uptrend and we’ll watch for how Asia and EU trade the move – as follow-through will confirm a potential change in structure in the FX market and perhaps allow further USD selling.

For those running EUR or EU equity exposures do consider the key event risk on the docket is the EU PMI data. You can see expectations, and for the EUR to build on the move an upside surprise would clearly help.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.