- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

The Daily Fix: Bulls in full control as a blue wave takes over

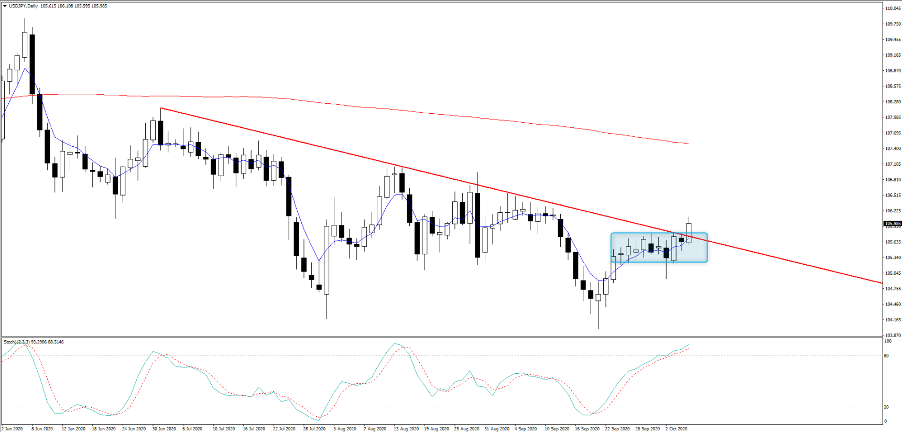

Some talk of fiscal has been in play again, but this has become tiresome and the markets don’t need a reason to rally, they just don’t need to hear negative news. So, in the absence of any we see equities flying and US Treasuries offered – with the Treasury curve steepening 4.5bp. The USDX is unchanged and we’re seeing good buying in the MXN, SEK, NOK, ZAR and AUD. USDJPY has even made a higher high and broken out of its consolidation range and downtrend. Although, my preference is to wait for a re-test of the breakout levels and anyhow, USDJPY 1-week implied volatility is 4.9% which suggests a grind in price at best – akin to watching paint drying.

We’ve seen the thematic of reflation working with US ‘breakeven’ inflation +3bp, while copper is +2.2% and precious metals have caught a further bid, notably silver. The S&P 500 materials space has worked well, putting on 2.6% and continues to be a place I feel will outperform, along with industrials should the markets continue to see the current US political trends evolve. I still like long US2000 and short NAS100 as a pairs trade too.

In equity land, my momo and trend model has a fair amount of green and shows the upbeat flow here, but while the debate on a fiscal stimulus this side of the election rages on, the real question is whether markets are front running a ’blue wave’ scenario? And whether the market is less convinced we will see an ugly contested scenario.

The FOMC minutes delivered us little new news, but one thing is clear, many within the Fed’s ranks have incorporated $1t of fiscal into their models and subsequent economic projections and that is not looking too likely. One can assume this means more Fed action in December, especially if US economics does start to crack.

There was renewed dialogue between Mnuchin and Pelosi in US trade, with an airline bill central focus, which sounded encouraging, but it seems Pelosi was not that interested – again, going to my point yesterday that the DEM’s don’t want a deal.

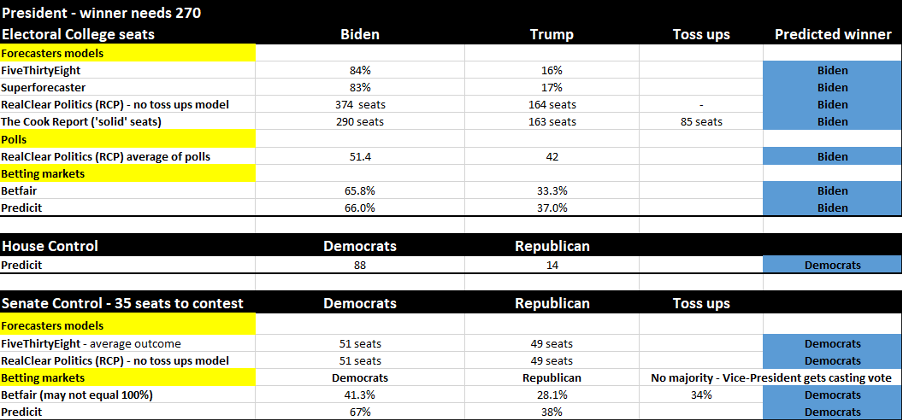

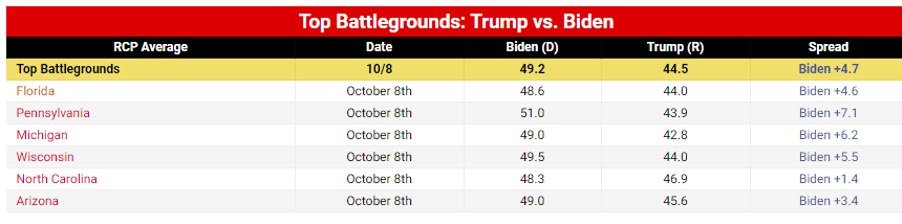

The aggregated model on election dynamics is pulling further towards a convincing Biden win in the White House and an easy win for the House. I have no political allegiance, and it’s always important in trading to have an open mind. The lead in the national poll has widened post the first debate too over nine points and far surpasses the differential seen in 2016. Biden is pulling away in key battleground swing states like Florida, Michigan, Wisconsin, and Pennsylvania.

(Source: Realclear)

Many have pointed to the fact that in 2016 20% of the voters didn’t really like either Trump or Clinton and nearly two-thirds sided with Trump. How many of these will remain loyal? The pollsters see a far lower prospect of polling error this time around for multiple reasons, but there are reasons to believe this will not be 2016 when we look at polling and other data.

Consider when the likes of FiveThirtyEight come up with a probability (currently 84%) they run 40,000 (Monte Carlo) simulations of state elections to assess the distributions and probability of the outcome. In 2016 they had a 30% probability of Trump winning, which was far higher than other models. They obviously don’t have a crystal ball, but this is the outline by how they come to these numbers and the market can use them as a guide to help price risk. It may well prove to be wrong and it's healthy to not blindly follow them, but to dismiss them seems incorrect and it seems the market is certainly watching these models closely.

The Senate is really interesting and the REP will want to defend this with everything they have. Not least because if this goes to the DEMs then it will mean the passage of some of Biden’s more liberal and further left-leaning policy promises will be enacted. As things stand, the REP has 53 (of 100) seats. For background, not all 100 seats are to be contested, but this time around 35 Senate seats are to be fought, with 12 of those currently held by the DEMs and 23 by the REP’s. The pollster’s models have the DEMs winning five seats, although if Biden gets the WH they only need four as VP Harris will get casting vote during voting sessions. In FiveThirtyEight’s simulation (again there cast 40,000 simulations), we see a normal distribution, with the probability skewed for the DEMs to get 51 seats. Let's see, but again statisticians will never say they can see the future, but they run scenarios and there is a method behind this.

One to watch, but it feels like the market doesn’t care about fiscal now, they know it's coming regardless, and they know more central bank action is likely too. Momentum and trend are all the rage. Onto the VP debate at 12:00pm AEDT.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.