- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

I expect the AUD to get some love today as well, with the Aussie September employment report posing an event risk for portfolios at 11:30 AEDT. The market expects 40k net jobs to be lost, however, it’s another report where forecasting is wholly impossible with the distribution of economist’s calls ranging from -123k to +100k, so this sort of distribution tends to lower the likely volatility.

We also hear from RBA Governors Lowe shortly at 9:00am and again that could cement expectations that we’ll see easing in the November RBA meeting – a fate that is largely priced in, with Aussie cash rate futures at 8.5bp and the 3-year govt. bond at 14.2bp.

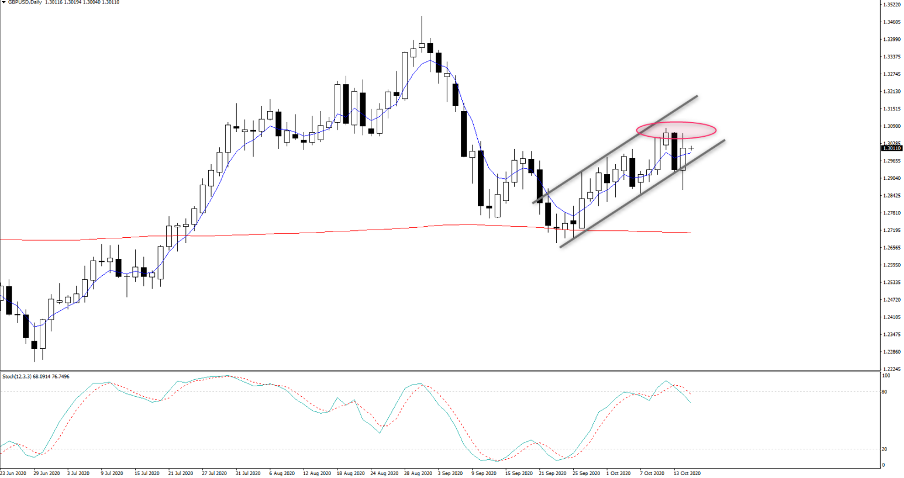

GBP has worked well in a market where FX moves have generally been sanguine, and US equity markets are down smalls (the S&P500 closed -0.7%). The rally from 1.2863 has failed to take out Monday's highs of 1.3072, and this seems the ST line in the sand. The rally likely given some added backbone by the weakness seen in USDCNH, where the USD weakness resonated through G10 crosses.

As I’ve said, GBPUSD is ‘cheap’, positioning is neutral and by and large, funds want to own it. There’s a ton of political premium in the mix, which, in my opinion, should prove to be a GBP positive. However, to get there we’re sailing some choppy waters – a fitting line given fisheries is a key point of contention between the UK and EU. Perhaps unsurprisingly, Boris Johnson has delayed the decision on whether to quit Brexit trade talks and will wait to see the outcome from the EU Summit which kicks off today.

Despite Johnson saying he’s disappointed with the progress, the right noises seem to be heard from key officials and given the rising concerns of COVID 19 into a cold and wet European winter. The last thing either side need, but more so the UK, is a move to WTO tariffs that will impact economics.

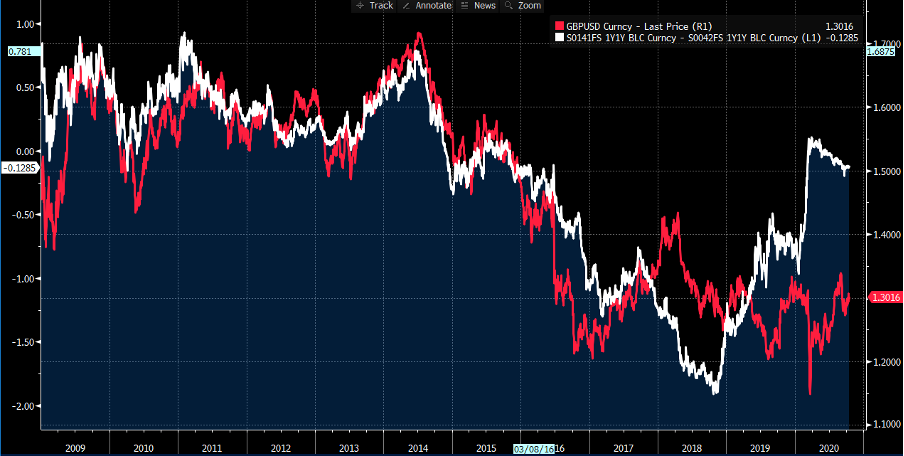

(White – GBPUSD, Red - UK-US 12-month forward rate differentials) (Source: Bloomberg)

(Source: Bloomberg)The prospect of a Free Trade Agreement (FTA) therefore seems high to me, with a back of the envelope probability calculation at 70-80%. The options market ascribes an 11.5% probability we see 1.3500 in cable in a months’ time, which seems a touch low, but then we have the US election to contend with as well as COVID trends and the potential for lockdowns. A break of 1.3082 would be helpful for GBP bulls, as the pair works highs in a bull channel.

(Source: Bloomberg)

Gold is oscillating around the $1900 level and really needs to take out the 50-day MA and 12 October high of 1933. We’ve also got trend resistance here (drawn from the 11 August high), so a break here should get us to $1960 and then onto $2k. There have been no moves to speak of in the US bond market, with yields across the curve unchanged, so the modest offer in the USD has resonated and pushed the yellow metal into the round number. Implied vol in gold is sub-20% again and this covers the US election, so traders are not pricing in explosive moves and the market puts a 15.11% probability we see gold above $2k in a month and 23.2% in 3 months.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.