- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

As of the 14th of October 2022, The NAV (Net Asset Value) is £497.44. This is the price of one share based on the price of the underlying investments.The fund is invested in 2,083 stocks, a highly diversified fund. There is no fee payable on entering and exiting the fund. The ongoing charge is the fee payable over a year.The risk factor is 5 out of scale of 1-7. 1 being low risk and 7 being high.

Figure 1 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund

Objective

The FTSE Developed World ex-UK is an index that is composed of medium to large cap companies from developed markets excluding the United Kingdom. The fund looks to track the index by replicating the same investments as the weighted capital of the index. The fund will remain fully invested except in extraordinary markets/circumstances.

Statistics

- The launch of the fund was the 23

- FTSE Developed World ex-U.K. Equity Index Fund has share class assets of £10.9 billion.

- The fund is run by Vanguard Global Advisors, LLC., Europe Equity Index Team.

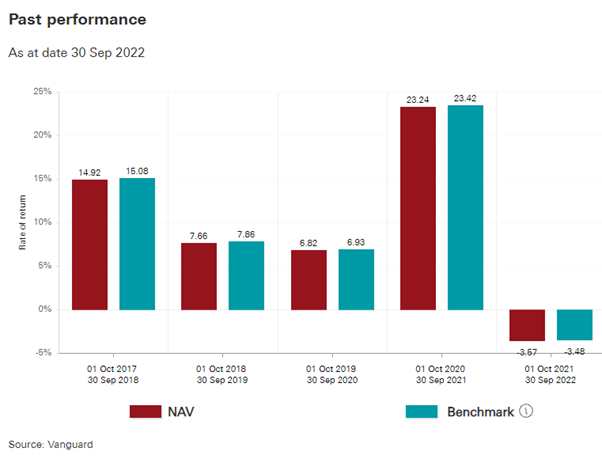

Past performance

The fund has posted net gains for four of the last five years.

Figure 2 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund 5-year performance

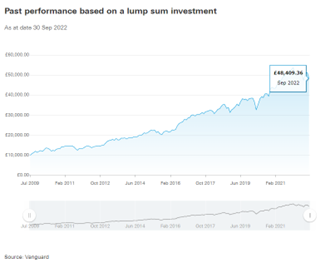

A £10,000 investment at inception (June 2009) would be worth £48,409.36 as of September 2022.

Figure 3 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund £10,000 invested

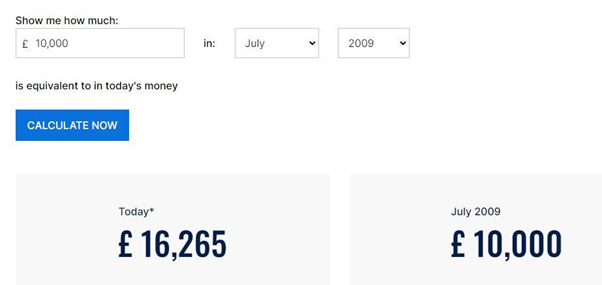

This greatly outstrips the rate of inflation according to the Hargreaves Lansdown Inflation Calculator. The cost of goods over this period would have grown by 62.7% with an annual average of 3.8%. This is compared to the fund increase of 384.09% over the same period.

Figure 3 Hargreaves Lansdown inflation calculator

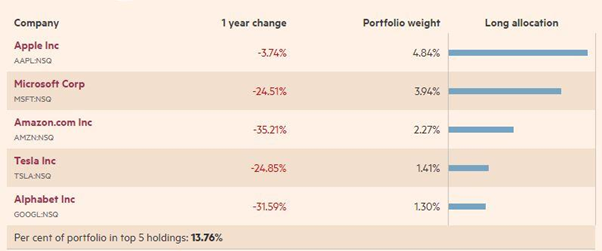

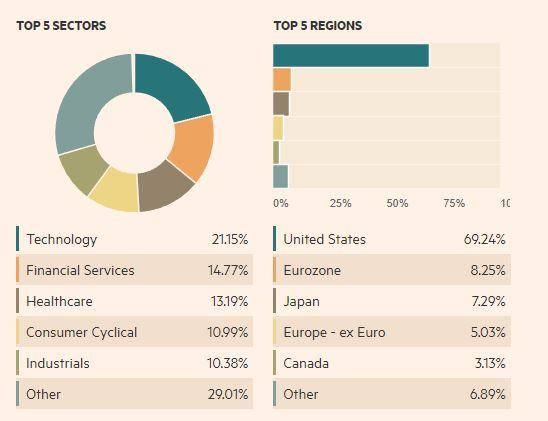

Invested stocks (top 5)

Figure 4 markets.ft.com top 5 stocks

For more information about the US FAANG stock, click here

Invested Regions

The fund is weighted towards the United States with the top 5 stocks being in the American technology sector.

Figure 5 markets.ft.com invested sectors

Conclusion

If your portfolio is heavily invested in the United Kingdom, you might consider a weighted investment in theFTSE Developed World ex-U.K. Equity Index Fund.This would offer diversification to some of the world's heavyweights, especially in the US technology sector.

For more information about available Pepperstone CFD ETFs (Exchange Traded Funds), click here.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.