- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

House Speaker Pelosi suggesting Trump’s COVID-19 diagnosis increases the possibility of stimulus, although it feels like this isn’t a Trump play and more whether the Dems choose to come down to the REPs plan and give Trump some additional support. An above consensus 57.8 read on the US September Service ISM hasn’t hurt sentiment either.

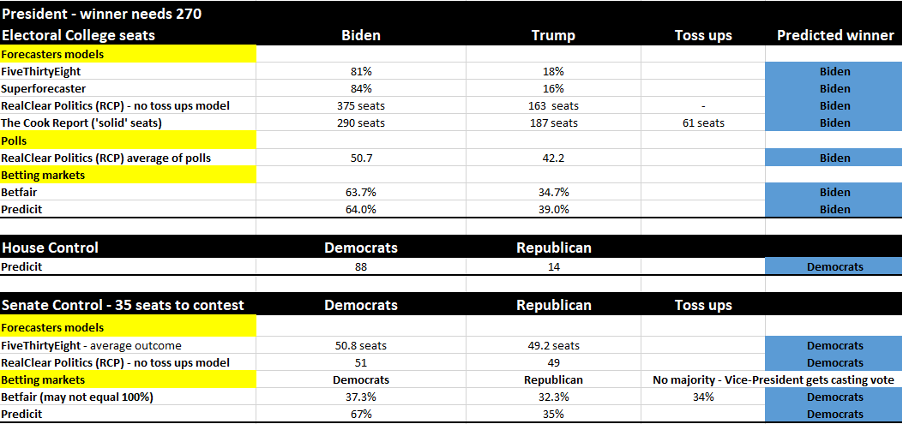

Support is certainly needed as Trump’s well behind in the polls and needs to pull a rabbit out of a hat. One could argue we’re seeing this view expressed today and that a blue wave is increasingly the consensus and perhaps being expressed through markets as per my playbook. Looking into the sectors in the S&P 500 and we see energy (+2.9%), tech (+2.3%) and healthcare (+2.1%) rocketing higher. Three sectors that could have headwinds under a ‘blue wave’, with even names like Marathon Petroleum higher by 3.4%.

(2020 election odds matrix)

A 6% move in crude is punchy, although there is some wood to chop into $41.30 and some decent resistance, where we may see supply kick in. However, the move in crude clearly overlooking the prospect of Biden restricting the Keystone XL pipeline and re-engaging with Iran further down the line. But a solid move in crude has seen reflation play out in markets, with US Treasuries well offered in 10s (+7bp to 0.77%) and 30’s (+9bp to 1.59%). With 30’s closing above its 200-day MA for the first time since March 2019, this resulted in a solid steepening of the Treasury curve.

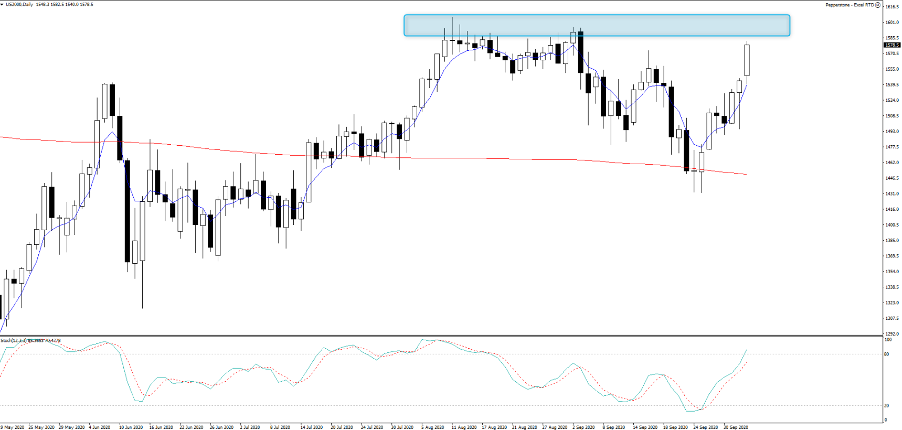

There's been some movement in breakeven inflation expectations, with both 5- and 10-yr breakevens up 5bp, but this hasn’t quite outpaced nominals, so ‘real’ Treasury yields are a touch higher. This hasn’t weighed on precious metals to any great extent and we see gold up 0.7% at 1913, just failing to push above Friday’s high of 1918. A break here and I’d be expecting 1941/55 to come into play and will re-assess here. Staying on the commodity theme and we did see copper-0.5%, but copper has been all over the shop of late so I wouldn’t read into that too much. That said, the reflationists would have liked to have seen copper participate in this rally to give it some backbone.

(US2000 daily)

Equities are all bid, with European bourses mostly up 1% and as things stand should open on a firmer footing later today. In the US, small caps have led the charge with the US2000 +2.8% and the risk here is that this index re-tests the August highs, so I’d be holding longs until price can close below the 5-day EMA which is defining the ST trend. The US500 looks bullish too, having printed a higher high, with excellent breadth as you’d imagine on a 1.8% move – that said turnover was light-ish and 18% below the 30-day average. Again, happy to be long here with stops on a close through the 5-Day EMA, but with implied vol so high (the VIX sits at 27.94%). I would be keeping position sizing to a minimum. In my view, volatility defines risk and position size – two factors which are at the heart of all traders’ frameworks and process.

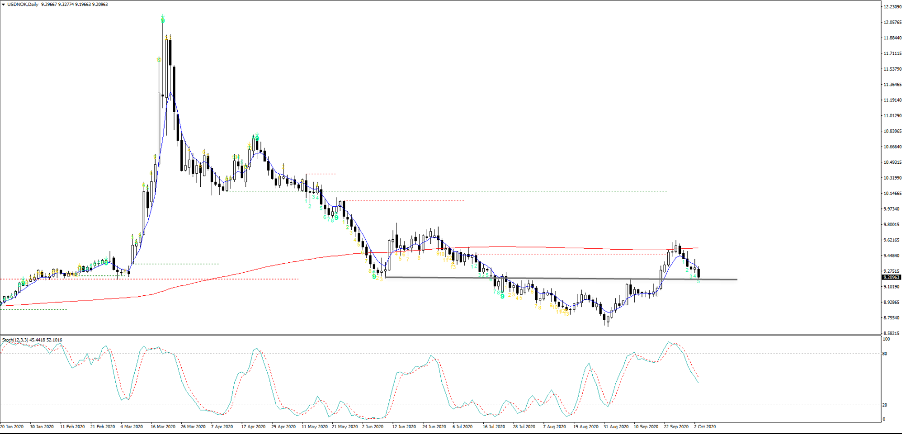

In FX markets the reflationary moves have been given additional wind by a weaker USD, with the USDX -0.4% and tracking in a bearish channel. This is obviously an environment where the USD move could flip at any stage, but the flow of capital seems to be moving out of the USD for now and I can’t fight that. On the leaderboard we see the NOK working well, naturally given life by the moves in brent crude and the trend on the 4-hour or daily is lower. Although, price may find support into horizontal support at 9.1832.

(USDNOK daily)

The MXN and EUR have also worked well, with EURUSD pushing back into its former July-August trading range. Hard to be long EURUSD and if I were to take a position then I would be closing out below 1.1720, but 60-pips of risk seems a lot. So trying to extract 100-120-pips of upside seems a tall order. However, the options market suggests if the pair is going to move the upside will be more intense than a downside move, with 1-week risk reversals at +0.42.

GBP has worked well too and GBPJPY especially looks bullish. I want to see a break of 137.41 to get excited, which is a touch higher than where spot sits now, so I’ll be watching to see if we see supply kick in at all – hard to chase at these levels though, especially with Brexit headlines only likely to be more prevalent this week.

AUDUSD hit a session high of 0.7193 and has underperformed other risky currencies on a day where one could argue the backdrop was there to break the 72-handle. A big day for the AUD, and the AUS200, with the RBA due at 14:30 AEDT and Budget at 19:30 AEDT. I wrote about both events in depth in yesterday’s note, so find the previews here. The 50-day MA (0.7209) could be tested today in AUDUSD should the RBA not meet the markets pricing and expectations of a move in November, and supply has kicked in above the 9 September pivot low. So, a break here, especially on a closing basis would be bullish. For mean reversion traders, unless the RBA truly surprise moves intra-day should be capped into 0.7230/40. On the downside a move I’d be looking to fade moves into 0.7125/35.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.