- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Trading The May BoE Decision: More Hikes To Come From The Old Lady

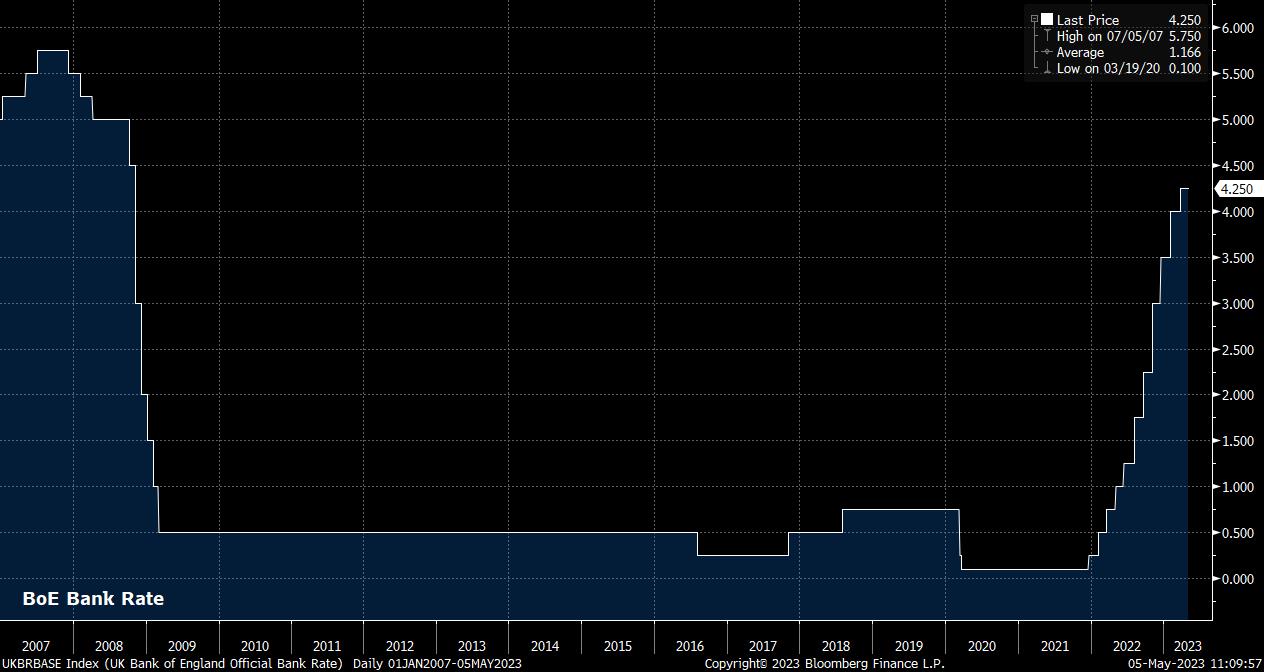

Against this backdrop, we expect the BoE to announce another 25bps hike on Thursday, the second straight increase of such magnitude, and the 12th consecutive rate increase since the tightening cycle began in December 2021. Such a move, to which markets assign approximately an 80% chance, would bring Bank Rate to its highest level since Autumn 2008.

Although another rate hike seems guaranteed, it is unlikely that the MPC will vote unanimously for such a move. Dovish external members Tenreyro (who leaves the Committee at the end of June), and Dhingra are again likely to vote for rates to remain on hold, though the present inflationary backdrop is unlikely to entice any further policymakers into a dovish dissent.

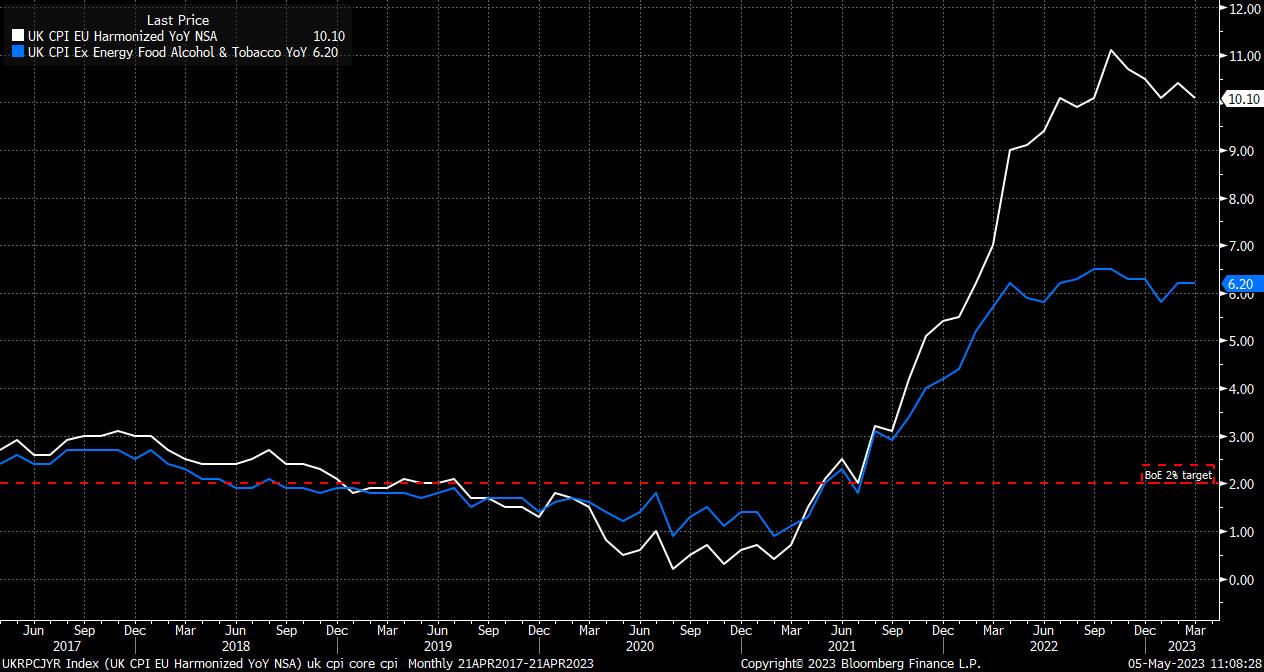

Said inflationary backdrop, with headline CPI having printed north of 10% for seven consecutive months, is also likely to see the MPC retain its tightening bias in the statement, again pledging to “adjust Bank Rate as necessary” to ensure a return to the 2% inflation aim. While the MPC are unlikely to pre-commit to further rate moves, another 25bps increase in June seems likely, with markets pricing a 3-in-4 chance of an additional hike in a month’s time, pricing a terminal rate just shy of 5%. Any explicit pushback on this pricing seems unlikely at this juncture.

Of course, with the May BoE decision being a ‘Super Thursday’ the MPC will also unveil their latest economic forecasts, with Governor Bailey also set to host a post-decision press conference.

In terms of the economic forecasts, the MPC are once more likely to point to headline CPI falling below 2% YoY by the end of the forecast horizon; however, with said horizon stretching until mid-2026, any near-term reprieve from the cost of living crunch is likely to be in short supply. Nevertheless, a significant degree of this decline in headline inflation will be largely mechanical, owing to a sizeable fall in energy prices after Ofgem’s new price cap took effect in April, and as the base effects from last year increasingly distort the data.

Of more concern should be the persistently high nature of core CPI, which excludes the volatile food and energy components, and shows little sign of rolling over significantly any time soon.

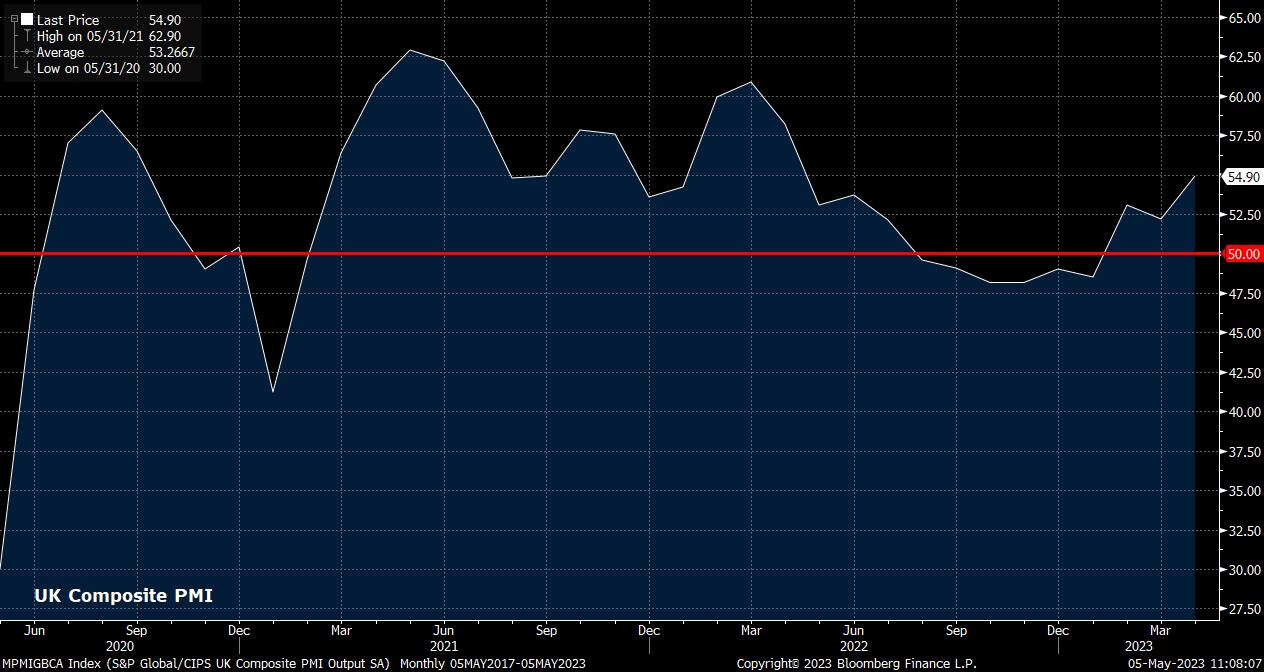

As for growth, the BoE are likely to upgrade their expectations for the UK economy, owing to the aforementioned decline in wholesale natural gas prices, but also as a result of the loosening in fiscal policy announced in the Spring Budget.

Although first quarter GDP is not due until the morning after the BoE announcement, the MPC will likely be in possession of the figures when making their policy deliberations. In any case, recent PMI figures reinforce the case for optimism, with the composite gauge (measuring output across the economy) pointing to the fastest pace of expansion in a year last month. Consequently, the MPC’s prior expectation that the UK would slip into recession this year is likely to be scrapped.

Unemployment, meanwhile, is once more likely to be expected to rise over the forecast period, with little if any revision to the prior call of a rise to 5.3% by the end of the horizon expected. The surprising rise in joblessness to 3.8% in the three months to February may be of some concern, though the bigger worry in terms of the labour market stems from earnings growth, which remains just shy of 7% YoY, a level clearly incompatible with a return to the MPC’s 2% price aim.

Financial stability is also a theme likely to crop up, especially at the press conference, in light of a resurgence in market concerns over US regional banks in particular. The BoE, in line with other G10 central banks, have made a distinct split between their monetary policy and financial stability functions, which is likely to be maintained. Furthermore, with present issues seemingly limited to smaller US institutions, and UK banks seemingly in little stress, an acknowledgement that the Bank are attune to global developments on this front, and that the UK banking sector remains resilient, is likely as far as Governor Bailey’s comments will go here.

Turning to the markets, cable has enjoyed a solid run of late, printing a series of higher highs and higher lows, while also at long last breaking convincingly to the upside of the 7 big figure range seen since last November. To the upside, the bulls will likely target 1.2675, with momentum likely to continue in this direction unless price makes a closing break back below the 1.25 handle.

_2023-05-05_11-06-43.jpg)

As for equities, the FTSE 100 has been trading rather soft of late, in line with the broader deterioration seen in risk assets and the pressure faced by global equity markets. A break below the cluster of moving averages currently providing support could entice further bears into the fray, targeting a move towards the pre-covid highs at 7,625.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.