- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Bailey did go somewhat against his deputy’s recent comments, with the governor pushing back on negative rates, saying it wasn’t something the bank was contemplating and channelling his inner Powell. Like Powell, he left negative rates on the table as a potential option, and just like the US, the UK will need to be in a far worse spot to see them being utilised.

UK rates did respond to Bailey’s comments, with 1Y1Y forward swaps going from -1.4bp to +0.5bp, with small selling seen in UK gilts. That said, front-end gilt yields are still negative, and this won’t disappoint the UK government who have over £300b borrow this fiscal year. GBP has been fairly well traded, with GBPUSD trading into the 7 April low but rallying back to the flat line, to print a hanging man doji – Today marks an interesting session then as a kick higher could see price re-re-establish a firm footing back in the 1.2650 to 1.2220 range. That said, we could easily see price roll over and start to trend lower.

EURGBP ready to break out of the range?

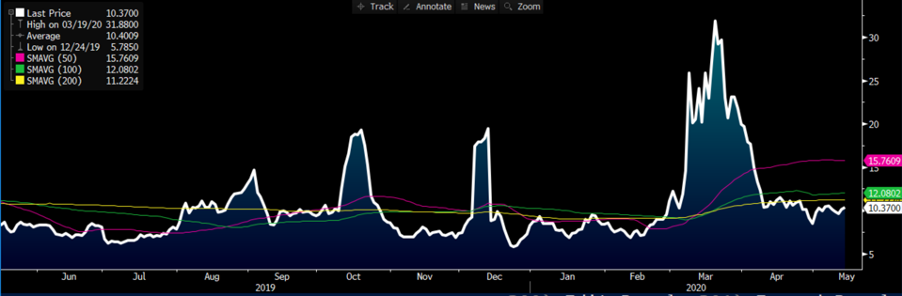

EURGBP has been in focus, with the 21 April and range high of 0.8864 in play – do the range traders kick this one lower through trade today? That is one for the radar, and I am reactive here, but an upside break would attract some attention. Consider EURGBP vols are subdued here, with 5-day realised at 8% (see chart below) and 1-week implied at 7.7% - So the market expects a grind in price, and not explosive break higher and this has implication for position sizing.

(Source: Bloomberg)

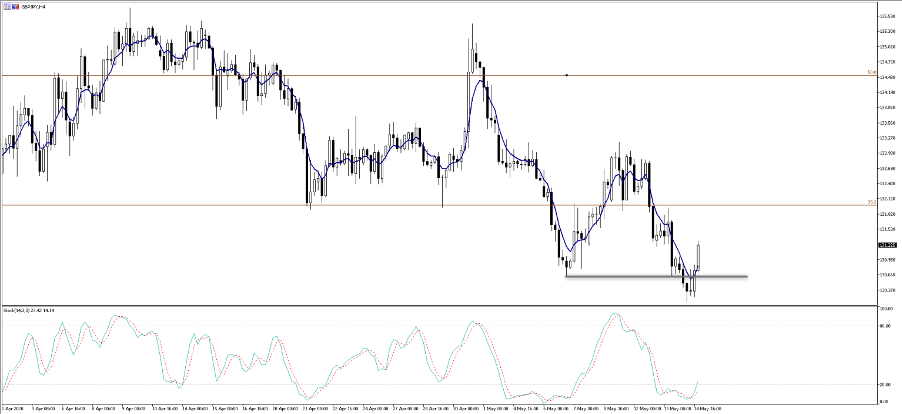

GBPJPY has also seen some flow, with price having a failed break of the May double bottom, which I’ve shown on the 4-hour chart. You can see the defence of the May low, and this is always why I wait for a period (ideally daily) close through a level to confirm that the market is ready to extend in that direction. That said, on the daily, the 5-day EMA is headed lower and the UK is making a dog’s breakfast of exiting lockdowns, so a close through 130.60 would be a sell signal, in my opinion.

Again, we can look at the options market and eye vols in GBPJPY, as this can be a fair proxy of risk, although most tend to look at AUDJPY, USDKRW and EURJPY as our guide here.

GBPJPY implied vol has ticked up a touch, but to give you a sense of the expected move, options traders see a range (over the coming five days) of 132.67 to 129.65. The daily implied move sits around 82-pips, which is a discount to the 5-day ATR of 131pips. We also see GBPJPY 1-month risk reversals at -2.63 vols. In layman’s terms, the options market holds a downside bias in spot, with GBPJPY 1-month put volatility trading at a premium (of 2.63 vols) over calls, which shows the market has paid up for puts (bearish) - this skew has come in from negative 8.99 vols back in mid-March.

(GBPJPY 1-week implied volatility)

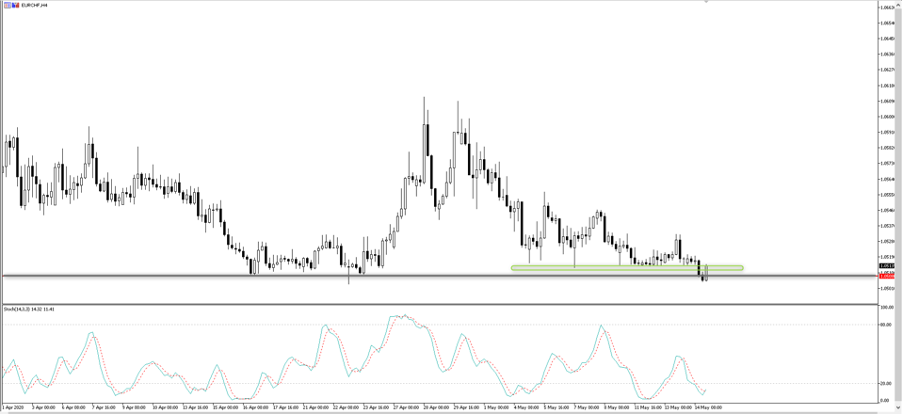

EURCHF

EURCHF has also garnered greater attention. I put this on the radar yesterday, and we have seen price come down to 1.0504. We saw a break of the recent series of lows, which has clearly been supported, with the buyer(s) coming back in on the break. The fact we have seen a broad risk reversal has presumably helped. Whether a future downside break leads to a stop run is a point of debate, but it is a risk. My own view is the SNB will not pull the rug from under the market, and comparisons to 2015 are probably misplaced, not just because of the duration of this move, but in 2015 there were billions of dollars of stops under 1.20 and no one had expected the SNB to pull the floor.

Solid moves in energy

Elsewhere, we’ve seen a solid bid in crude, backed by a mix of OPEC cuts kicking in, with exports reduced to 5.96m for the first 14 days of May. Saudi cut sales to the US and Europe by half, while positive comments from the IEA about an improvement have also helped. A drawer in the weekly DoE inventory report would not have hurt either!

Either way, it’s no surprise that the MXN and CAD have performed well, and the fact we’ve seen a strong turnaround in equity sentiment, with S&P500 futures rallying a lazy 3% off the session lower. Naturally, this has offer support to risk FX, with AUDUSD lifting from 0.6404 into current levels.

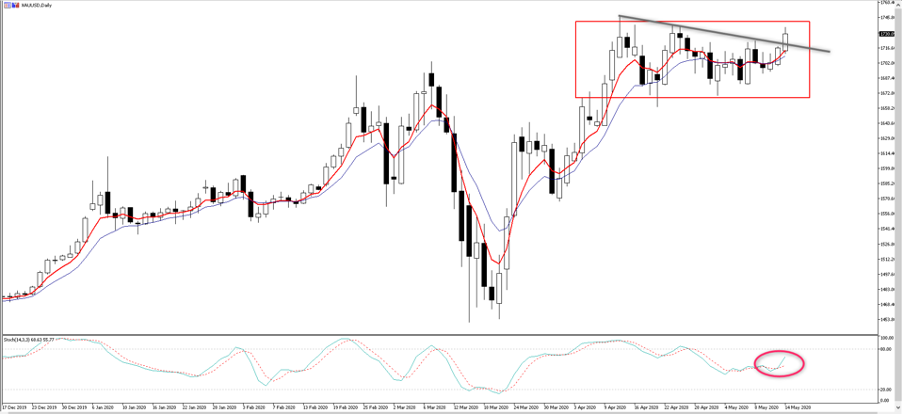

Gold ready to break out.

Gold has also seen solid flow, with price pushing into 1736 and the top of the range. I identified this range high in my recent piece on gold and feel the flow of capital is looking pretty good for gold and silver - “The Japanification of the US – the truly bullish case for gold". I would be looking at the fact that ‘real’ (or inflation-adjusted) rates have pushed a touch lower has also helped, not to mention further talk of fiscal stimulus which will only increase the deficit. The bulls look to be in control here, and I expect an upside break to get plenty of attention from clients.

Related articles

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.