- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

The Daily Fix: The USD hits a two year low, with USDCNH as our central guide

This propelled the NAS100 +1% to a new all time high, while other US indices haven't fared as well, with the US500 +0.2%, while the Dow and Russell 2000 closed down 0.2% and 1.1% respectively. Gold has held $2k, with silver also gaining 1%, yet Bitcoin is down 2.5% and below 12,000. Copper has been impressive putting on 2.3% and eyeing a test of $3.00 p/lb, while crude is lower by 0.68%, so the commodity trade is not as clear cut as we all think.

There has been modest buying across the US Treasury curve, with yields towards the long end outperforming (lower). Inflation expectations have risen a touch, and one just has to look at the moves in 10-year breakevens (inflation expectations averaged over the coming 10 years) to see they are trending like a dream - the result has been that ‘real’ yields have fallen 3bp for 5yr Treasuries and 6bp on 10-year Treasuries. I guess this also points to support in the NAS100, precious metals and acts a headwind for the USD, which has also been sold, with talk that investment managers continue to hedge USD-based investments - it’s cheap to do so.

News elsewhere has been largely political in nature, with focus on the Democrat convention, where the message is one of unity within the US. You win elections by having a positive message (think “Making America Great Again”, not by taking on China and this is the message we heard.

I'm not convinced the USD move is down to further hedging of US election risk, with some pointing to a loss of US competitiveness under a Biden administration (think higher regulation, taxes, changes in tariffs), but it’s palatable to use this as a reason for the USD breaking lower. We’ve also seen Nancy Pelosi saying she is willing to cut the DEM’s stimulus proposal in half, which has presumably supported risk, as it leads to the view that an agreement will eventuate, presumably to tune of about $1.5t in the coming weeks – the fate of risk assets now hinges on whether we see signs of economic fallout from the delayed stimulus in the lead up to an agreement – markets have become more interested in the higher frequency data as a result.

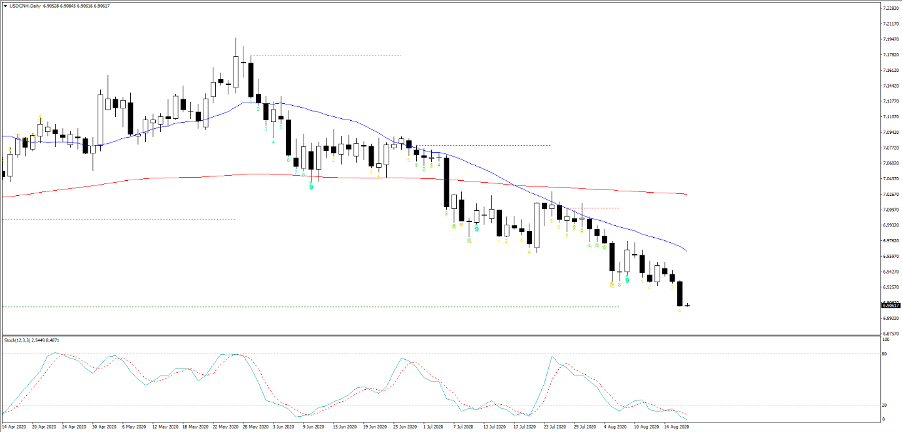

On the USD move, I like to start by looking at USDCNH, as this cross has broken down through the recent low of 6.9276 and is testing of the March lows. The weakness in the pair seems to be resonating across the USD spectrum and traders need to have this cross firmly on the radar, as how price reacts at this support level could dictate so much for the USD.

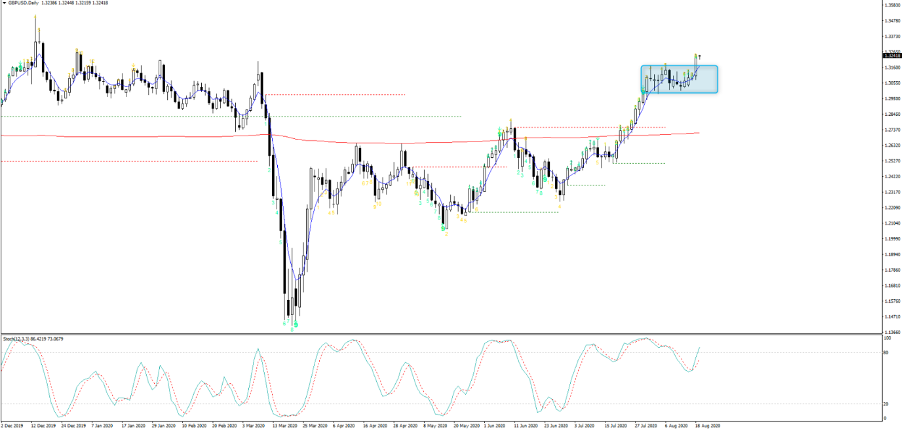

If we look at the intra-day relationship with other FX pairs, the relationship has been strongest with GBPUSD, which has been flown on the day, with the GBP the top of the leaderboard. By way of price action, we see price has broken out through the 1.3186 high and has given us a definitive message that this pair is ready to command a 1.32-handle and may push towards 1.3370 – a decent level of supply seen since 2018. Brexit related headlines should start hitting the wires soon enough, so there is the catalyst right there.

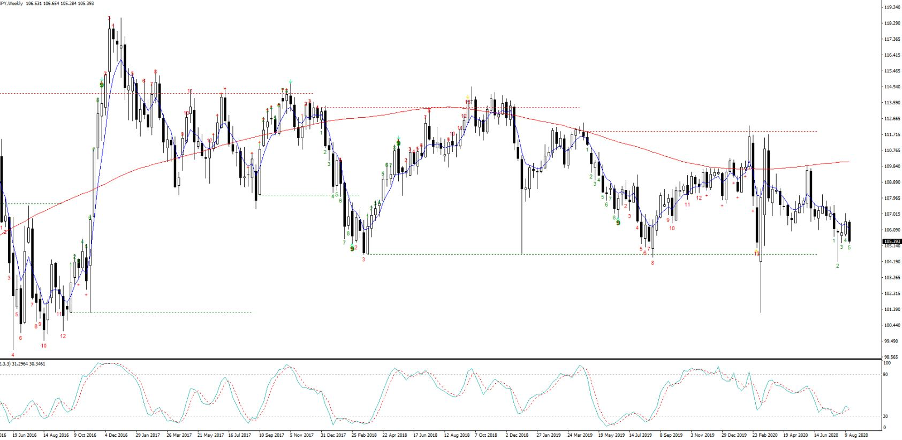

USDJPY has been sold, with the JPY the next strongest currency on the day. Buyers have held the 6 August low (105.29), so a break here and we run this risk of a sub-105 move, where there has been incredible support for the pair since 2018 – look at the pair on the weekly.

EURUSD has held the 1.1900 level, hitting a high of 1.1966, although has lagged the CNH move if I overlap the chart. AUDUSD is eyeing a breakout of its own consolidation zone, but again this will be dictated to by USDCNH in upcoming trade, as I don’t see Westpac Leading Index (due 10:30 AEST) being a volatility event.

What could be though is the FOMC minutes at 4 am AEST, so this is where the USD short position will be called into question because the market will be exploring these minutes in great depth for signs that the Fed is ready to announce the findings from its long-running review on policy change and to potentially alter its language in the September FOMC meeting to a more outcome-based approach. That being that they will now allow inflation to be above 2% for a sustained period. If we don’t get the clarity or urgency the market expects then the USD should rally. One to watch out for.

Artículos más leídos

¿Listo para operar?

Comenzar es fácil y rápido – incluso con un depósito pequeño. Aplique en minutos con nuestro simple proceso de solicitud.

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.