- Français

- English

- Español

- Italiano

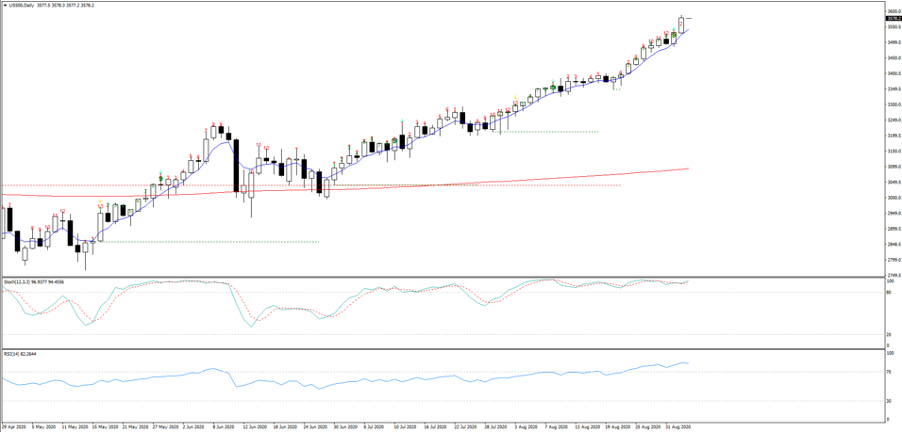

The S&P 500 closed +1.5% (its 22 record close of 2020), the NAS100 +1%, and Russell +0.9%. Yet if we look under the hood we see utilities were easily the best performing sector, which is typically a red flag for me. REITS, communication services and healthcare were not far behind. Breadth was solid with 93% of stocks higher on the day, while 1.77m S&P 500 futures were traded which is still a tad on the light side.

In the options world though things get spicy, where 4.97m SPY ETF (S&P 500 ETF) options were traded, which is punchy. The strike with the biggest change in open interest coming in the 376 strike (expires 25 September), which given current levels in the SPY ETF is a bet on 5.3% more upside through that period. What's interesting is if you see the broader volatility space, we see the VIX +0.45 vols to 26.57% - so, yet another day where equities are up and implied volatility is also higher. Break it down and we see S&P 500 1-month call volatility gaining 1.77, relative to no change in 1-month put vol. All the talk is that market makers are short gamma, given traders have been buying out of the-money equity calls (right for upside/bullish) and as the S&P 500 rallies then market makers need to cover. This means buying stocks or S&P 500 futures. It’s all flow driving the show.

But look elsewhere and despite the strong yet defensive (sectors), equity tape things were not so rosy. Credit markets were unchanged, crude closed 2.7% lower, US Treasuries are unchanged out to 10yrs, but then we see yields lower in 10s (-2bp) and 30s (-4bp). Inflation expectations (breakevens) are 4bp lower, so ‘real’ Treasury yields are 4bp higher in 5-year Treasuries and 2bp in 10s. Equity didn’t mind one bit, although value has certainly outperformed growth as a factor, with Apple -2.1% on the day.

The USD has found further short covering here, with the USDX +0.31%, driven as we always expect by EURUSD which is 0.5% lower at 1.1853. Just off the lows of 1.1822 with support into the 20-day MA. The AUDUSD is not far off at 0.7337, with buyers into the 5-day EMA. The NOK is the weakest link in G10 FX, but that's not surprising given Brent crude is lower. AUDJPY is -0.26%. If we want to use this as a risk proxy in FX, although the cross has come off the earlier low of 77.53, but 1-week volatility hasn’t moved to any extent.

Gold has had a reasonable flush out, with price down 1.4%. While silver is 2.4% lower and we’ve seen selling in crypto’s. This makes sense given the USD flow and real yield dynamics.

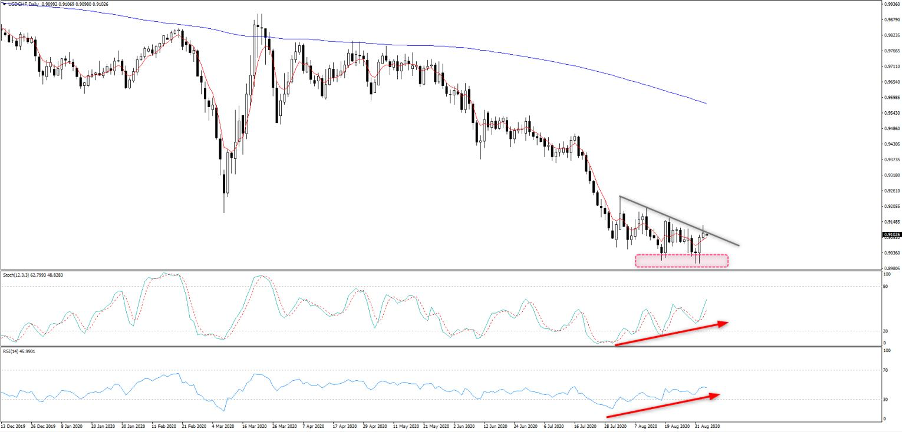

(USDCHF daily)

So, some interesting dynamics at hand and on any other day you could argue equity should be lower given the real yield, crude and USD moves. But this is a world driven by flow and the options world is playing a big part of it. Stay long it seems, even if it all seems incredibly perplexing. The bigger issue for me is what to do with the USD. Buy this early resurgence or apply new shorts and which cross to go for ahead of weekly jobless claims (00:00 AEST – consensus 950k, continuing claims 14m), services ISM (00:00 AEST – 57.0) and payrolls tomorrow (consensus 1.35m). USDCHF is perhaps my go-to here, as I see divergence in play and price looks to be putting in a bottom. If we see a break of the trend and I’d be tempted with a nibble, adding if and when the set-up looked more compelling.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.