- Français

- English

- Español

- Italiano

I can imagine the flow will turn more bullish as we head into the cash open and we’ve seen a nice move off the lows in HK and A50 futures. Could we be staring at a rally in trade today, given just how oversold markets are? It certainly feels like longs could get a better say and we’re already seeing supportive comments of potential fiscal policy support – and this will be headed for domestic companies that are doing the right thing.

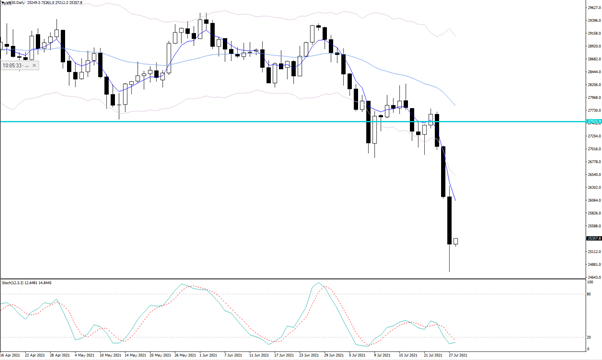

HK50

There's a clear drive not just to focus more intently on equality, but also in creating a more prominent oversight on foreign investments and capital ownership in domestic businesses listed in offshore geographies. It perhaps suggests long A50 index and short HK index could be a good relative play.

With the Chinese authorities working to promote Chinese businesses and create new opportunities to close the wealth divide, it certainly makes you question if Tesla, a US business now operating so actively out of China, faces potential major downside risks – especially given US and China relations are still fragmented.

I feel there's plenty more in this saga and markets are still facing limited clarity – if holding exposures in these markets it is wise to be in front of the screens more readily. That is, if you’re not running an EA who will execute based on the set of implemented rules.

Still, while we saw US indices close lower, the move was nicely off the low and that will enthuse the bulls. Tech underperformed, and again found buyers into the latter stage of US trade - the fact that US real rates broke to new lows (now -1.13%) would have supported to a degree, although the focus is turning to one of concern as to the message real rates are portraying.

In FX, USDCNH has also broken out of the range, but we’ve not seen any major panic selling in the AUD, NZD, or CAD. Fine, we’ve seen selling but it's very orderly. Clearly, we’ve eyes on the Aussie CPI (11:30 AEST) and the FOMC meeting (4:00 AEST) but to offer an idea of movement (given we've Aussie CPI & the FOMC meet in play) - AUDUSD overnight volatility sits at 16.86%, the highest since March – this equates to options market makers pricing the daily straddle for a 0.8% move – this puts 0.7417 to 0.7313 as the implied range to trade on the day (with a 68% confidence). Happy to fade moves into these levels as a trade.

For additional colour on the FOMC, Research Analyst Luke Suddards wrote more in this piece.

GBPAUD daily

(Source: Tradingview)

In other good news, GBP is outperforming where long GBPAUD has been a position I’ve been keen to be involved with. News that the UK was considering opening its borders to EU and US travellers who are double vaccinated, while putting 77 countries on the ‘Green List’ put the GBP as a clear re-opening play. Happy to hold for now as the trend is strong, but realise the cross is hot and perhaps too hot. EURGBP could be another way to express a strong GBP, and I like this lower – adding on a close through 0.8490.

Facebook on the docket

On a stock level, it's all eyes on Facebook who report in the post-market in the session ahead. This is another business doing all the right things and when it comes to earnings typically smashes expectations out of the park. The implied move (derived from options pricing) is 6.3%, so this could move in the session ahead and many will vividly remember the 7.3% rally we saw in Q1 – the fact it has rallied 45% since March may be a headwind though and one questions if it is priced for perfection. The street looks for EPS of $3.52 on revenue of $27.86b, and while the outlook is far more important, we note that this is an earnings darling - these names not only need to beat but they need to absolutely blow the lights out – similar to Alphabet who closed +3.2% and showed yet again why it is the marquee name of US and global corporates right now.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.