- Français

- English

- Español

- Italiano

The Daily Fix: Trump walks away from Fiscal, but did he really have a choice?

Did the market get stimulus wrong? Perhaps, but they’ve been guided to expectations of bipartisan agreement through recent upbeat dialogue between various leaders. It’s not even just about FOMO these days, but if an agreement was to be struck, you just can’t be left behind – FOMU – Fear of Meaningfully Underperforming.

I've maintained a sceptical view on fiscal given I don’t think the DEMs ever really wanted a deal – why would they? The wind is to their backs, they’re up double digits in the polls and delivering a deal would have given Trump ammunition to take into the election. Well, at least it would've back in August and September, with personal income dramatically boosted and disposable capital ramping up, which would have meant the difference between US Q4 GDP being 10% or 2%, following a likely 30% GDP print in Q3. The DEMs have also recently been helped by news of Trump's taxes, an unfavourable performance in the first debate and the appointment of Amy Coney Barrett. The likes of Nancy Pelosi knew their $2.4t proposal would have unlikely passed through the Senate anyhow.

Trump may have accepted the DEMs proposal, but again knew it would likely have failed in the Senate. He has promised more stimulus post-election, but the DEMs are not going to lose the House, so passing a Trump stimulus in the future (if he was to win) still faces headwinds. Although, these headwinds will be less of an issue after the election. More fiscal is needed, which is a concern given how much has already been rolled out.

Trump’s tweet clearly resonated through markets sending the S&P 500 down 2.2% from the highs of the day, to close -1.4%. The US2000 has certainly outperformed with the small-cap index -0.3%, but it’s enough for me to close my long here for a small loss. The NAS100 closed -1.9% and we’ve seen NASDAQ futures trading 20bp lower on the re-open. Tech remains one to watch given headlines rolling out about the House DEMs plan to break up giant internet platforms from other business lines, limiting the monopolistic qualities of US tech.

Given the DEMs stance on tech, which I am not sure surprises too greatly, it makes me think that if we do see a ‘Blue Wave’ that long US2000 and short NAS100 will be an incredible medium-term trade. If the DEM’s promise huge fiscal spending which will benefit the Russell (the earnings are far more US-centric), while going after big tech, I find it hard to see how this will not be a solid macro thematic trade.

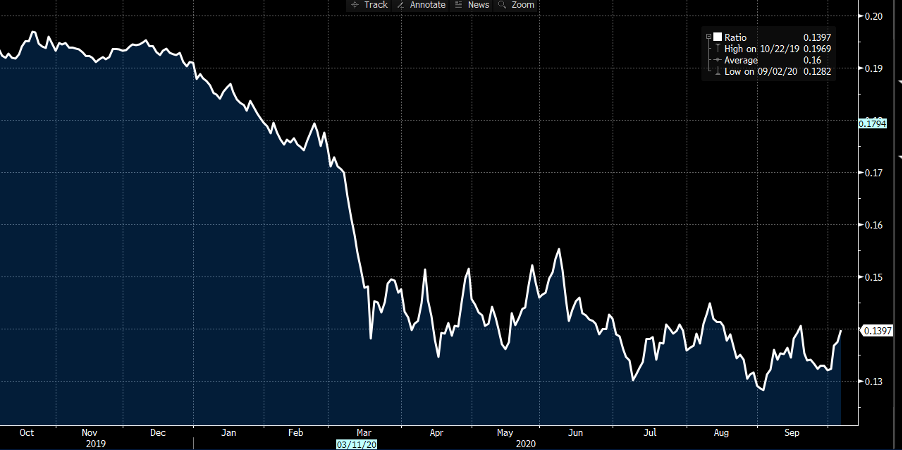

The Trump tweet caused a rush to safe havens with US Treasuries bid, with 10s dropping 5bp to 72bp before finding a base, the VIX pushing into 29.5%, and the USD, CHF and JPY all finding buyers, with selling resonating in AUD, MXN and NOK most prominently. AUDUSD was falling anyhow, with one prominent local commentator calling for the RBA to act in November and we see the rates market at 7bp for November and the Aussie 3-yr Treasury now trading at 13.4bp – a cut, it seems is coming, while the RBA will lower the yields cap. More QE for good measures?

Market pricing aside, the RBA made it clear that this is a confidence issue faced in the real economy, not a cost of credit problem. If we explore the last line in the statement – “The Board continues to consider how additional monetary easing could support jobs as the economy opens up further”, it's hard to see how cutting either the cash rate or reducing yield caps aids that. The budget is key here and seems market-friendly enough, and the RBA will welcome the measures, but it's going to be a slow-moving ship and one that may take time to filter into the economy.

We look ahead to see how Asia deals with the above news flow. As we look to Europe the focus falls on German industrial production, September FOMC minutes, and then to the Vice-president debate which promises to be a far more statesman like affair.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.