- Français

- English

- Español

- Italiano

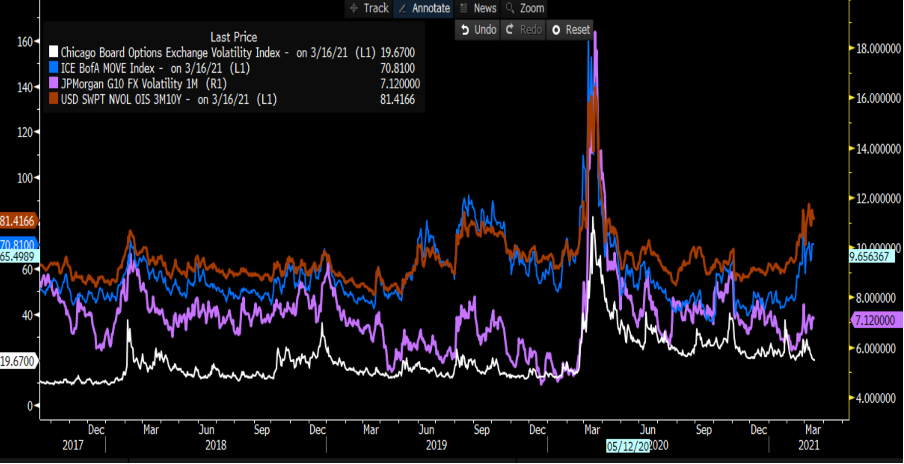

As we look ahead to the FOMC meeting (tomorrow at 5:00am AEDT) and assess the probability matrix, the likely outcomes and subsequently our exposures, one chart that has caught many trader’s attention in the cross-asset world is one of multi-asset implied volatility.

(Source: Bloomberg)

Here we see implied volatility (vol) in swaps (orange) and US Treasuries (blue) moving sharply to the upside, while FX (purple) and S&P 500 (denoted by the VIX index in white) has lagged this move. FX traders would like to see a sustained move higher in FX vol and movement, so this chart and the historically strong correlation interests greatly - higher bond volatility typically feeds FX and gold vol.

The move in bond and swaps volatility indices is partly explained by the recent rise in long-end bond yields. However, there's also a lack of clear consensus around the outcomes of tomorrow’s Fed meeting. We can add in worries about the Fed not extending the SLR (Supplementary Leverage Ratio) exemption on 31 March, while there's also a clear disconnect between market pricing for rate expectations and the Fed’s own idea of not reducing accommodation until “substantial progress” is achieved.

The Fed may lift its median expectations

I don’t sit in that camp myself, but many are calling for it. With markets pricing three hikes through end-2023 would the Fed moving modestly towards the market matter anyhow, especially given Jay Powell will likely downplay the merits of the ‘dots’ in his press conference? I suspect it would be symbolic and justify the notion that we are looking at a world where ultra-easy policy is behind us and the world shouldn’t need such a setting.

Another factor to watch is Powell’s push back on long-end bond yields. Could we be entering a realm where the Fed allows market forces more independence?

What this means for markets longer-term is huge and if bond volatility is going to continue creeping higher then FX volatility will follow. Central bank divergence is one of the simplest yet most effective fundamental strategies a trader can deploy in trading.

For years we’ve been treated to central banks throwing the kitchen sink at suppressing volatility, offering not just dovish outlooks but forward guidance that has resulted in very predictable policy. That era may be coming to an end.

I touched on it yesterday with calls that the Russian central bank may hike even as soon as April. However, we can look at a few emerging markets banks already hiking, while Brazil, Norway and others should tighten policy this year. In the major DM economies, we’re still talking nuance, but rates pricing in Canada is looking quite interesting and we’ll be talking about lift-off in NZ and Australia later this year if the path of recovery continues.

We may see measures imposed to calm bond markets

If financial conditions do worsen, the diverging paths in rate expectations will play front and centre into the bond market and we see the yield demanded to hold one sovereign nations debt increasing over another – currencies will follow this yield spread and it's why higher bond volatility will spill over into FX markets. This is the nature of cyclical currencies.

It’s not just the long-end, say the 10-yr spread, but we can start to look at yield differentials in the 5-year part of the bond curve. If the yield commanded to hold the Aussie 5yr Treasury rises to say 200bp or 2% (it's currently 146bp) over German bunds, then EURAUD will be trading closer to 1.4000 (currently 1.5368). If NZ yields rise relative to Aussie yields, and assuming NZ financial conditions don’t get hit then AUDNZD will likely trade lower.

It’s hard to see how EUR, CHF and JPY rally too aggressively, if bond yield differentials are incentivising the flow of capital to regions with higher bond yields, especially vs the NOK, NZD, CAD and AUD. However, I guess we need to consider what’s priced and how much of that investment capital is hedged and that is especially true of Japanese funds who are big buyers of offshore assets.

Equity volatility is different from FX volatility and while a pickup in bond vol has seen as few rapid moves in tech. However, on the whole, the equity market is fine with rising rates as long as inflation expectations are also rising. The cash VIX now sits below 20%, implying a daily move in the S&P 500 of 1.2%, while our VIX index is priced off the futures and sits at 24% - one to watch over the coming 24 hours and whether Powell opens the door not just to higher rates vol, but FX and equity vol too?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.