I CFD sono strumenti complessi e comportano un alto rischio di perdere denaro rapidamente a causa della leva finanziaria. Il 72.2% dei conti degli investitori al dettaglio perdono denaro quando scambiano CFD con questo fornitore. Dovresti considerare se hai capito come funzionano i CFD e se puoi permetterti di correre l'alto rischio di perdere il tuo denaro.

- Italiano

- English

- Español

- Français

September FOMC review - rates to be kept lower... forever

I, for one, would have liked more from the Fed. To really challenge behaviours and drive animal spirits. But, as detailed in my prior note if the Fed didn’t win the credibility battle then they would see a tighter financial backdrop. Which is the case, where we’ve seen a steeper yield curve, a slightly stronger USD and equities have been sold.

I have put more detailed thoughts into this video (see above), which I hope best portrays what's a big subject but needless to say, I'm left with a number of questions. Consider the overriding statement that the Fed will maintain the current policy target range “until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

I, like many, want to understand:

- What constitutes a “moderate” overshoot? 2.5% perhaps

- How will the Fed assess the duration of ‘sometime'? 3 months, 6 months... longer?

- Why, when the Fed is pro-actively driving inflation above 2% do the inflation projections (in the set of forecasts) not reflect this?

- Could we not have had more colour on future asset purchases (QE) – size, scope and composition are important to bond traders, which could be why we saw 10-year Treasuries sell-off and subsequently the NAS100 finding sellers.

- This policy regime is an outcomes-based approach, but how flexible are they on their outcomes?

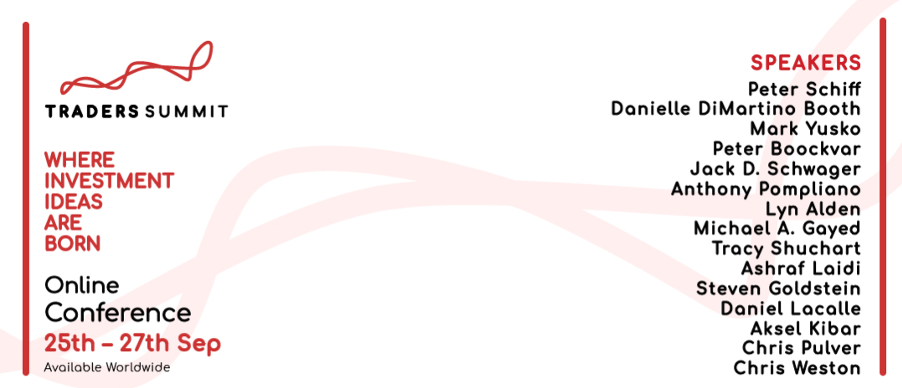

I also want to give you the heads up on Trader Summit, an event I will be speaking on the 27th on the Fed’s new policy regime and how to trade it. The line-up (perhaps yours excluded) is as good as you will see in any event and promises to be an incredible event. Get involved, it's free.

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.