I CFD sono strumenti complessi e comportano un alto rischio di perdere denaro rapidamente a causa della leva finanziaria. Il 72.2% dei conti degli investitori al dettaglio perdono denaro quando scambiano CFD con questo fornitore. Dovresti considerare se hai capito come funzionano i CFD e se puoi permetterti di correre l'alto rischio di perdere il tuo denaro.

- Italiano

- English

- Español

- Français

Trader thoughts - a sinister close in US equities but bullish moves in copper, AUD, and NZD

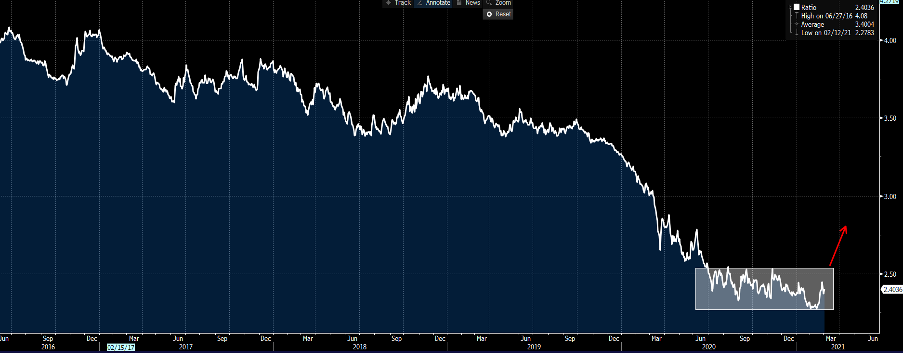

To start, sentiment in equities has soured into the cash close, with small caps (US2000) closing -1.9% and tech finding supply (NAS100 - 1.7%) – this despite a 7bp decline in US real yields, amid rising speculation the Fed will look to roll out a re-run of its ‘Operation Twist’ program. Despite what many say, in my view this is not Yield Curve Control (YCC), but more aimed at issues in ultra-short-term rates (collateral scarcity) and re-aligns policy with other central banks. Long US30 and short NAS100 may be worth a look.

(Dow/NAS ratio)

(Source: Bloomberg)

Crude is 1.7% lower with all eyes on the full narrative from the OPEC meeting, with the group now expected to increase production - the $58.50 19 Feb swing low will be closely watched – we’ve just seen the weekly API inventory report showing a massive build of 7.4m barrels. Considering as today’s DoE inventory report (02:30 AEDT) is expected to show a drawer of 735k barrels and one suspects consensus needs to be adjusted.

Crude aside, commodities look interesting notably copper. After pulling back from $4.37 to $4.04, copper has seen buyers all through US trade, printing a solid bullish outside day reversal. On the 4-hour, we saw a failed breakthrough of $4.07 and price has reversed and built on that. Watch Chinese equities today as the tape was poor yesterday amid comments from China’s bank regulator of being “very worried” about risks from the domestic property sector. However, the fact we’ve seen copper regain composer is interesting and if this kicks on through trade today, then it could suggest we go back to test the recent highs.

The bears will point to extreme and almost record bullish positioning in LME and Comex. However, positioning aside the price action we’ve seen in copper and industrial metals more broadly suggest growing conviction the commodity bull market morphs into something far more prolonged and thematic of a multi-year supercycle.

By way of inspiration, the market sees continued growth in housing, with lumber more than doubling since October portray this eloquently. EV will only evolve and an ever-greater move to renewables-related consumption will boost the demand outlook for certain industrial metals, such as copper. Do consider that the recent fall in mined production and significant draw in inventories that the copper market will be in a massive deficit this year and perhaps 2022 too.

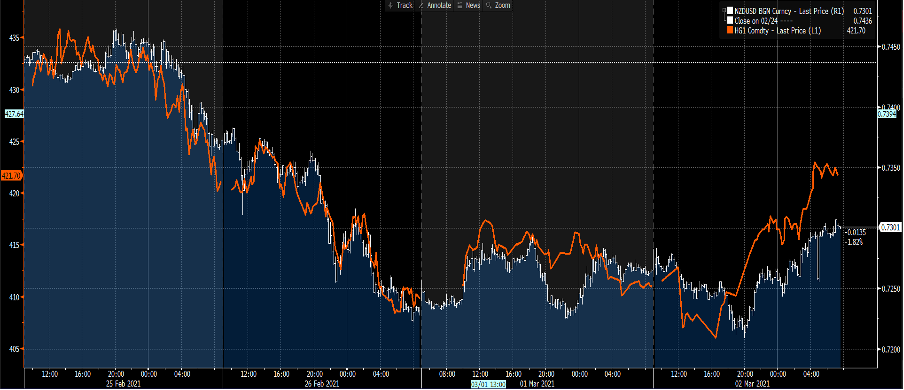

(Orange – copper, white – NZDUSD)

NZDUSD has basically tracked copper prices as the Bloomberg chart portrays, so it won’t surprise to also see a bullish outside day in this pair. The 50-day SMA has contained the selloffs of late and despite the moves in equities the flow in the pair looks solid. A close through the 5-day EMA and I’ll be taking the timeframe down and looking at buying strength for a test of 0.7430/40 (Jan 2018 high).

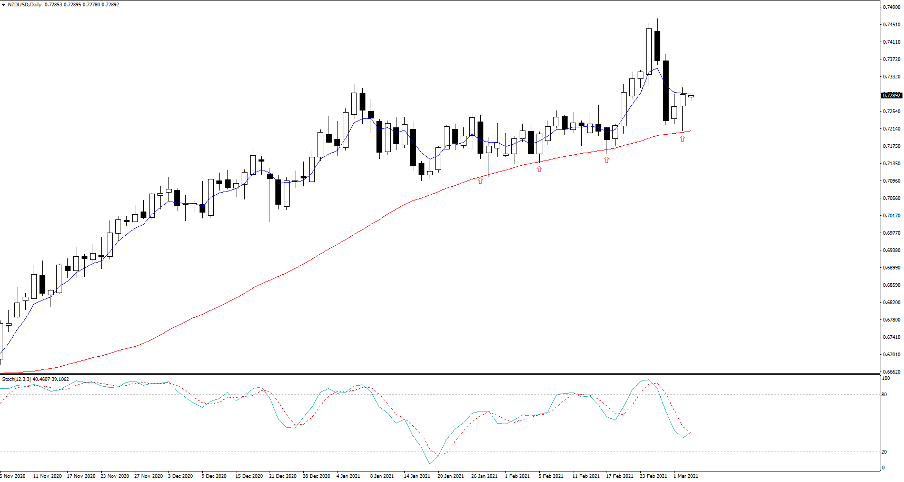

(NZDUSD daily)

The AUD is also making a charge higher and despite the negative equity backdrop, with price rallying from 0.7736 in EU trade into 0.7838. I was keen on buying weakness yesterday, but the limit was a touch aggressive and it was a case of chasing price from there. Judging by the move higher in Aussie 10-year bonds from 1.66% into 1.74% the actions of the RBA were not dovish enough relative to expectations. The bank has said they’d do more QE if needed and one suspects they'll need to increase the ‘envelope’ of capital. We get Aussie Q4 GDP at 11:30 AEDT, although I’m not expecting this to move markets.

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.