- Italiano

- English

- Español

- Français

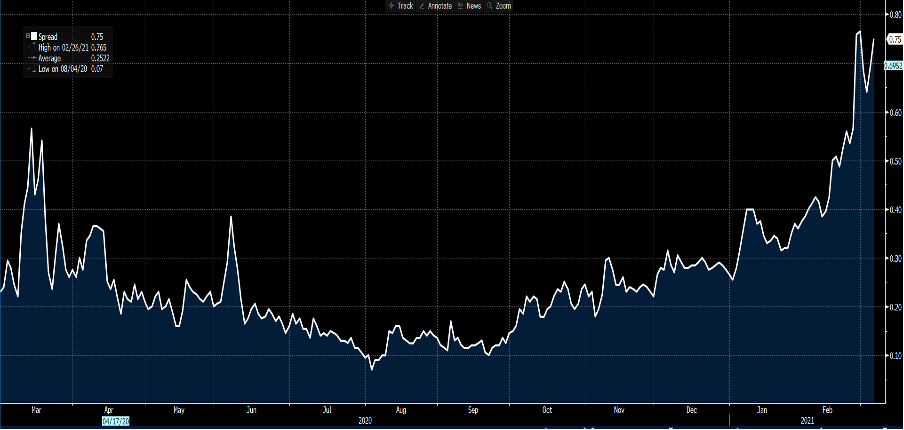

The long end of the bond curve moved higher with vigour, with UST 10s trading from 1.47% into 1.55% and we look for a re-test of the recent highs of 1.60%. Eurodollar futures sold off, notably into the 2023 to 2024 contracts and we now see 75bp (see chart below), or three hikes from the Fed pencilled in for end-2023. Real Treasury yields have moved higher, with 10yr real rates moving to -66bp (+6bp). The USD has gained 0.8% and there you see the holy trinity of market fears – rising real rates, increased expectations of rate hikes, and a stronger USD.

(What priced in? Yield differential between Eurodollar futures – Sept 2023 to March 2021)

(Source: Bloomberg)

Aside from a near 5% rally in crude after OPEC choose not to lift production by the expected 500,000 barrels a day, financial conditions have tightened. This is somewhat ironic given that while Powell said the rates market had “caught his attention”, he was watching broad financial conditions more closely. For the bond bears the lack of genuine push back from Powell was music to their ears and it just raises the notion that the Fed cut (taper) the pace of its monthly bond purchases in 2022. There was no real signal around looking to alter the shape of the yield curve through ‘Operation Twist’ or an acknowledgment of Yield Curve Control, where he suggested the “current policy stance was appropriate.”

Most recent commentary from the Fed’s ranks, such as Lael Brainard and Charles Evans, had suggested they are watching the long-end of the Treasury curve and the speed of the move. This wasn't reinforced as intently as many would have liked by Powell and given that there's no more speeches until 18 March, there's no real circuit breaker for yields to rise further until then.

With US payrolls out today (00:30 AEDT - consensus 195k net jobs), US CPI out next week and a raft of government Treasury issuance, there's real catalysts out there to cause a further move in bond markets and this means risk assets will be super sensitive.

The world is changing

Everyone has a view on bonds now – that’s great, it's central to everything. However, I can't go past the move in US interest rate markets. There's a real and growing disconnect, as is the case in other countries like Australia, where the interest rate market is pricing in several hikes through the central bank's guidance period despite central bankers having tried to hit home this week that they will leave rates unchanged. When the market shares a different outcome from the Commander-in-Chief then we see dislocations and volatility and we’re looking at a world that is looking into the future and seeing the punchbowl being taken away and this changes the game.

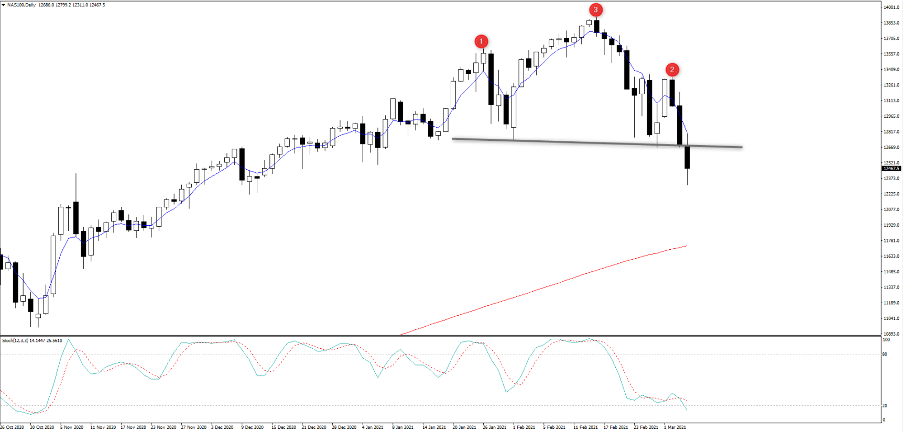

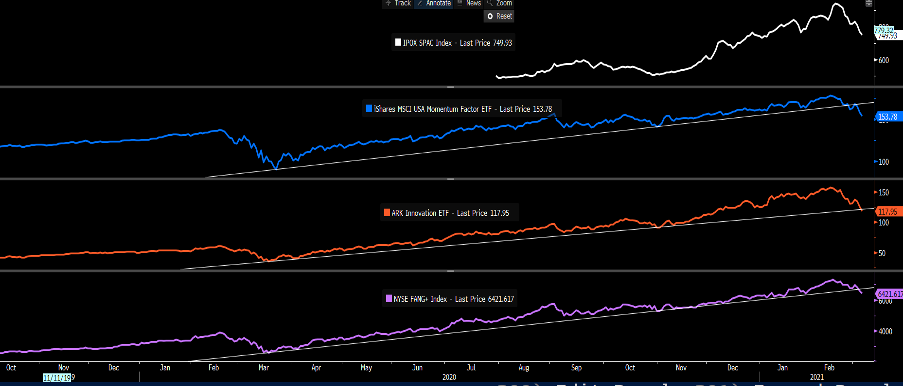

Look at the various posterchild’s and beneficiaries of zero rates, low bond yields and high liquidity and we see the impact most intently. One place I always head to is Tesla. Here we see the stock briefly touch $600, taking the drawdown from 25 Jan high to 33%. Short selling in Tesla is fair game. The NAS100 has broken the neckline of a rather pronounced head and shoulder pattern which argues for further downside. As we see the SPAC index, momentum ETF, ARK ETF and FANGS index have all crumbled and this is testament to the outlook for rates and a normalisation of policy.

(Order of panes – SPAC index, Momo ETF, ARK Innovation, FANGS+ index)

(Source: Bloomberg)

Gold has been sold on rallies and as I suggested recently the investment case for a sustained bull market is just not there – a lack of signal that the Fed will use its balance sheet to calm long-end yields is clearly not helping, and rising yields and USD has pushed gold below $1700.

The world is shifting and the markets are now looking past the period of incredible uncertainty and seeing a world with inflation, normalised monetary policy settings and a higher discount rate. The market is the dog, central banks the tail and this means volatility as the market tries to scramble to understand this world, where the idea of a policy mistake gets greater airtime. It means two-way opportunity and notably, in FX markets the idea that there will be divergence among central bank policy settings means we should see great volatility here too and even incredible trending conditions fills me with hope.

Now more than ever it pays to be open minded, understand the risks and react to changes in flow and sentiment. A trader’s domain. Ready to trade the opportunity?

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.