A traders’ week ahead playbook – China and US CPI the core trading themes

Core macro themes traders need to roll with:

- China reopening plans – after Friday’s incredible moves will the market buy the expected early weakness? Consider copper had a 4 standard deviation move on Friday (+7.6%) and the HShares closed its best week since 2015.

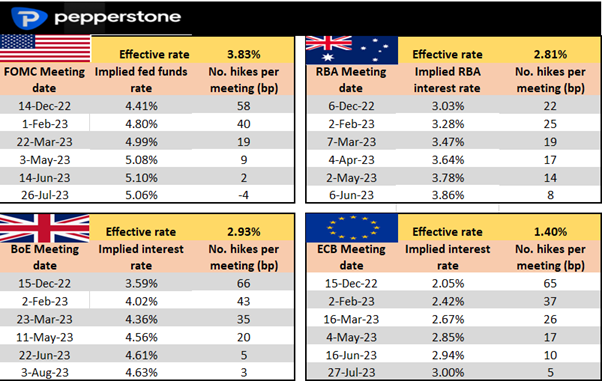

- Central bank divergence is even more pronounced – several central banks have underwhelmed on hikes and in some cases, there was a slight shift in the communication - we see expectations of synchronized tightening reduced and bank's actions are becoming far less aligned – this should cement the idea of trending conditions in the price action and certainly in FX markets

- Light at the end of the tunnel – the Fed to step down the pace of hikes to 50bp in December – this week’s CPI data and the suite of Fed speakers may influence this pricing – but peak core inflation/peak rates remain a key theme

- Has the USD peaked – are we in a distribution phase?

- How much juice has this new bear market rally got left? Is the equity melt-up real?

The week ahead playbook

Most have their eyes on US CPI this week, but trading China reopening is also front and centre and causing some incredible moves across markets – aside from a number of unsubstantiated tweets focusing on a reopening, there are multiple focal points for traders to sink their teeth into, including:

- The US audit (PCAOB) of Chinese companies is speculated to be ahead of schedule, which could lead to a favourable decision on whether to delist Chinese ADRs –

- Talk that China is to tweak rules of international flights bringing heavily infected passengers into the country – this includes removing the 2-day negative PCR proof needed for incoming passengers.

- Germany detailed that China would make the mRNA vaccine available to foreigners living in China

- Medical officials lowering the level of concern on Covid’s long-term effects on health

In essence, the news flow, while consistent, has largely been of limited substance - the market, however, has taken the comments seriously enough to cover shorts and initiate longs for the more aggressive traders. Rightly so, China's re-opening is a game changer as it would clearly help reduce global inflationary pressures and catalyse a low in the synchronized global growth slowdown. If we consider the USD ‘smile’ theory, increased demand from China and improved supply chains suggests reduced demand for USDs and play into a view that the USD is putting in the process of a top.

Weekend news is perhaps not so inspiring with the official rhetoric pushing back on reopening hopes, with authorities vowing to maintain “unswervingly” its stringent Covid Zero policy – galvanised by the daily covid case count which is pushing 3500 new cases. It will therefore be interesting to see if we see a reversal in a number of the Friday moves – notably where we saw the yuan rally over 2%, copper +7.6%, AUD +2.9%. gold +3.2% and HK50 +5.4%. The HShares had its best one-week gain since 2015. These are incredible moves, but what seems apparent is the market is living in the future and starting to price in a higher probability of a reopening – even if it is staggered and likely to occur in Q1 23.

With the Fed the standout, and almost lone hawkish central bank, it’s not all about the Chinese market (and its second-order derivatives – such as the AUD), but the key event risk of the week is the US CPI print – core CPI is what gains the central focus with the consensus at 6.5%, and with the market just so used to above consensus prints it would shock to see a below estimate print.

As part of the risk assessment, I question how this print reconciles with current market sentiment – ask yourself, do we get a bigger move in the USD on a below-consensus core inflation print, or a gain in the USD on an above-consensus print? Positioning is always a factor here, and the extent of the beat/miss, as well as the components – my own view is risky assets rally harder on a 6.3% core CPI print than a 6.7% core print – I know many will disagree.

(Gold daily chart)

Gold is front and centre partly because Friday’s monster 3.2% rally took price up to channel resistance and the top Bollinger Band– this will happen when the USD is smacked 1.8%, and US 5yr real rates move 11bp lower. Clients have started to build a net short position into this resistance zone.

Europe and UK also look interesting – Europe equity indices are on a tear (even when priced in USDs), EU Nat gas prices are down 66% from the August highs – Italian 10yr BTP spreads remain contained vs German bunds at 2.16% – the downtrend in EURUSD - drawn from the Feb highs – looks to be over and despite a barrage of bad news over the last 2 months is still printing higher lows. There is a China play in EU assets, but the momentum in EU and UK100 equity indices looks real, although the move is becoming overbought and suggesting buying weakness may be the better play.

SpotCrude daily is one to focus on, with price into the 7 Oct highs and making some power plays on Friday – a break of $93.52 naturally puts $100 back on the radar, but again while this reflects the China reopening expectations, a higher crude price isn’t perhaps what the world needs now.

Rates Review – we look at market pricing for the next central bank meeting and the step up (in basis points) to the following meetings

Other known event risks for traders to navigate this week

- US Oct CPI (11 Oct 00:30 AEDT) – The market expects a 7.9% YoY headline print, and 6.5% core inflation – The core measure is the more important of the two and obviously the most important data point for markets right now. The question – as always - do we get the bigger reaction on a below consensus number or above?? Consider CPI has come in above consensus in 10 of the past 12 reports

- University of Michigan 5–10-year inflation survey (12 Nov 02:00 AEDT) – No change is expected at 2.9%, but we’ve seen this miss consensus before and move markets

- US midterm election (Tuesday) – the Republicans are expected to win both the Senate and House which as I put it in the playbook has implications for future fiscal policy and the debt ceiling – however, what if the polls are wrong and the DEMs get a bigger advantage? The USD could push higher – one consideration is the timing of the results and whether we get a full understanding on the day of the election or further out the week.

- Central bank speeches – it’s a huge week ahead for central bank noise – we see 9 Fed speakers, 18 ECB speakers and 7 BoE speakers. In Australia, RBA deputy gov Bullock speaks (9 Nov 20:05 AEDT)

- The ECB will publish its economic bulletin (10 Nov 20:00 AEDT) – the forecasts could have a bearing on the perception of the ECB's economic projections due out in the December ECB meeting – could we be looking more intently at a recessionary forecast?

- Japan Summary of Opinion (8 Nov 10:50 AEDT) – while the BoJ has held a consistent dovish line, the market will be watching to see if there are any hints at changes to its YCC policy in the future

- China CPI/PPI (9 Nov 12:30 AEDT) – CPI is expected to drop to 2.4% (from 2.8%) – Covid policy remains the central focus, so this data point isn’t likely to move the yuan – we also get the money supply and new loans data this week (no set time)

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。