For every unit created, the fund buys 1/110th of a fine troy ounce of gold. NewGold then stores the physical gold for an annual fee of 0.3%.

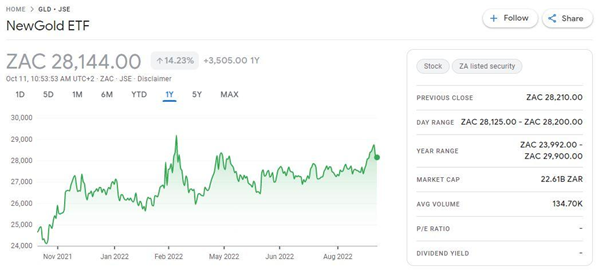

Google.com

*An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, an index or, in this case, a commodity. An ETF is traded like shares on a stock exchange. It is a pooled investment fund. Trading CFD ETFs through Pepperstone is a derivative of the underlying product.

Why invest in NewGold

The NewGold ETF is an alternative solution to gaining exposure to gold.

Many investors look to invest in precious metals in times of uncertainty and regard gold as a safe-haven.

Take the COVID-19 pandemic as an example.In the chart below we can see the timeline when the World Health Authority (WHO) announced the first case of COVID-19 on January the 9th 2020. Gold went on to gain in value by over 24% in the coming months (Gold priced in USD).

Figure 2 rise in spot gold after COVID-19 was announced

Buying and selling physical gold comes with its difficulties. Where can you buy gold bullion at the market price? Where are you going to store your newly purchased treasure? What if you want to liquidate your gold holding quickly. Are you going to get a fair price from your local bullion dealer? You can see it is fraught with obstacles and is likely to be an expensive endeavour.

An Exchange Traded Fund (ETF) is traded on the stock exchange like a share, making it easy to buy and sell your investment.

Currency exposure

With the NewGold ETF being priced in South African Cents (ZAC / ZAR South African Rand), it is exposed to currency fluctuations against the US Dollar.

When the South African Rand is weakening (USDZAR strengthening) NewGold will outperform spot gold. When the South African Rand is strengthening (USDZAR weakening), NewGold will underperform spot gold.

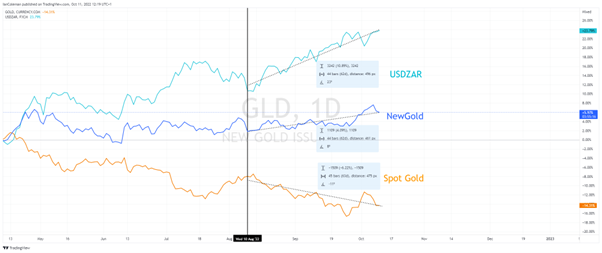

Let us look at a chart to get a better understanding of this phenomenon. We will look at the period starting from the Wednesday the 10th of August to date (Until 11/10/2022):

- USDZAR has increased by +11.96%. This is a weakening

- Spot gold has

- NewGold increased

It should be noted that the difference between spot gold and NewGold is 11.12%, close to the percentage gain on USDZAR (11.96%)

Figure 3 TradingView comparison chart

Other ways of gaining exposure to gold

Pepperstone offers various ways to gain exposure to Gold through Contracts for Difference (CFDs).

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。