分析

Australian Banks 1H earnings preview

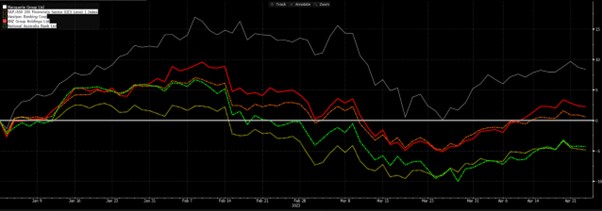

How these banks are tracking financially and the trends they are seeing in lending, their asset quality and capital position could genuinely influence broad sentiment towards broad Australian assets.

From a trading perspective, we see the market looking for between a 3.1% to 1.7% move (higher or lower) on the day of the respective bank earnings. Given their high weightings on the ASX200, if we do see these banks having a big move on earnings, we could feasibly see the AUS200 also having an outside move as well – so it's an event risk that both equity CFD and equity index traders should be across.

It seems unlikely, but there is the possibility that commentary on housing or lending trends could even move interest rate expectations and by extension the AUD.

MQG

MQG (+8.4% YTD) has been the only one of these financial institutions to outperform the ASX200 YTD, but the investment case is clearly different from the big Australian commercial banks. MQG is a trader favourite – historically the attraction has been heightened movement in the share price, which can enhance various trading strategies – this time around the options market prices a +/-3% move for MQG on the day of earnings.

The focus from investors are less on domestic economic trends, and more on its commodities and global markets income, as well as annuity income and M&A activity.

By way of expectations, the market is looking for FY net income of $4.957b, sales of $18.14b, paying a dividend of $6.91 and surplus capital of $12.2b.

Consider the market is expecting net income of $4.67b in 2024 – a potential decline of 6%, so we’ll be looking at the outlook to see if these expectations are indeed priced correctly.

After a rally from $167 to $182 the bulls will want to be inspired to keep the bull trend going for a re-test of the Feb highs of $195.

The three Australian commercial banks will see other factors in play and the market is specifically looking at volumes and credit growth. They are focused on bad and doubtful debts and asset quality, as well as expenses and margins.

Any outlook on housing, the impact how the roll-off from fixed to higher variable rates potentially impacts households and views on RBA rates could move markets.

ANZ

ANZ have performed the strongest going into earnings with the market inspired by solid mortgage growth and reduced approval times. Valuation has also played a part, and we see ANZ is trading on 10.4x 2024 earnings, vs the long-run average of 11.3x.

The market expects ANZ to report 1H23 cash earnings of $3.75b, paying a dividend of 78c and to report net interest margin of 1.83% - total bad and doubtful debts and a percentage of gross loans and advances (GLAs) are expected to increase by 7bp.

NAB

NAB has found good sellers into $29.00, so the bulls will be looking for good numbers and a solid outlook to push the price into the 200-day MA at $30.17. The market prices a 2.5% move on the day of earnings, with investors seeing the skew of risks to an upside surprise although its pedigree at earnings is hardly inspiring – we see NAB has missed the street’s forecast on revenue and net income in 6 of the past 7 and 5 of the past 8 reporting periods respectively.

(NAB daily chart)

This time around the market expects NAB to report 1H23 cash earnings of $4.19b, paying a dividend of 84c and net interest margin of 1.83% (+16bp from 2H22), total bad and doubtful debts and as a percentage of gross loans and advances (GLA’s) by 10bp.

Westpac

The market prices a 1.7% move on the day of earnings from WBC, so this more sanguine implied move may see WBC garner less of a focus from traders. With WBC holding a larger mortgage book than NAB and ANZ means the market may place greater emphasis on its outlook on margins and cost guidance, but for now, the street looks for cash earnings of $3.7b. We see estimates that margins will hit 2.03% (+14bp HoH) and pay a 72c dividend.

With the market questioning if we see another rate hike this year from the RBA, any views on the housing market, and volumes could resonate across markets.

Its time to put the banks on the radar, as given the current climate they could reveal a lot about trends in the economy, as well as throwing out compelling trading opportunities for equity CFD and AUS200 traders.

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。