分析

US PPI inflation came in at 0.2% m/m, where we take elements from this inflation read and feed them into the core PCE calculation (due on 26 April). We also take elements from the CPI basket, where it now suggests the Fed’s preferred inflation gauge is running around 0.28% m/m in March or 2.7% y/y. Certainly not low enough to compel the Fed to cut rates anytime soon, but it does reduce some of the concerns that arose yesterday from the hotter US CPI print.

The PPI print has taken some of the impetus to push US bond yields further higher, where another session of big selling in US bonds (taking yields higher) – especially when married with further USD strength – would have likely seen US equity indices trade through key support/technical levels and promote a new wave of deleveraging and selling from more systematic players.

New highs in the NAS100 incoming?

New all-time highs in the NAS100 is where my directional bias falls right now, which is not a huge call given we’re only 1% away from this level. The US500 needs a bit more convincing though, with trend resistance (drawn from the 1 April high) seen just overhead and offers a headwind for the bulls in the near-term – subsequently, a upside break of 5237 and I would be looking at momentum longs, for new highs here.

Tech aside, I’d be wanting the US banks to fire up and investors will need to hear something in the session ahead that compels new money to be put to work in this space, with earnings from Citi, Blackrock, and JP Morgan on the docket. The implied moves on earnings from these names sits at -/+ 3 to 4%, so it could get lively in these individual names, while the XLF ETF (S&P financials ETF) may get some focus from clients.

ECB meeting review

The ECB meeting received interest from traders and expectations for a June start date for a cutting cycle have been galvanised. The bigger issue now facing the individuals within the ECB is providing a more compelling thesis as to why they shouldn’t cut. The question traders are also asking is around the ongoing pace of cuts when they do potentially start in June, and what will be the frequency of cuts in the meetings ahead – this is where central bank policy divergence with the Fed will be seen more intently and it's where EURUSD could trend.

We can already see that the US 10yr Treasury yield commands a 211bp premium to German 10yr bunds and this is near a multi-year high – a factor supporting the USD and one dynamic that should see traders selling strength in EURUSD and suggests the path of least resistance is for EURUSD to gravitate towards 1.0500. For bearish momentum to get going it will require a break of the 14 Feb swing low of 1.0695 – but should this break play out then shorting EURUSD will likely be all the rage.

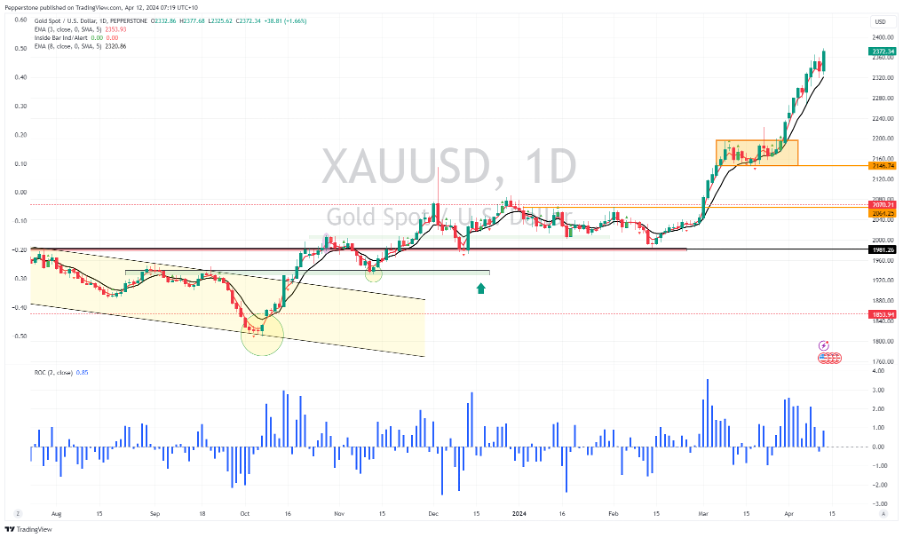

On the flow side, we’ve seen upbeat interest in gold once again into new highs. I had been looking for a bit more heat to come out of the move to reengage with longs, but it seems $2320 was as deep as the pullback was to be. Onwards and upwards it seems, and momentum remains the powerful force. Once again, adopting a more systematic approach would have kept you in the move higher and unemotional. Using a simple use of a 5-day moving average (i.e. exit when price closes below the short-term average) or a 3 vs 8-day MA crossover as an exit signal would see longs remain in place and the art of holding winners is still the play.

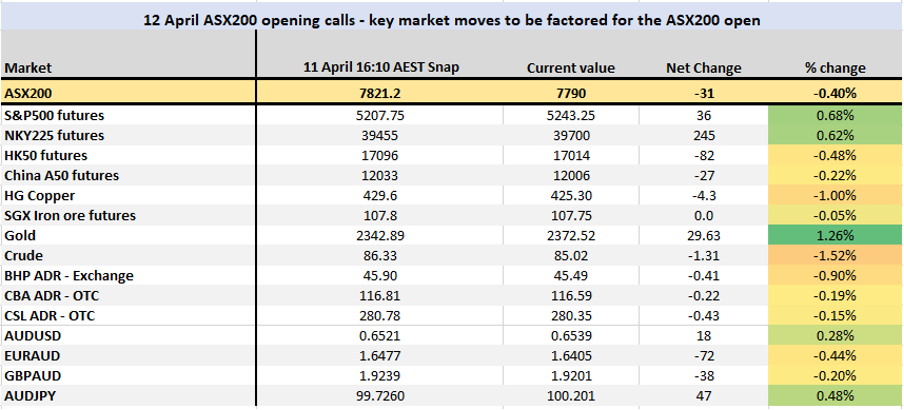

Asia equity opening calls

Turning to our opening calls for Asia equity markets, we see the ASX200 opening on the back foot, which is interesting given that S&P 500 and Nikkei futures are 0.7% and 0.5% higher from the ASX200 close (at 16:10 AEST). A weaker open in HK is a factor, and we can see modest headwinds arising from copper, iron ore and crude. As we’ve seen of late, one consideration for traders is holding risk into the weekend and the prospect of a geopolitical headline leading to gapping risk on the Monday re-open. This could keep would-be buyers away and could see gold push higher through the day.

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。