差價合約(CFD)是複雜的工具,由於槓桿作用,存在快速虧損的高風險。80% 的散戶投資者在與該提供商進行差價合約交易時賬戶虧損。 您應該考慮自己是否了解差價合約的原理,以及是否有承受資金損失的高風險的能力。

What is the RBA cash rate?

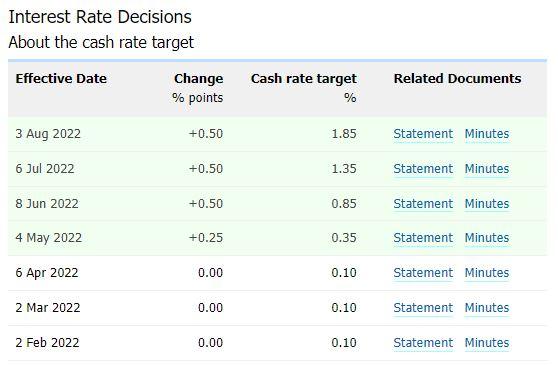

The RBA cash rate currently stands at 1.85% *. The cash rate is the interest rate charged on overnight unsecured loans between banks. This rate is set by the Reverse Bank of Australia.

Changes in the cash rate are a closely watched event for currency traders.

Why does the RBA cash rate change?

The Reverse Bank of Australia is a Central Bank. Its role was set out in the Reserve Bank Act in 1959. The main aim of the RBAs monetary policy is to ensure market stability.

Setting the cash rate affects the ability for banks to lend at certain interest rates. This then filters down from banks to consumers. The higher the interest rate the more expensive it is to borrow and spend.

Setting the RBA cash rate is a fine balancing act. They look for the rate to be low enough rate to promote full employment, but not so a low that it results in inflationary pressures on the economy.

Source: RBA

The Reserve Bank of Australia statement and minutes

The RBA monetary policy committee meets 11 times a year. This is the first Tuesday of every month apart from January.

The RBA rate decision and statement are leased at 4.30am UK time. That is 1.30pm local time in Sydney.

How do the currency markets react to the rate decisions

A higher interest rate is normally bullish or positive for the single currency. A lower interest rate is normally bearish or negative.

It should be noted that a lot of emphasis is taken from the statement and minutes. Traders look to this information for forward guidance on the future direction of the RBA cash rate and the potential longer-term outlook for the Australian Dollar.

*as of 19th August 2022

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。