Aston Martin Aramco Formula One™ 車隊與 激石:追求卓越,永不止步

.jpg?&fit=crop&crop=center)

Aston Martin Aramco Formula One™ 車隊與 激石:追求卓越,永不止步

兩個世界級團隊,一個共同理念,追求卓越成果。以賽道和市場表現為基礎,探索和建立合作夥伴關係。

只因我們追求卓越,永不止步。

我們的數據說明一切

截至2025年10月的Pepperstone集團數據

830K+

交易員

$1TN+

每月交易量(AUD)

$100M+

每月出金(AUD)

10

全球辦事處

提升您的交易潛力

與真正了解交易者需求的經紀商一起,將您的交易策略提升至新水平。

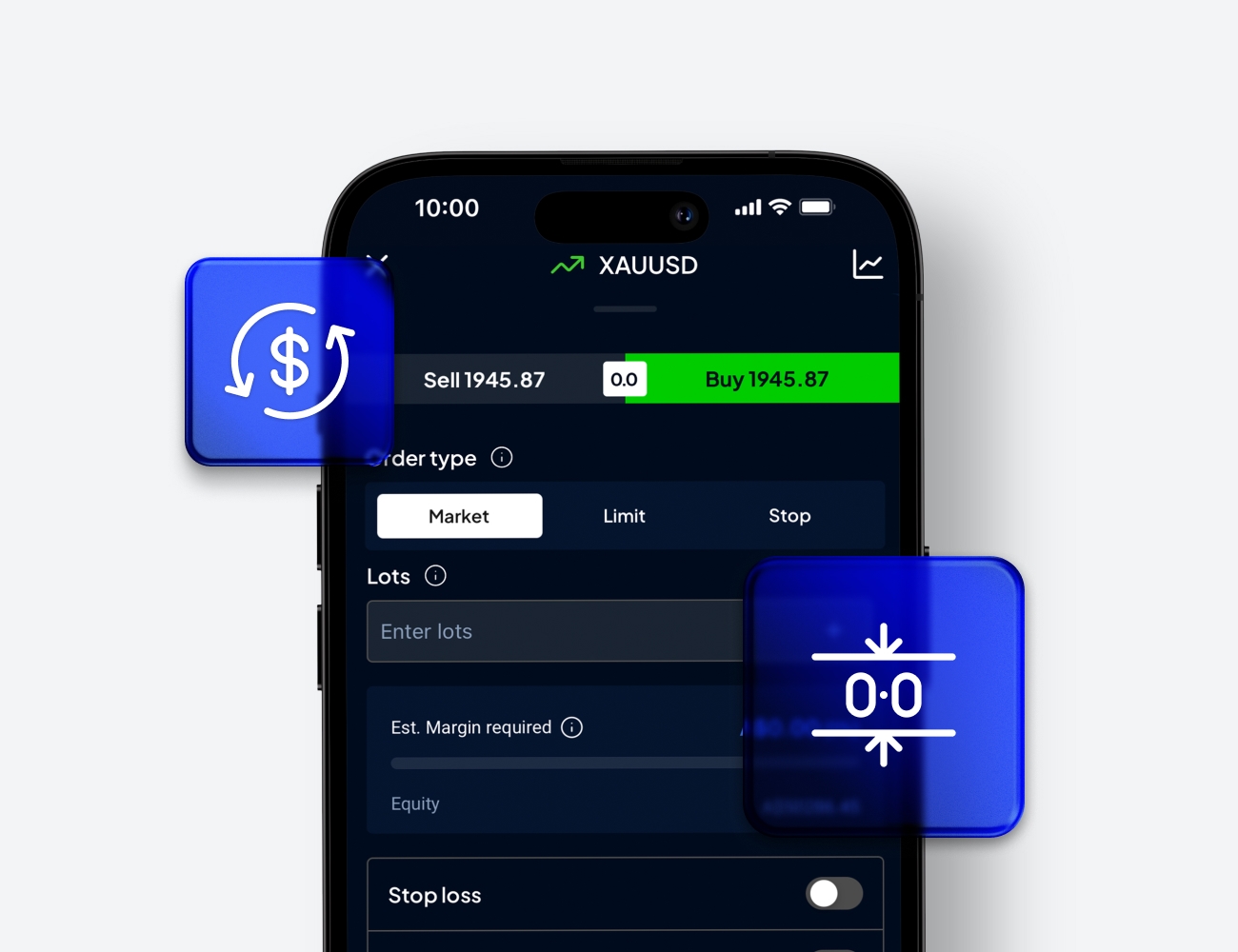

超低點差

使用Razor帳戶交易,點差從0.0點起。1

菁英交易技術

選擇MT4、MT5、TradingView、cTrader或使用Pepperstone平台。

跟單交易

尋找並複製經驗豐富的交易者策略。

高速且可靠的執行效率

獲得99.59%的成交率,無交易員幹預。2

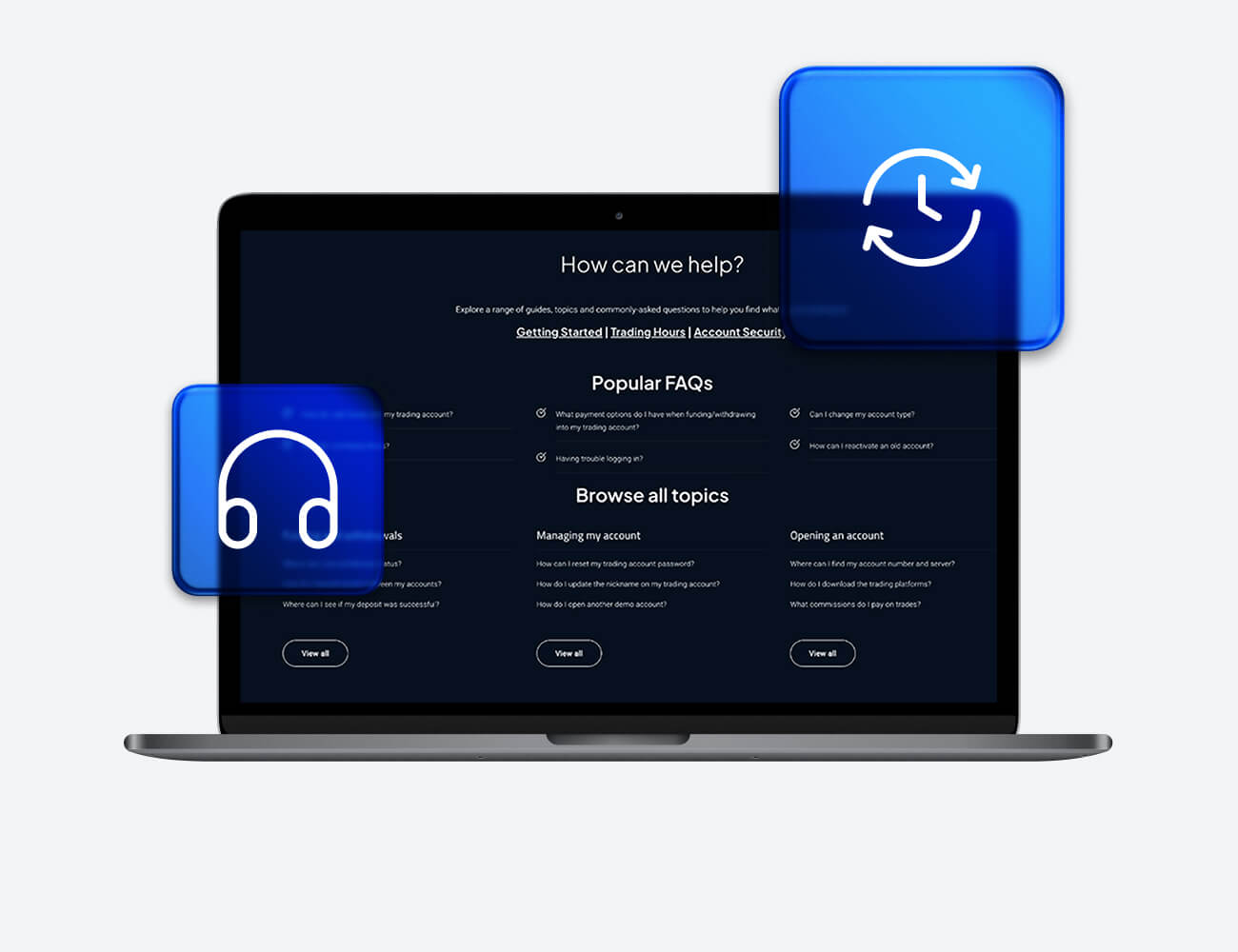

24小時全天候客戶支援

週一至週五全天候支持,週末提供18小時支援。

智慧教學

透過網路研討會和指南提升新手與進階交易者技能。

屢獲殊榮

我們的獎項

企業認證:

準備好享有更好地交易體驗了嗎?

立即切換至 Pepperstone,加入我們超過 62 萬名交易者的全球社群。3簡單申請,只需幾分鐘即可開啟交易之旅!

1.

註冊

使用您的電子郵件地址註冊並獲得免費模擬帳戶。

2.

問題評估

我們將評估您是否適合我們的產品。

3.

驗證您的身份

您的安全是我們的首要任務。

4.

儲值資金

已完成!您可開始交易。

1需繳納其他費用和收費。

299.59%。成交率是根據2025年7月1日至2025年9月30日期間的所有交易數據

3數據截至2025年2月。

.jpg?&fit=crop&crop=center)