To, attempt, to answer those questions, it’s worth outlining the pillars on which the above themes were constructed:

- US economic growth ‘catching-down’ to that of DM peers, bringing to an end the ‘US exceptionalism’ theme that had driven markets during much of H2 23

- Disinflation continuing, as headline price metrics fall back towards central banks’ 2% targets, albeit in a bumpy manner, with the ‘last mile’ of said return to target proving the most difficult

- In turn, converging economic outlooks and increased confidence in disinflation permit central banks to begin to normalise policy, in a relatively synchronised manner

- The delivery of said policy easing, and beforehand the belief that such powerful easing can now be delivered at a time of policymakers’ choosing, subsequently keeps a lid on volatility, somewhat insulating markets from exogenous shocks

- The aforementioned low volatility, and return of the central bank ‘put’, ensures that the path of least resistance for risk assets continues to lead to the upside, with dips shallow, and short-lived

Examining each of those in turn should help to answer the questions just posed.

On growth, it’s relatively clear that things are becoming somewhat more equal across developed markets. In Q1, the US snapped a run of six consecutive quarters of >2% annualised QoQ real GDP growth, as economies on this side of the Atlantic, particularly in the UK, showed a marked pick-up in momentum.

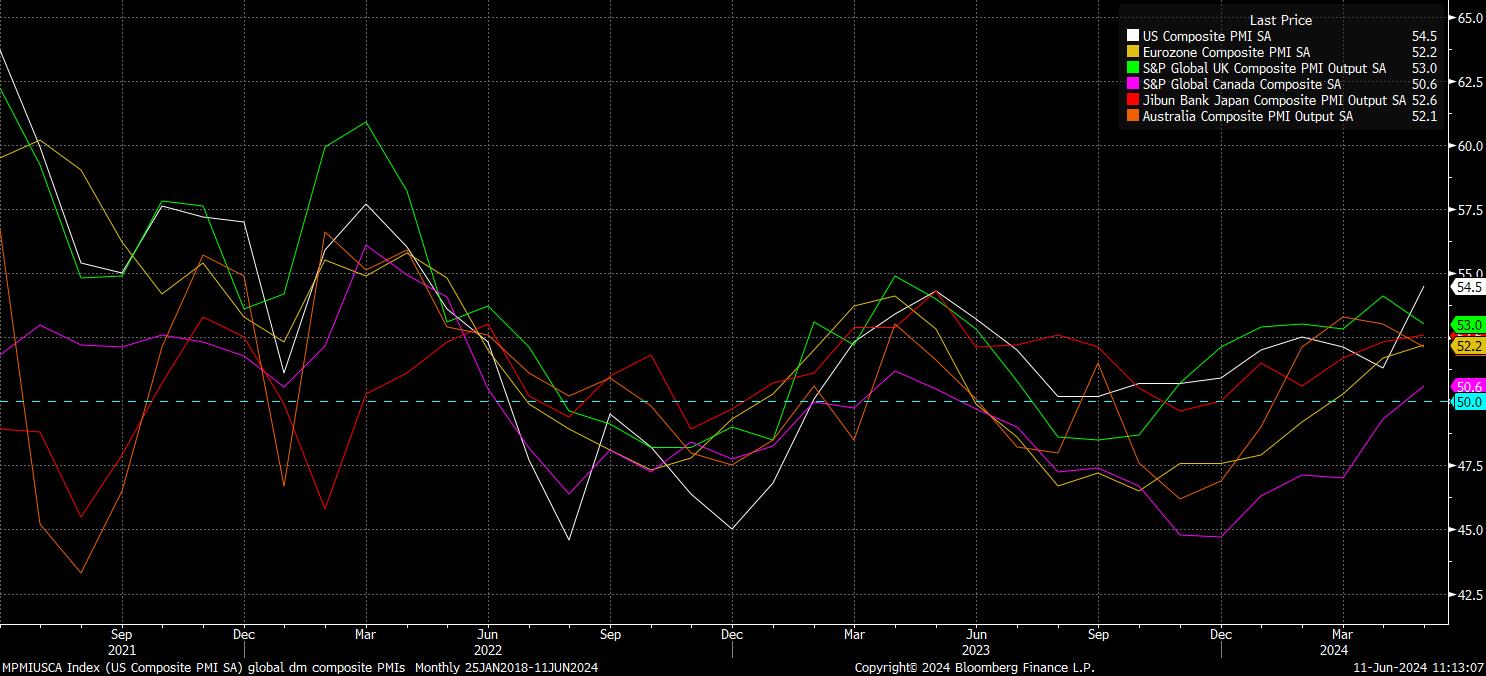

Coincident, and leading, indicators also paint a similar picture. According to the most recent round of PMI surveys, although the US does outperform on the composite measure, momentum elsewhere has continued to pick-up in recent months, with the aforementioned output gauge now comfortably above the 50.0 breakeven mark in the majority of major economies.

Furthermore, and perhaps more importantly, is that US economic data continues to disappoint compared to market expectations. Citi’s surprise index, despite last week’s hotter-than-expected labour market report, remains in negative territory, just a hair above its lowest level since the start of 2023.

This implies that, even if the US economy were to outperform once more, such a theme is unlikely to be tradeable, given that said outperformance – unless it is to a significantly greater degree than seen already – has already been discounted en masse by market participants.

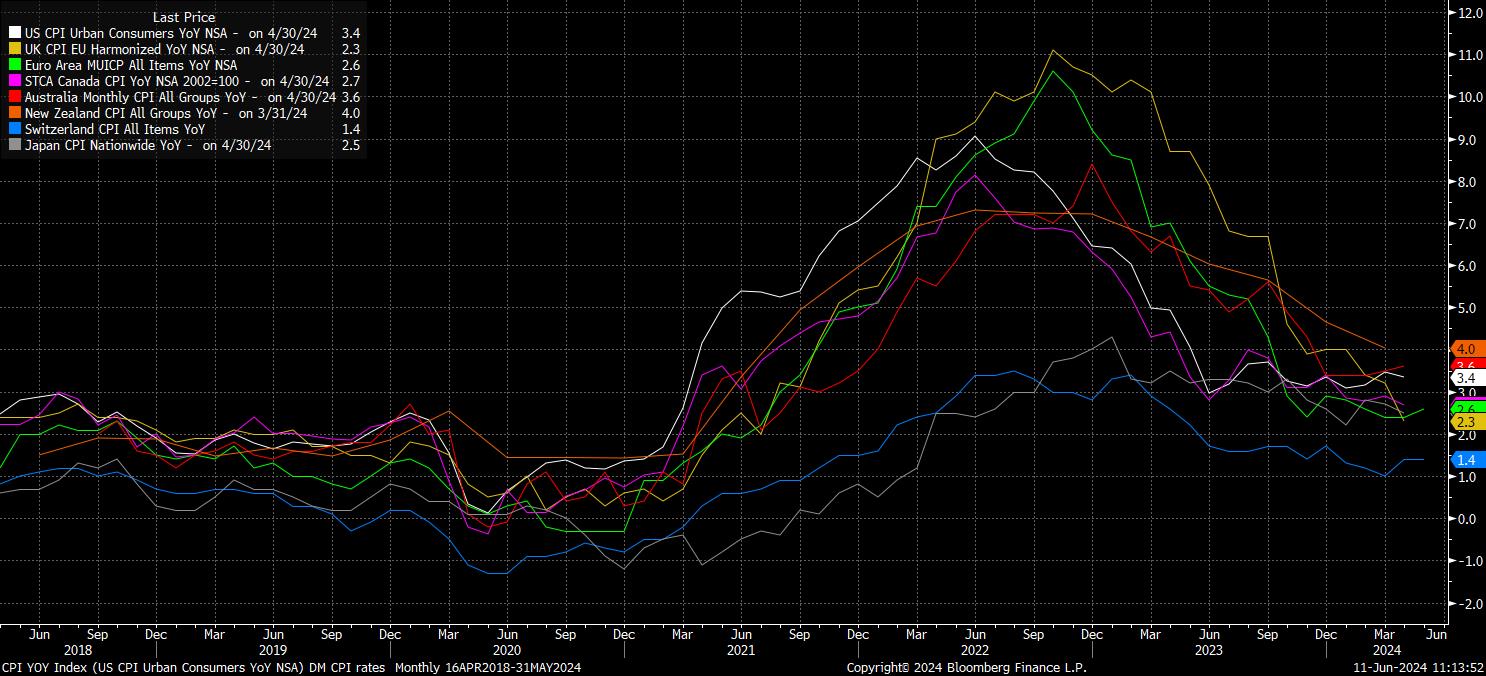

Meanwhile, on inflation, the journey back towards 2% continues across DM, albeit in relatively bumpy fashion. While the 2% mark has already been achieved in Switzerland, where inflation has been below said level for over a year, headline price metrics remain within touching distance of that mythical figure in the UK, eurozone, Canada, and Japan – albeit, with the latter being something of a ‘special case’.

Though headline prices remain more elevated in the US, core CPI fell to a near 3-year low in April, ahead of the May data due later this week. In any case, as had been expected, the ‘last mile’ back to target is proving slower than earlier parts of the disinflationary journey, with services prices in particular remaining relatively stubborn, in part due to the continued tight nature of global labour markets.

While bumpy, said journey remains relatively synchronised, in turn making the policy normalisation cycle equally as co-ordinated.

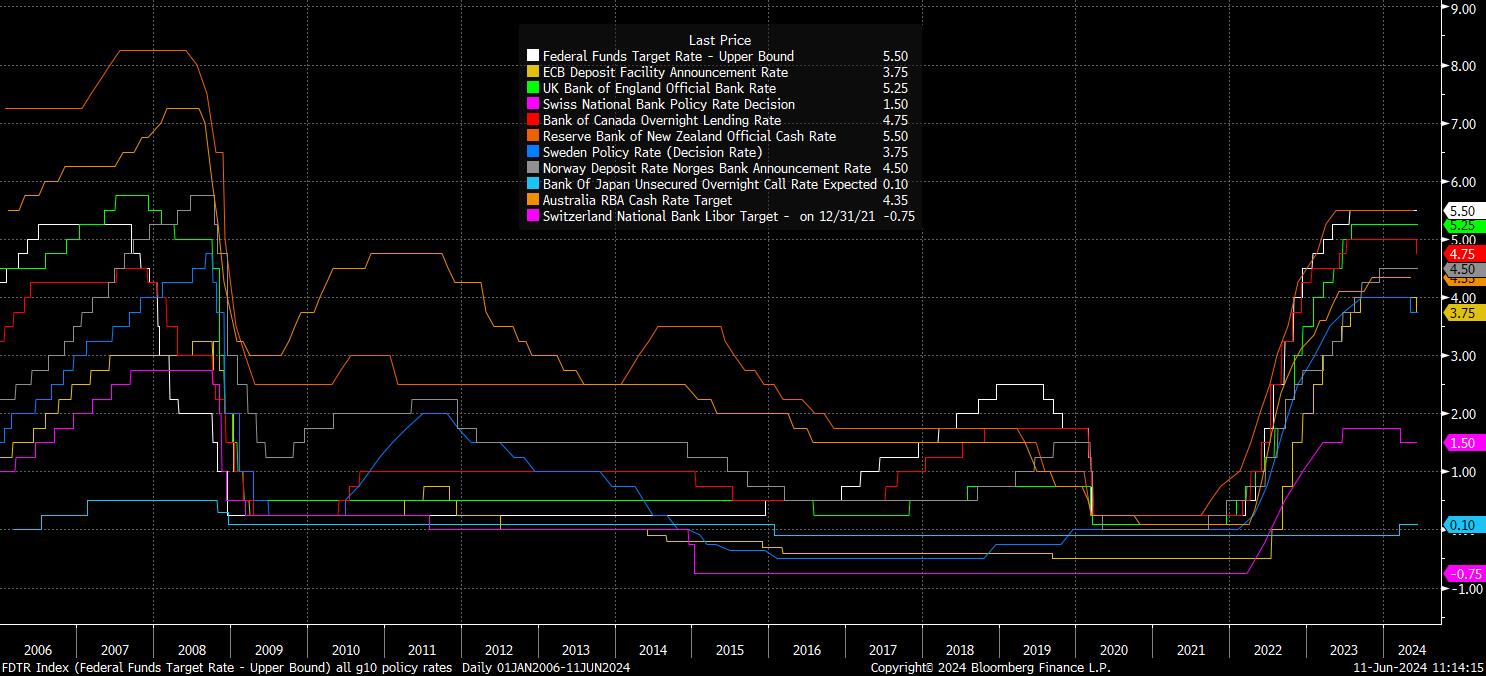

Four G10 central banks – the SNB, Riksbank, BoC, and ECB – have already delivered their first 25bp cuts of the cycle, with money markets pricing an even chance that the SNB plump for a second such cut later this month. Over the remainder of the summer, the BoE look set to join the party with a rate cut of their own, while my base case remains that the FOMC cut in September, even if the OIS curve doesn’t fully discount such a move until the middle of the fourth quarter. The ‘summer of easing’, long flagged in these pages, is well and truly underway.

Of course, this relatively co-ordinated pace of policy normalisation has not only encompassed rate cuts, but also guidance that further cuts are on the way, in addition to tweaks to the process of balance sheet normalisation.

These latter aspects are particularly true for the FOMC, who – from the start of June – begun a faster than expected tapering in the pace of balance sheet run-off, now capping monthly Treasury redemptions at $25bln, down from a prior $60bln. Furthermore, this increased liquidity was accompanied by dovish guidance. The next move in the fed funds rate will clearly be a cut, as outlined by Chair Powell, either due to having obtained “confidence” in inflation returning towards the 2% target, or due to “unexpected” labour market weakness.

Coupling these factors together provides not only the delivery of policy easing in the ‘here and now’, but also a strong belief that further policy support is on the way. As well as this, there remains confidence among market participants that, were economic conditions to significantly sour, policymakers are both willing and able to deliver even greater stimulus were it to be required.

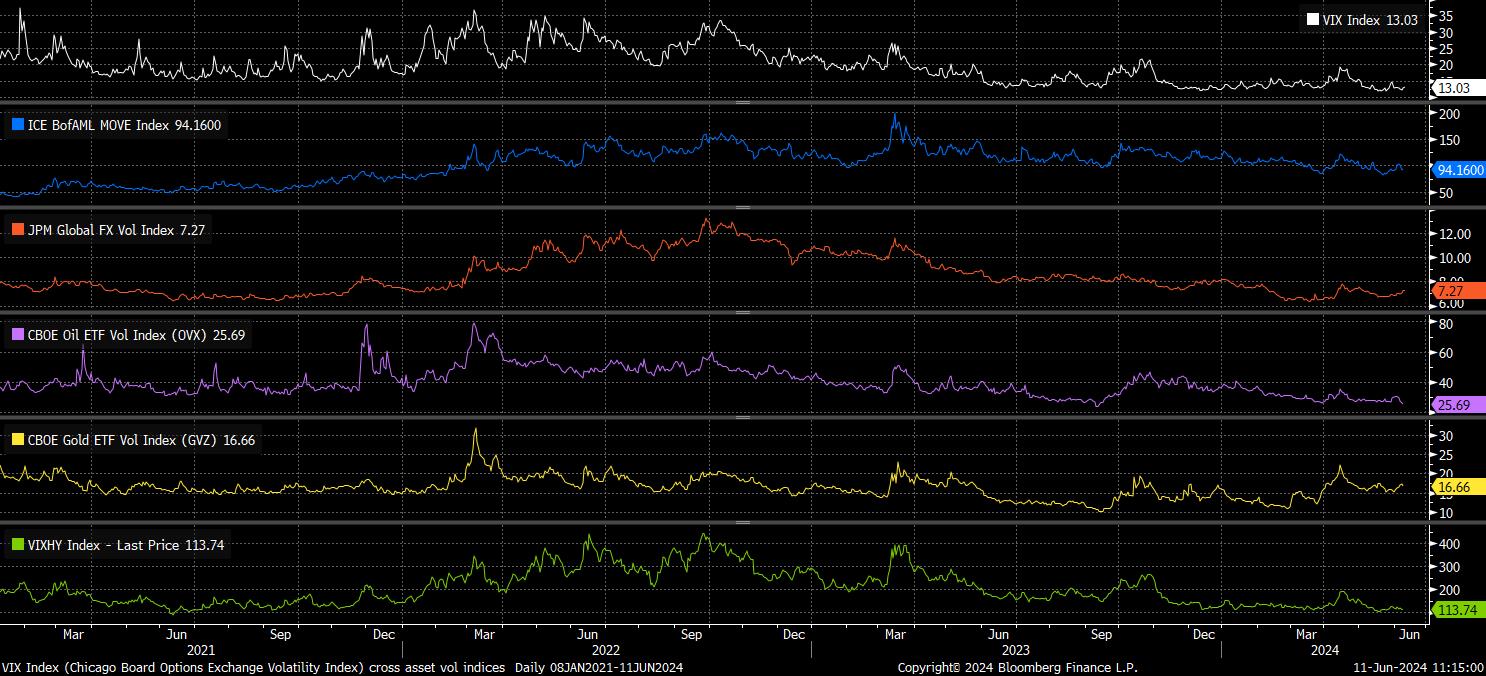

In other, simpler, words – the central bank ‘put’ is back – and keeping a lid on volatility as we approach the typically quieter summer months.

As is typically the case, vol displays an inverse correlation with risk, as equities continue to power higher, with both the S&P and Nasdaq notching a succession of fresh record highs, while European equities were also performing well, before the recent bout of political uncertainty halted the rally in its tracks.

Nevertheless, the aforementioned return of the central bank ‘put’ continues to give investors confidence to move further out the risk curve, and remain in dip buying mode, with any bouts of weakness short-lived, and shallow in nature. Overall, the path of least resistance for the market more broadly continues to lead to the upside.

Concurrently, as the policy backdrop becomes increasingly supportive, and importantly does so in a synchronised manner across DM, the G10 FX market remains rangebound, with the DXY remaining in the broad 104 – 106.50 band flagged some time ago. Barring a material hawkish shift from the FOMC, throwing hikes back onto the table, which seems highly unlikely for now, any significant USD upside seems a long shot. So long as vol remains subdued, carry trades are likely to remain the order of the day, hurting funders such as the JPY, EUR, and CHF.

_d_2024-06-11_11-15-41.jpg)

In summary, and to answer the questions posed at the start of this note, a thorough assessment of current conditions, including both the macro and policy backdrops, suggests little by way of significant changes to my core, longstanding views. While risks remain, most obviously those of either a further flare up in geopolitical tensions, or a ‘hard landing’ occurring, the aforementioned scenario remains the base case for now.

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。