CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren.72.6% der Kleinanlegerkonten verlieren Geld beim CFD-Handel mit diesem Anbieter. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

FOMC meeting preview - will the Fed signal rate hikes are coming?

Event – March FOMC meeting on 17 March (6:00pm GMT) / 18 March at 5:00am GMT. Fed chair Powell holds a press conference at 05:30am AEDT.

Market form (Movement in the 60 minutes after the FOMC statement). In the last eight FOMC meetings, the USD has seen a mixed reaction, rallying 50% of the time with an average gain of 0.2%. The US500 has seen more consistent form rallying six of the past eight meetings. Gold has also rallied six of the past eight meetings and each of the last four consecutive meetings.

The focus

Whether running a discretionary or systematic strategy the FOMC meeting naturally throws up risk but also opportunity for traders. Such is the importance of this meeting that most markets will likely see heightened correlations into and after the fact. With interest rate markets almost pricing three rate hikes by the end-2023, the Fed can push back on this market pricing and enforce the notion that rates will stay lower for longer.

The question remains will they choose to do so? Or will they continue to welcome the pricing in interest rates markets and US Treasuries, believing the market sees their policy settings as credible. Market participants have been inspired by inflation expectations moving to the highest levels since July 2014, amid evidence of an efficient vaccine rollout, $1.9t fiscal stimulus and improving economics.

What’s the message we’ll hear from the group this time around?

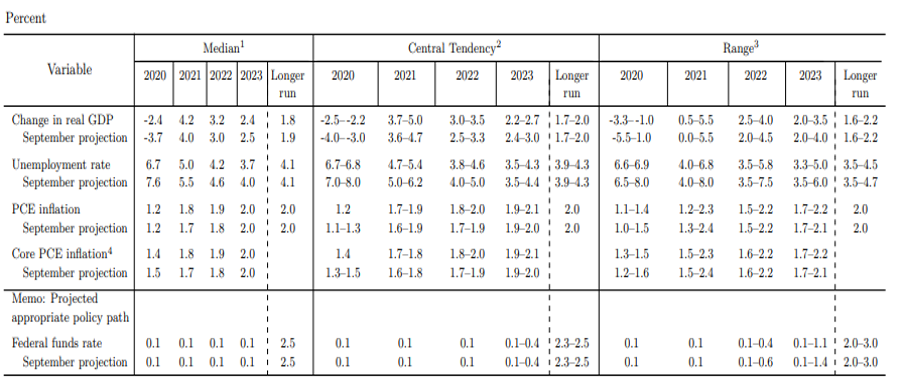

The voting members within the FOMC offer their forecasts on economic projections and where they see the Fed funds rate (or the so-called ‘dots’) this year, 2022 and 2023 – as well as the long-term or ‘terminal’ projection. The market will assess each member’s projection and the degree of dispersion, where the reaction will come from any changes to the median projection and specifically if the median projection for 2023 on the Fed funds increases.

(Source: Fed Reserve)

GDP forecasts

There'll be a significant upgrade to the Federal Reserve growth forecasts, not just because the US economy is recovering, but they now need to factor in the $1.9t in COVID-19 relief package into their forecasts. The current median projection for 2021 growth stands at 4.2%, but that is clearly far too low and should be revised above 6%. With much of the expected growth and consumption front-loaded into 2021, the question then becomes whether they downgrade their 2022 and 2023 GDP projections from 3.2% and 2.4% respectively.

Unemployment forecasts

On the unemployment projections, economists expect the median projection to be cut from 5% for 2021 closer to 4.5%, with the 2022 projection of 4.2% to fall below 4%. The long-run estimate should remain at 4.1%.

Inflation projection

If we’re going to see changes to the Fed’s inflation forecasts they will be very modest indeed. We should see PCE inflation revised up 10bp in 2021, 2022, and 2023, but it will be slightly above 2% and clearly won't constitute an inflation scare.

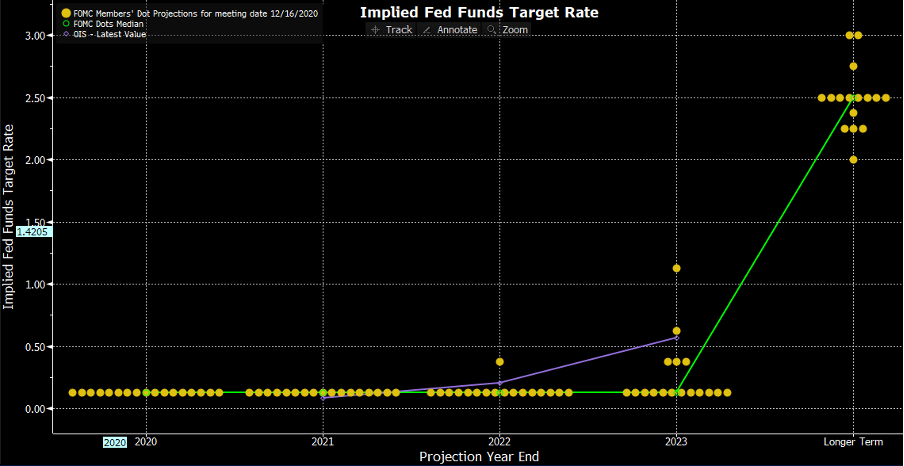

Fed funds projection (‘dot’ plot)

The probability is we see the median projection for the fed funds rate to remain unchanged. The potential elephant in the room would come if the median projection moved to pencil in one hike in 2023. In December five Fed members voted for hikes in 2023, and we would need to see a further four more revise up their call for the median projection to one hike in 2023. The probability of this is somewhere around 25-30%, so should it play out it would bring out bond sellers and with it, the USD would rally. While gold and growth equities (like tech) would likely fall.

(Source: Bloomberg)

The more likely scenario is we see the dots plot remain unchanged, with one or two members moving their rates call for 2023. In this case, there is scope for an element of rates hikes to come out of markets, resulting in USD selling and gold buyers.

Outlook and guidance

Recall, the Fed will continue to purchase assets (QE) until “substantial progress” has been made on the group’s employment and price stability goals. Will that change at this meeting? It seems unlikely as it was only recently (4 March) that Jay Powell used similar wording in a WSJ interview. That said, the market works on one-word changes, and even the most subtle change to guidance could be magnified in market pricing.

If the median ‘dots’ for 2023 are left unchanged, which is the higher probability, then Powell could use the press conference to solidify the lower for longer message and detail they are not really thinking about rate hikes – that would obviously be a hard sell to markets if we saw the median dot plot pricing in one hike in 2023. The debate on rate hikes would fire up.

They will not want to alter the markets positive view on economics and policy but will want to gently push back on expectations of three hikes through to 2023. Should this play out, the reaction should be seen intently in the bond and interest rates market, with gold and NAS100 also benefiting and the USD finding sellers. Ready to trade the opportunity?

Bereit zu traden?

Es ist einfach, ein Pepperstone-Konto zu eröffnen. Stellen Sie Ihren Antrag innerhalb von Minuten, auch mit einer geringen Einzahlung. Beginnen Sie Ihre Reise mit Pepperstone noch heute.

Bei diesem Artikel handelt es sich um eine Werbemitteilung. Diese Information wurde von Pepperstone GmbH bereitgestellt. CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. Zwischen 74 % und 89 % der Kleinanlegerkonten verlieren beim Handel mit CFD Geld. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren. Zusätzlich zum untenstehenden Haftungsausschluss enthält das auf dieser Seite enthaltene Informationsmaterial weder eine Auflistung unserer Handelspreise noch ein Angebot oder eine Aufforderung zu einer Transaktion in ein Finanzinstrument. Pepperstone übernimmt keine Verantwortung für die Verwendung dieser Kommentare und die daraus resultierenden Folgen. Es wird keine Zusicherung oder Gewähr für die Richtigkeit oder Vollständigkeit dieser Informationen gegeben. Folglich trägt der Anleger alleinverantwortlich das Risiko für einzelne Anlageentscheidungen. Jede angebotene Studie berücksichtigt nicht das Investment spezifischer Ziele, die finanzielle Situation und die Bedürfnisse einer bestimmten Person, die sie empfangen kann. Sie wurde nicht in Übereinstimmung mit den gesetzlichen Vorschriften zur Erstellung von Finanzanalysen erstellt und gilt daher als Werbemitteilung im Sinne des Wertpapierhandelsgesetzes (WpHG).

.jpg?height=420)