CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren.72.6% der Kleinanlegerkonten verlieren Geld beim CFD-Handel mit diesem Anbieter. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

As always when playing a more exotic currency pair the spread may not initially enthuse, but recall the spread is a function of movement (and liquidity), with the 5-day ATR at 577 pips (5778 points) and in this case you also get paid swaps for holding.

I lay out the technical and fundamental case, and for those not au faux with ‘carry’ hopefully there's some insight here. There's an emerging macro play which is also worth exploring.

Technical focus

As we see from the daily chart, price is moving to the range low and strong horizontal support, where a closing break below 72.85753 would open a run towards 71.00000. A bounce is entirely possible given the risks from this week’s FOMC meeting, so the preference is to wait for the closing break to confirm the bears have the emphasis to take this lower. With rallies contained into the 5-day EMA, I would use this as a guide and would hold shorts (on the close) until the price can firmly close above the average.

USDRUB daily technical set-up

The positive view on emerging markets (EM) has softened a touch of late with rising real yields in the US, but the RUB has been the best performing currency in EM over the past month. Aside from the Indian Rupee, it's the only EM currency to be higher vs the USD, gaining 0.6% through this time. Contrast that to say the TRY (USDTRY +7.6%) or BRL (USDBRL +4.6%) and it shows the RUB as a solid performer and emerging momentum vehicle.

The fact that Brent crude prices have traded into $71.38 has certainly helped, while we also saw a hawkish statement from the Russian central bank (CBR) in its Feb meeting. Inflation has moved to 5.7% - the highest levels since 2016 and far beyond the central banks 4% target. There's been reports that the key interest rate may lift by 125bp, which would be double the current consensus forecast held by economists. The CBR meet next on 19 March and may offer some hints at policy changes, although it’s more likely to become clear in the April meeting when the CBR should lay out a roadmap on raising rates.

Watching RUB forward points for carry

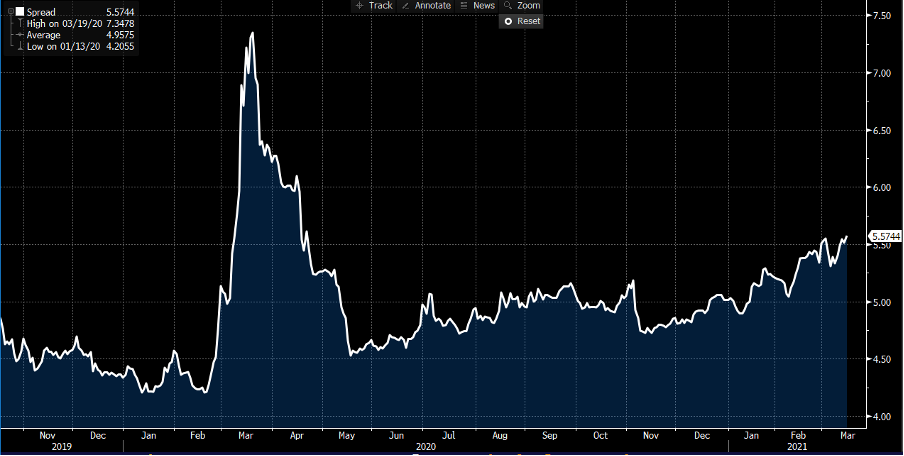

Russian bond markets have seen yields moving higher, with the yield advantage seen over US Treasuries (in the 5-yr part of the curve) moving to 5.57% - this is compelling inflows into the RUB. By way of carry (or income), the RUB forward curve has progressively steepened since the start of the year and stands at the highest level since May 2020. Tom Next (TN) forward rates, which form the basis of our swap rates have been fairly consistent of late. However, the move in rates suggests TN forward points may start to move higher into April suggesting even better carry for short-term traders.

Russia minus US 5yr bond yield – 5.57%

(Source: Bloomberg)

Further out and we’ve seen 12-month USDRUB forward points moving more intently. This is incredibly important for any corporate Treasury department who may want to want to lock in interest rate risk, where they enter into a forward contract. The higher the 12-month forward rate the greater the premium they will receive on their 12-month rolled position to account for the carry.

RUB 12-month forward points

(Source: Bloomberg)

Naturally, if short USDRUB you expect to be compensated for the carry and having the FX position trade rebooked at a higher level is obviously positive. Conversely, if long USDRUB and want to delay settlement for 12-months then you know you have to pay for that given expected interest differentials - interest rate expectations feed into the forward markets and they matter in FX markets.

Central bank divergence is a growing theme

There's also a core macro message here too. The once core hedge fund thematic of carry trading is hardly back with vengeance, especially with so many DM economies with negative or zero interest rates. However, we’re seeing ever-emerging signs of divergence within central bank policy settings and the difference in forward rate settings could become a key theme. The RUB is certainly one I have an eye on in this regard.

*Do also keep in mind that USDRUB does not trade 24 hours, so there's gapping risk.

Related articles

Bereit zu traden?

Es ist einfach, ein Pepperstone-Konto zu eröffnen. Stellen Sie Ihren Antrag innerhalb von Minuten, auch mit einer geringen Einzahlung. Beginnen Sie Ihre Reise mit Pepperstone noch heute.

Bei diesem Artikel handelt es sich um eine Werbemitteilung. Diese Information wurde von Pepperstone GmbH bereitgestellt. CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. Zwischen 74 % und 89 % der Kleinanlegerkonten verlieren beim Handel mit CFD Geld. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren. Zusätzlich zum untenstehenden Haftungsausschluss enthält das auf dieser Seite enthaltene Informationsmaterial weder eine Auflistung unserer Handelspreise noch ein Angebot oder eine Aufforderung zu einer Transaktion in ein Finanzinstrument. Pepperstone übernimmt keine Verantwortung für die Verwendung dieser Kommentare und die daraus resultierenden Folgen. Es wird keine Zusicherung oder Gewähr für die Richtigkeit oder Vollständigkeit dieser Informationen gegeben. Folglich trägt der Anleger alleinverantwortlich das Risiko für einzelne Anlageentscheidungen. Jede angebotene Studie berücksichtigt nicht das Investment spezifischer Ziele, die finanzielle Situation und die Bedürfnisse einer bestimmten Person, die sie empfangen kann. Sie wurde nicht in Übereinstimmung mit den gesetzlichen Vorschriften zur Erstellung von Finanzanalysen erstellt und gilt daher als Werbemitteilung im Sinne des Wertpapierhandelsgesetzes (WpHG).