CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren.72.6% der Kleinanlegerkonten verlieren Geld beim CFD-Handel mit diesem Anbieter. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

My own view is they leave their rates projections unchanged, which should see some element of rate hike expectations coming out of the markets and supporting market sentiment, but it’s a real risk.

The macro community has focused squarely on the US bond market and the rise in long-end Treasury yields and what it means for the present value of growth firms (think discounted cash flow analysis). Not to mention corporate debt servicing and the implication on investment and CAPEX. However, despite a monster sell-off on Friday, it feels like we’re getting near to a short-term peak in yields although it’s quite brave to step in front of the move.

There'll also be a close eye on the Fed’s commentary around extending the SLR (Supplementary Leverage Ratio), which expires on 31 March. Effectively, the ruling requires US banks to hold a minimum of 3% Tier 1 capital against their total leverage exposure – so, if the SLR is not extended the concern is we’ll see financial institutions dump a chunk of their US Treasury exposure, which would see yields spike and send short-term shockwaves through markets. It’s quite political, but one suspects the Fed will push for a one-year extension.

We also hear from the BoE and BoJ this week, with the BoJ announcing its long-awaited policy assessment, so watch JPY exposures into mid-Asia trade on Friday. There's several key monetary measures likely to be disclosed by the BoJ and many have been speculated on, such as expanding the yield target range to allow for increased movement. There may be some flexibility on ongoing ETF and REIT purchases.

In Australia, the big event will be Thursday’s (Feb) employment report, with the market expecting 30,000 jobs to be created. For breakout traders watch AUDJPY for a move through of 85.00 and the highest levels since Feb 2018. There’s always a science to trading breakouts, but this is one for the radar given the culmination of strong trending conditions, key levels and two major fundamental event risks.

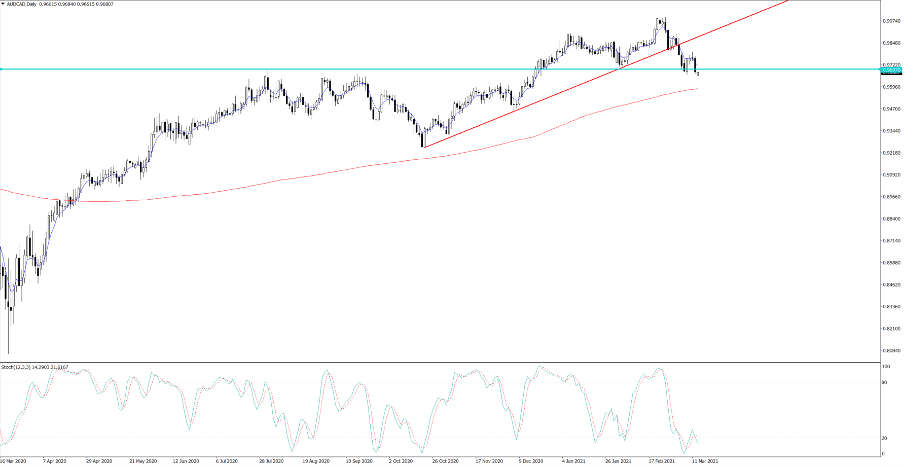

We also see two-year highs in GBPJPY and CADJPY, with the CAD looking relatively strong at this juncture as the best performing G10 currency in the past five days. While I'm constructive on the AUD, AUDCAD shorts may be worth a look at as price trades through the 100-day MA and eyes a downside break of 0.9666, which should take the pair into 0.9466 over a medium-term timeframe. I would be waiting for the close through 0.9666 though.

USDCAD looks to test 3-year lows of 1.2468 and is benefiting from a ridiculously hot Canadian employment print on Friday (259k vs 75k expected) and the CAD’s petro-currency tailwind with US crude looking to make a higher high.

With position sizing always front of mind, assessing exposures into the FOMC is essential, as it's a potential volatility event. Thinking about the event in a holistic manner I do see the balance of probability skewed for a weaker USD. That said, if the Fed lift the 2023 dot plot and fail to hint at extending the SLR, then I’d imagine stops on USD shorts will come into play rather quickly. Gold longs are therefore favoured into the FOMC, although, I see the upside likely capped this week into 1760. I am a seller on the week into 1780, although the prospect of it getting there is 15% or so.

In equities, the GER40 looks strong at all-time highs and is trending beautifully and of the EU indices the GER40 is always one that gets the most attention. I think clients like the mix of volatility, yet while there's some concentration element (from 40 companies) there's real quality in the constituents.

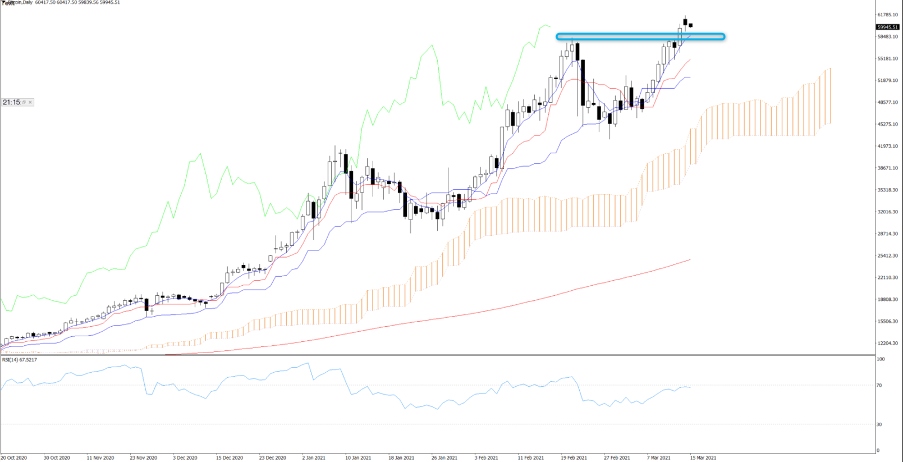

Crypto has also seen some good flow with trader’s front running US stimulus checks, amid talk that close to $150b may make its way into markets. We got to 61,673 in Bitcoin, although some of the smaller market cap coins saw a big percentage move. Sellers are getting a better say as we start Monday's proceedings and it would not surprise to see a re-test of the 21 Feb high of 58,315 – if we’re to see a new bull leg higher then this obviously needs to hold.

Bereit zu traden?

Es ist einfach, ein Pepperstone-Konto zu eröffnen. Stellen Sie Ihren Antrag innerhalb von Minuten, auch mit einer geringen Einzahlung. Beginnen Sie Ihre Reise mit Pepperstone noch heute.

Bei diesem Artikel handelt es sich um eine Werbemitteilung. Diese Information wurde von Pepperstone GmbH bereitgestellt. CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. Zwischen 74 % und 89 % der Kleinanlegerkonten verlieren beim Handel mit CFD Geld. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren. Zusätzlich zum untenstehenden Haftungsausschluss enthält das auf dieser Seite enthaltene Informationsmaterial weder eine Auflistung unserer Handelspreise noch ein Angebot oder eine Aufforderung zu einer Transaktion in ein Finanzinstrument. Pepperstone übernimmt keine Verantwortung für die Verwendung dieser Kommentare und die daraus resultierenden Folgen. Es wird keine Zusicherung oder Gewähr für die Richtigkeit oder Vollständigkeit dieser Informationen gegeben. Folglich trägt der Anleger alleinverantwortlich das Risiko für einzelne Anlageentscheidungen. Jede angebotene Studie berücksichtigt nicht das Investment spezifischer Ziele, die finanzielle Situation und die Bedürfnisse einer bestimmten Person, die sie empfangen kann. Sie wurde nicht in Übereinstimmung mit den gesetzlichen Vorschriften zur Erstellung von Finanzanalysen erstellt und gilt daher als Werbemitteilung im Sinne des Wertpapierhandelsgesetzes (WpHG).