Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Blockbuster Payrolls Print Reinforces Powell’s Patient Stance

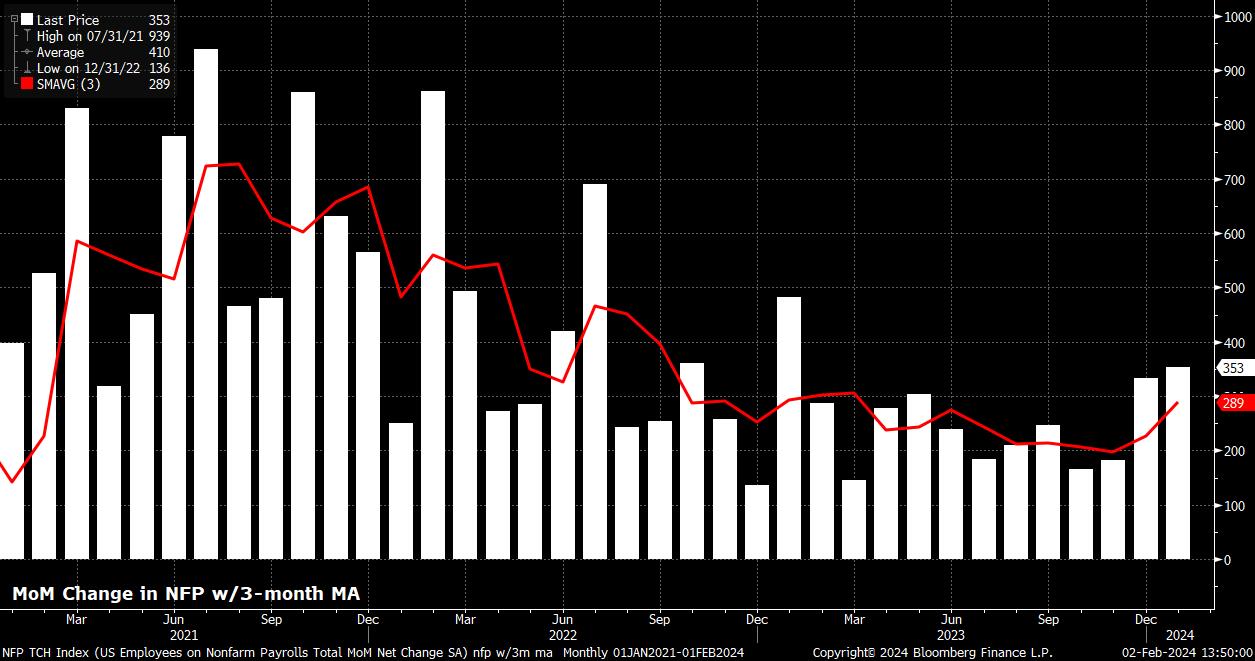

Headline nonfarm payrolls rose by +353k in the first month of the year, substantially above consensus expectations for a +185k print, and well above the top of the forecast range. In conjunction with the January print, the prior 2 months of data saw a net upward revision of 126k bringing the 3-month average of job gains to +289k, the highest since last March.

The beat on headline nonfarm payrolls came despite a handful of downside risks heading into the print, including the frigid weather during the survey week, and the typical January wind-down of temporary hiring over the festive period. Payrolled employment rose in every sector bar mining and logging, with private education & health, along with professional & business services, notching the biggest MoM job gains.

On the subject of revisions, as is typical with the January report, the BLS also released the annual benchmark revision, which reduced the March 2023 level of employment by 266k, broadly in line with expectations. The policy implications of said revision, however, are likely relatively minimal.

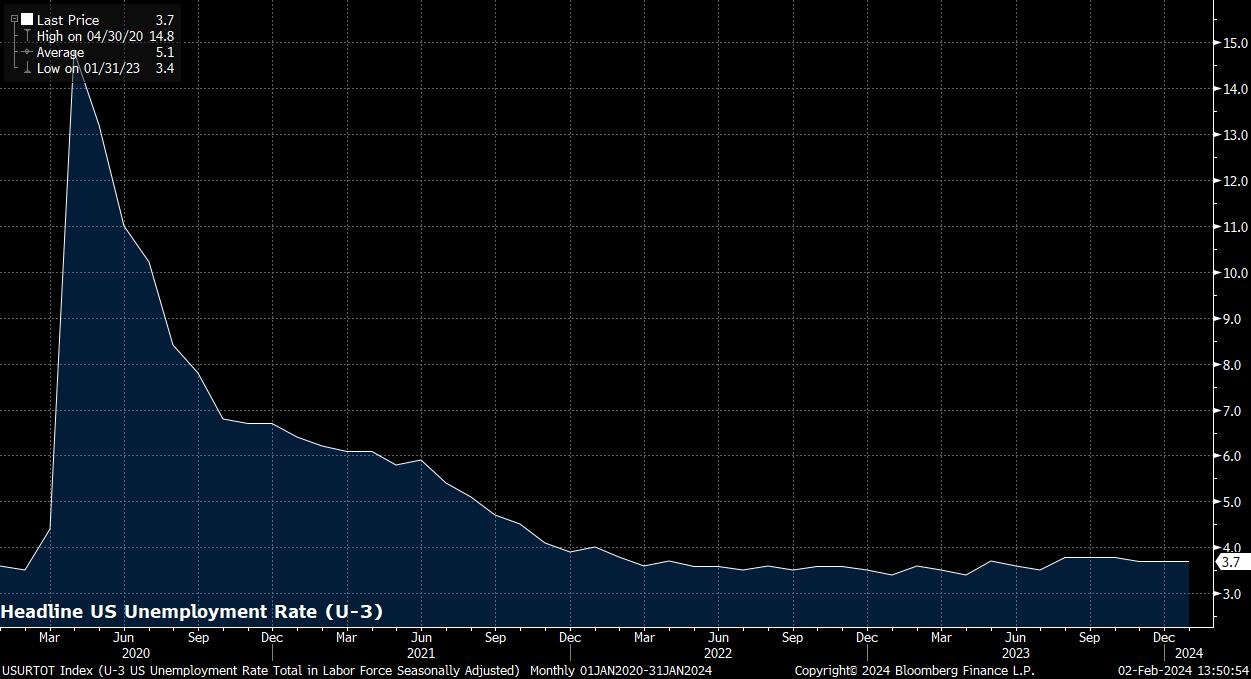

Turning to the household survey, unemployment held steady at 3.7% on the month, beating expectations of a modest 0.1pp uptick to 3.8%.

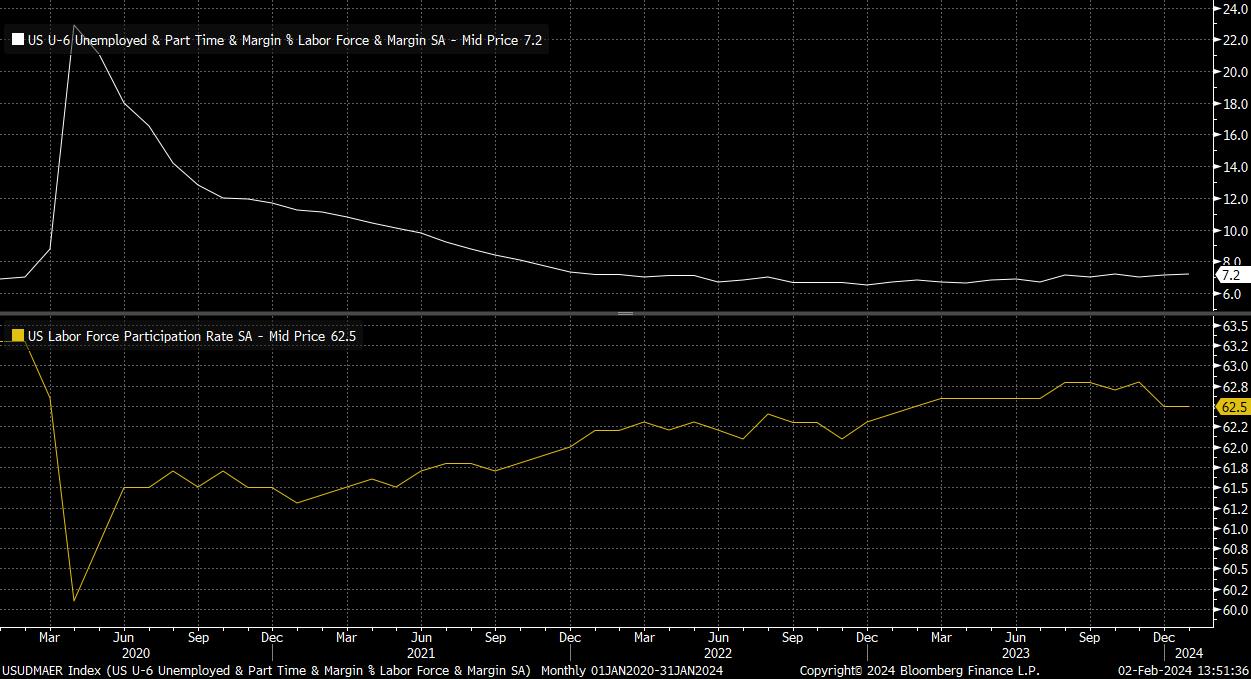

As always, one must view the headline unemployment rate in conjunction with other measures of labour market slack, which tell a slightly different story. Underemployment rose a further 0.1pp on the month to 7.2%, while participation held steady at 62.5%, remaining unmoved after having notched its biggest MoM drop since the height of the pandemic in December.

Unsurprisingly, as recent data has largely pointed to, this all continues to indicate a relatively tight labour market which shows little sign just yet of being adversely impacted by the continued lagged impact of the FOMC’s tightening cycle.

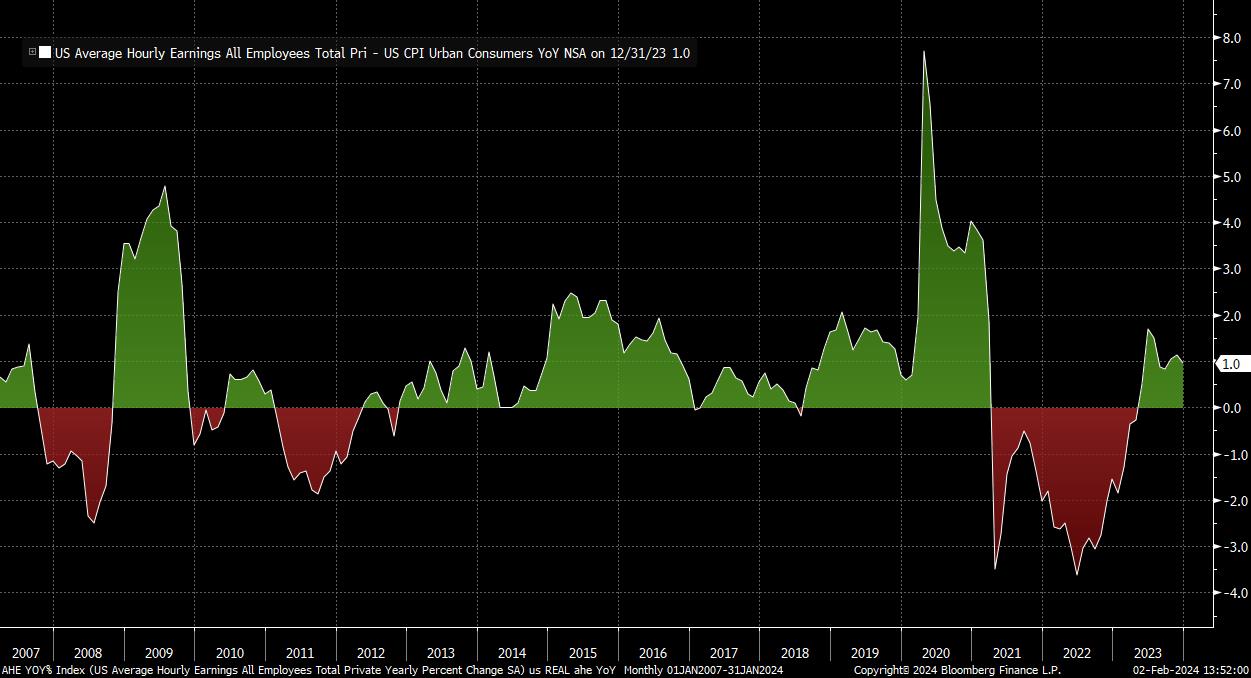

Consequently, earnings pressures remain, albeit at a level that is unlikely to cause too much discomfort among members of the FOMC. Average hourly earnings surged 0.6% MoM, the fastest monthly rise since March 2022, bringing the annual rate of earnings growth to 4.5%, a chunk higher than the 4.1% printed in December. Nevertheless, while continuing to represent positive real earnings growth, there remains relatively little risk of any wage-price spiral developing, particularly at this relatively late stage of the cycle.

With payrolls smashing expectations, money markets sharply revised expectations for the near-term policy path. USD OIS now prices around a 20% chance of a 25bp cut in March, sharply reduced from a 1-in-3 probability pre-release. Looking further out, money markets continue to fully price the first 25bp cut by the May meeting, while pricing a total of 130bp of easing over the year as a whole, a substantial hawkish repricing from the 145bp foreseen prior to the NFP print.

Unsurprisingly, this substantial repricing, by virtue of NFP smashing consensus expectations, sparked a knee-jerk hawkish reaction across financial markets.

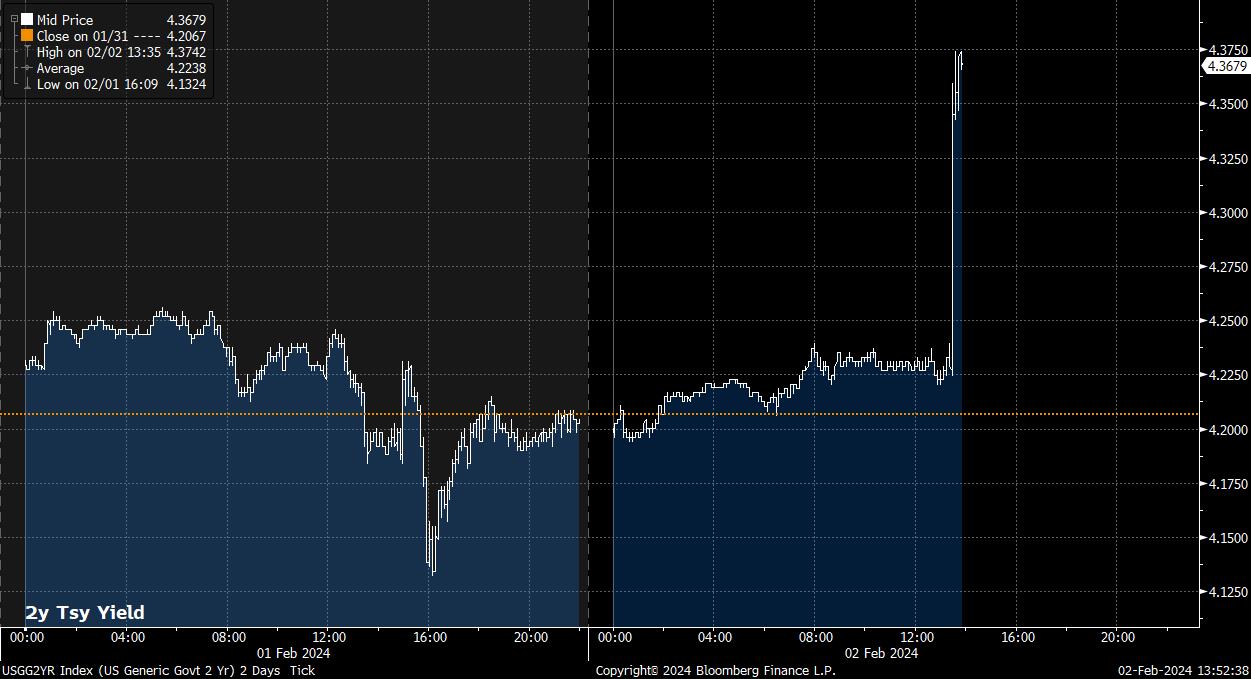

The brunt of this was borne by the front-end of the Treasury curve, where 2-year notes sold off over 15bp, trading north of 4.35% once more, though selling pressure was obvious and intense across the curve, which bear-flattened once more after the print.

Equities were, perhaps, somewhat more insulated from this hawkish repricing than may otherwise have been the case, owing largely to strong pre-market gains in AMZN and META after blockbuster earnings dropped on Thursday evening. In any case, the rapid manner in which the equity dip was bought suggests that the bulls continue to retain the upper hand, and that the ‘path of least resistance’ continues to lead higher.

The near-term path for the USD likely continues to point in the same direction, with risks remaining to the upside amid the continued overly-aggressive OIS pricing for the Fed’s policy path, with a residual amount of easing still to be priced out of the March meeting, likely contingent on CPI in a couple of weeks’ time.

_2024-02-02_13-53-27.jpg)

That raises an important point, in that there is still a long way to go until the next FOMC meeting, including a further jobs report, and two more CPI releases. While the labour market, clearly, remains strong, and continues to confound most expectations, the FOMC shan’t make any policy decisions based on one print alone. However, the January jobs report, coupled with the FOMC’s data-dependent stance, does point to the first rate cut coming in late Q2, at the earliest.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.