Analysis

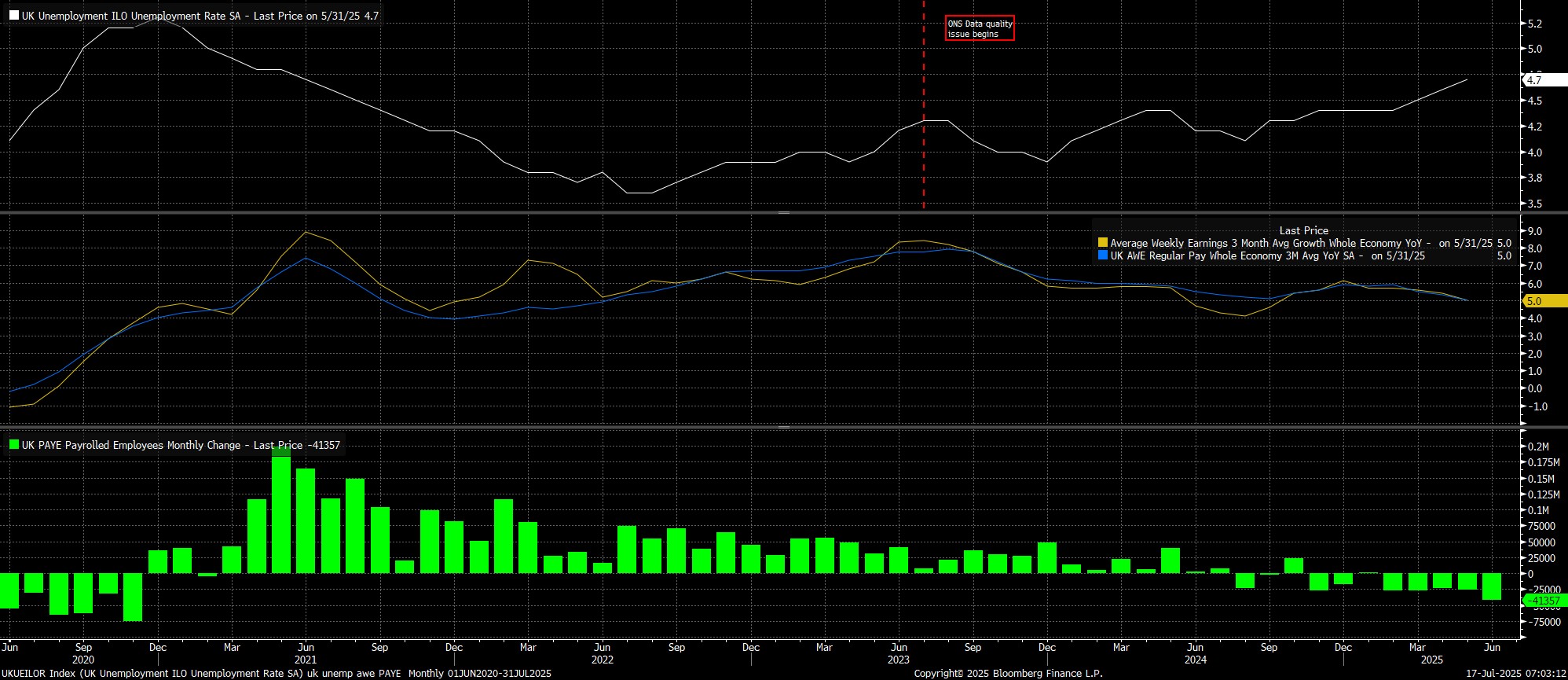

Unemployment, in the three months to May, rose to 4.7%, above consensus estimates, and the highest such level since mid-2021.

Meanwhile, earnings growth continued to cool. Regular pay rose 5.0% YoY, the slowest pace since the middle of 2022, while overall earnings rose 5.0% YoY, the slowest such pace since last September, with both moderating from the pace seen in April.

The more timely HMRC PAYE payrolls indicator, for June, pointed to further 41,000 jobs having been lost last month, meaning that payrolled employment has now declined for 8 months in a row. In other words, the UK economy has lost jobs every month since last October’s tax hiking Budget.

All in all, this morning’s figures pointed to a greater margin of slack continuing to develop in the labour market, where risks remain clearly tilted to the downside, amid not only the continued effects of April’s National Insurance hike, but also the impact of a higher minimum wage, and the significant degree of uncertainty which clouds the outlook.

Despite this, today’s data is unlikely to see the BoE pursue a faster pace of easing, with a dovish turn still prohibited by stubborn price pressures, particularly after the hotter than expected June CPI released yesterday. Consequently, the Bank’s ‘gradual and careful’ guidance looks set to stay in place for now, likely leading to just two 25bp cuts being delivered over the remainder of the year.

This continued tight monetary policy stance, combined with the prospect of further fiscal tightening in the autumn, means headwinds facing the labour market are set to persist. The employment backdrop looks set to sour much further in the months ahead.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.