Analysis

Week Ahead Playbook: The Market & Macro Narrative Turns Sour

The Week That Was – Themes

After a hectic week jam-packed with top-tier data, G10 policy decisions, and a deluge of news flow, the dismal July jobs report is probably the best place to begin.

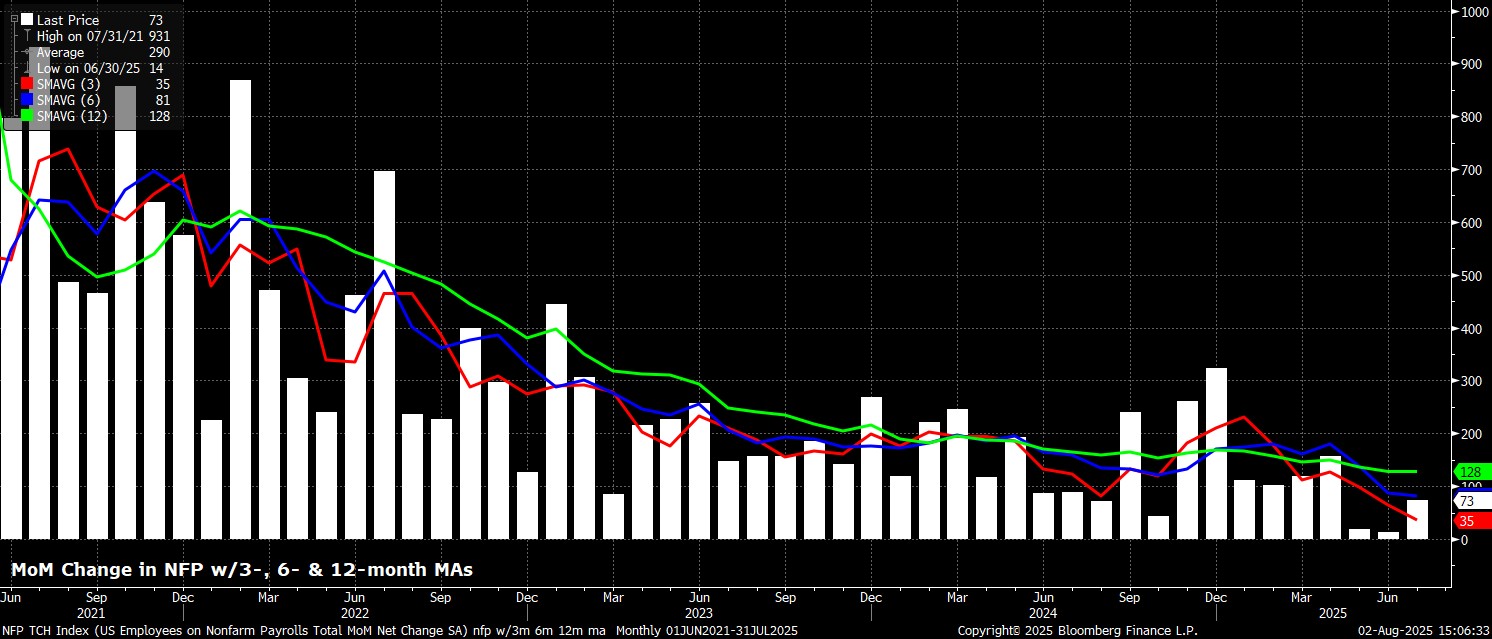

Headline nonfarm payrolls rose just +73k in July, well below consensus, and below the ‘breakeven’ pace too. Worse still, the prior two prints were revised lower by a huge net -258k, in turn dragging the 3-month average of job gains to a paltry +35k. This revision is particularly problematic as it makes it much more difficult to discount that headline miss as a ‘one-off’, that will be reversed next time out. As near as makes no difference, the economy hasn’t really added any new jobs over the last quarter.

While earnings growth held up ok, at 0.3% MoM, and 3.9% YoY, the household survey also made for rather grim reading. Unemployment ticked higher to 4.2%, as expected, though this fails to tell the full story, with the headline U-3 rate continuing to be depressed as a result of falling labour force participation. The participation rate fell further last month, to a cycle low 62.2%, likely a result of continued tighter immigration enforcement, with the decline here, and subsequent cap on headline unemployment, potentially lulling participants, and policymakers, into a bit of a false sense of security regarding the state of the labour market, which clearly now appears to be weakening considerably.

I’ll get onto policy momentarily, but must first cover the presidential reaction to the figures. In a move straight out of the EM textbook, Trump announced late-Friday that he will be firing the Commissioner of Labor Statistics at the BLS, purportedly due to the jobs figures being “rigged”. To be clear, the figures are not rigged at all, and revisions are a normal part of the BLS’ data collection process, which many rightly see as a ‘gold standard’ in national statistics. Still, the President firing public officials because they present him with bad news sets a very worrying, and dangerous precedent, raising obvious questions over data reliability going forwards, and likely necessitating that the USD and USTs both price a higher risk premium to boot.

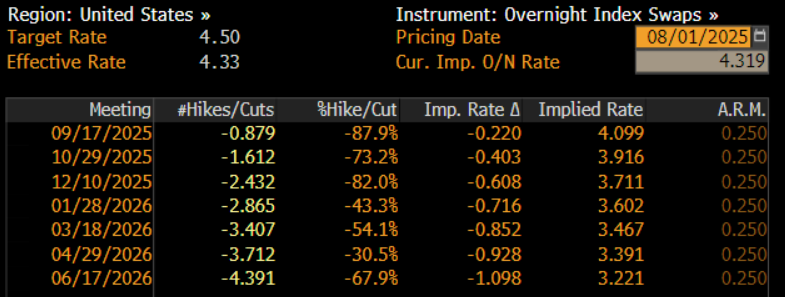

As for policy, markets repriced in a dovish direction post-NFP, with the USD OIS curve now discounting a near-90% chance of a 25bp cut at the September FOMC meeting, while also pricing 61bp of cuts by year-end.

These odds, though, seem over-the-top. The FOMC stood pat on policy last Wednesday, as expected, with Chair Powell reiterating his ‘wait and see’ stance amid trade uncertainty, and the upside inflation risks that tariffs pose. While Governors Bowman and Waller dissented in favour of a 25bp cut, in what essentially amounts to an application for Powell’s job next May, the majority of policymakers appear to continue to prefer a patient approach, viewing inflation as further from the FOMC’s objective than the employment side of the dual mandate, a view that many policymakers reiterated post-NFP.

Speaking of the next Fed Chair, we may get some idea on that front sooner than we’d previously expected. Governor Kugler, whose term was due to expire in January, surprisingly announced her immediate resignation on Friday, to return to academia. It seems plausible that the Trump Admin will have next May in mind when filling this Board vacancy, appointing someone who could then step up to the Chair role upon Powell’s term expiring. This, most likely, means that Trump will have at least three votes for a rate cut on the Board, upon confirmation of the new Governor to their post, especially when one considers that undying loyalty to the President, as opposed to pragmatic policymaking or macroeconomic knowledge, is likely to be the number one criteria sought in any potential candidates. Of course, Trump’s calls for rate cuts have continued all week.

That said, for the time being, my base case remains that we will see just one 25bp cut this year, most likely in December, as tariff-induced price pressures keep policymakers on the sidelines, seeking to ensure that inflation expectations remain well-anchored.

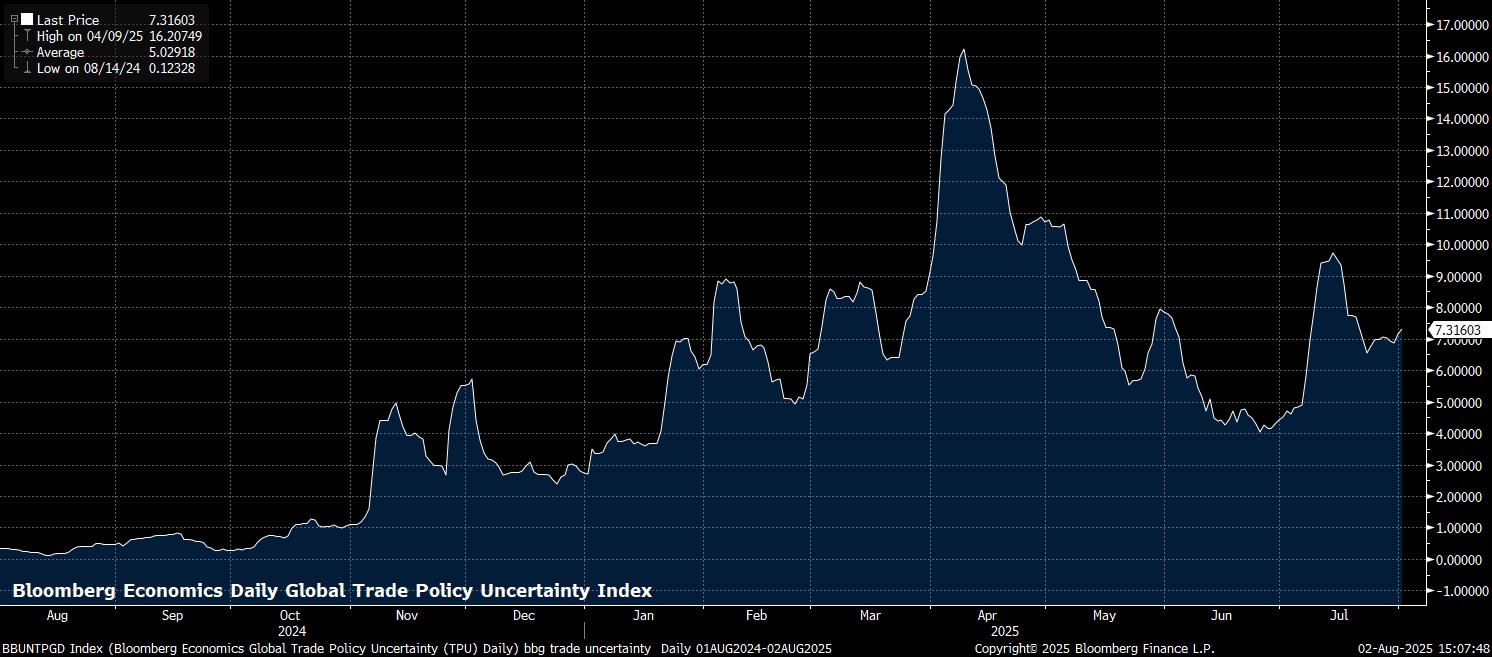

On the subject of tariffs, to the surprise of many, myself included, we didn’t get another ‘TACO’ moment last week. The 1st August tariff deadline came, and went, with Trump then slapping sizeable levies on imports from countries unable to negotiate a deal with the US – e.g., 39% for Switzerland, 35% for Canada, 25% for India, and a whopping 50% for Brazil. Clearly, this has seen trade uncertainty take another leg higher, even if the potential for negotiations remains, not least with these new levies not due to take effect for another week.

Still, we are also sorely lacking clarity on any potential extension to the US-China trade truce, despite talks between the two parties having concluded last Tuesday, and with the 12th August deadline rapidly approaching. The working assumption remains that the ‘status quo’ continues, with the tariff can kicked down the road once more, but the present information void certainly shan’t be helping sentiment.

Away from all of that, there were plenty of other interesting developments last week.

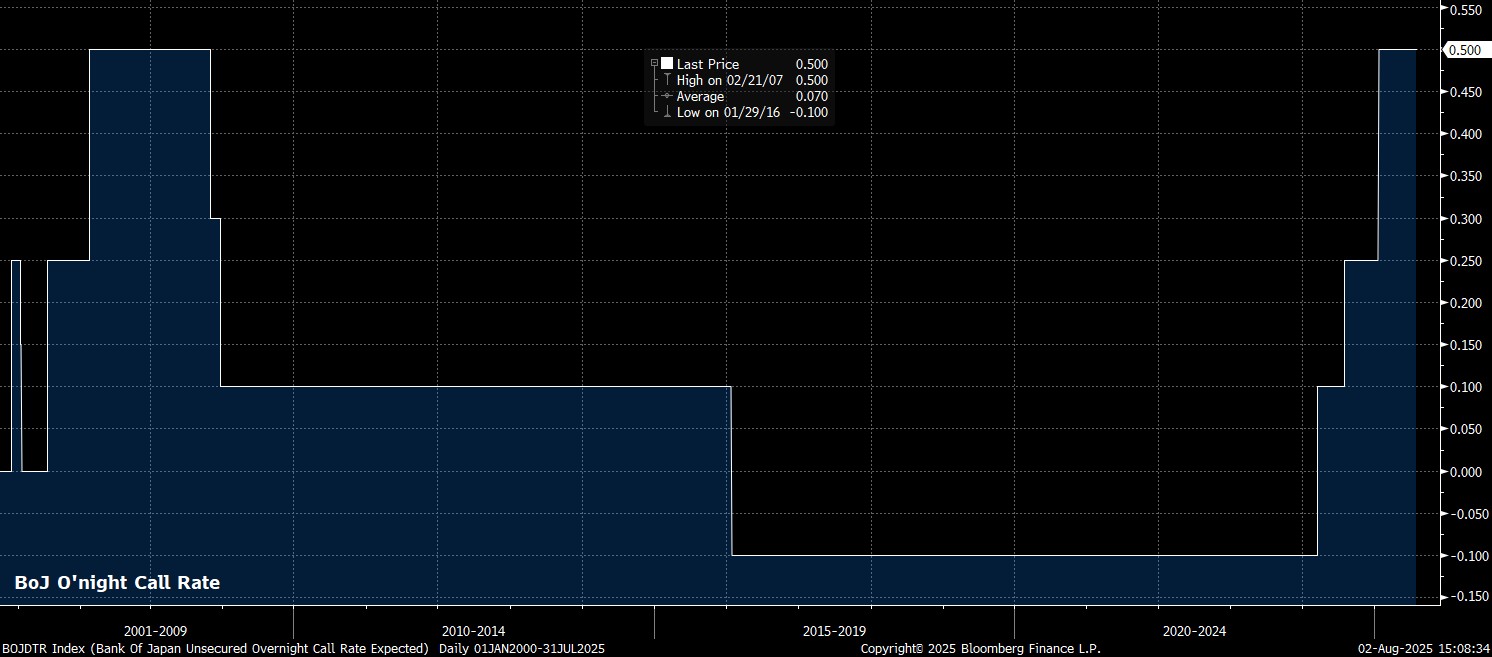

Besides the FOMC, both the Bank of Canada and Bank of Japan also stood pat on policy. Both, however, also reiterated their readiness to act moving forwards, with the BoC noting that further cuts may be delivered if the economy weakens further, and the BoJ reiterating that they will hike again if their outlook is realised. Despite that, it does feel as if the BoJ are continually finding any excuse they can not to pull the trigger on further tightening – first it was trade uncertainty, now it’s domestic political uncertainty. The risk here is that policymakers end up completely missing the boat, and get stuck with negative real rates for the foreseeable future.

Meanwhile, in the equity complex, even if the busiest week of earnings season was rather overshadowed by events elsewhere, the megacap tech names nevertheless delivered solid results, as META, MSFT, AMZN & AAPL all surprised to the upside of consensus expectations. Not only were the figures themselves solid, but the AI ‘arms race’ also shows no sign of slowing any time soon, with capex guidance being raised left, right, and centre, in turn likely providing further support to the ‘picks and shovels’ plays of this whole theme, such as Nvidia (NVDA) and Broadcom (AVGO).

As for the bigger picture, two-thirds of the S&P 500 have now reported, with 4-in-5 firms delivering both revenue and earnings beats. Helped by those megacap tech stocks, the blended earnings growth rate for the index is now a chunky 10.3% YoY, which if realised at the end of reporting season would mark the third consecutive quarter of >10% YoY earnings growth.

Here in Europe, finally, it proved something of a more subdued week, as participants digested last weekend’s US-EU trade ‘deal’. While said ‘deal’ does leave EU exports to the US subject to a 15% tariff, this is clearly much better than the 30%, or even 50% levies that had at one stage been threatened, hence we should probably judge it a success on that metric alone.

Of course, the sizeable purchase commitments, and private sector investment pledges, that were also part of the deal, should both be taken with a huge pinch of salt, and will probably never materialise, either in this deal, or any others. Anyone remember the ‘phase 1’ US-China trade deal from 2019/20?

The Week That Was – Markets

Amid that plethora of catalysts, it proved to be a ‘week of two halves’ for financial markets across the board, though also one which again pointed to a ‘buy America’ or ‘sell America’ dynamic, as opposed to the traditional risk on/risk off dynamic that we’re all used to.

In the equity space, a run of six straight daily gains in the S&P 500 was snapped, before stocks cratered into Friday’s close after both the dismal jobs report, and Trump’s attacks on the US’ economic institutions, seeing all three major Wall St benchmarks notch weekly losses.

In light of the developments seen late-last week, I’m minded to revisit my tactical equity bull case. The first leg of which, progress on the trade front, now appears rather shaky, given that ‘TACO time’ didn’t come around ahead of the latest tariff deadline, and considering the unknowns which remain on the China tariff front too. The second leg of that bull case, resilient underlying economic growth, is also now being called into question, after Friday’s employment report, and with the logical conclusion that sustained labour market weakness could lead to a sizeable pullback in consumer spending in the coming months.

While earnings growth remains solid, as outlined above, two of the three parts of that bull case are now looking rather perilous. Coupling that with relatively poor seasonality at this time of year, and it seems plausible that sentiment will face further headwinds in the short-term, until the narrative on either trade, or the economy, flips again.

As for markets elsewhere, while that sort of an environment should be something of a boon for Treasuries, such an effect is only likely to be seen at the front-end of the curve. Indeed, it was seen as last week wrapped up, with benchmark 2-year yields falling almost 30bp on the day, to the lowest level since early-May.

That aside, Trump’s continued attacks on economic institutions within the US, and the continued erosion of Fed policy independence, are likely to not only create ongoing investor jitters, but also lead to underperformance at the long-end of the curve, not only as fiscal concerns continue, but also amid the considerably higher risk of inflation expectations becoming un-anchored. While very much a consensus view, it seems folly to bet against a continued steepening of the curve for the time being.

Those factors are also likely to continue to pose relatively significant headwinds to the dollar, which must also grapple with an apparent slowing economy, and a dovish repricing of policy expectations – even if we’ve probably gone too far on that final point for the time being.

While the buck started last week solidly, seeing the DXY break above not only the 100 figure, but also close above its 100-day moving average for the first time in four months, those gains evaporated in the ‘blink of an eye’ post-NFP.

_2025-08-02_15-10-00.jpg)

The balance of risks, now, once again points to the downside for the greenback, especially considering that short positioning is much lighter, after the squeezy nature of last week’s action. Further outflows from the USD, which are likely to accelerate amid Trump’s continued ‘unorthodox’ (I’m being kind!) policy approach, will probably benefit the EUR most out of all G10s, simply because it is the largest possible alternative.

Gold also stands to benefit, though, particularly as demand from EM remains strong.

_sp_2025-08-02_15-10-17.jpg)

Spot gold bounced off its own 100-day MA last week, though in the short term it will probably take a closing upside break of $3,400/oz to get the bulls excited. Such a break would then leave just the June and July highs at $3,445/oz as resistance before we look towards the record highs, a test, and break above, which I still see as plausible before the year is out.

The Week Ahead

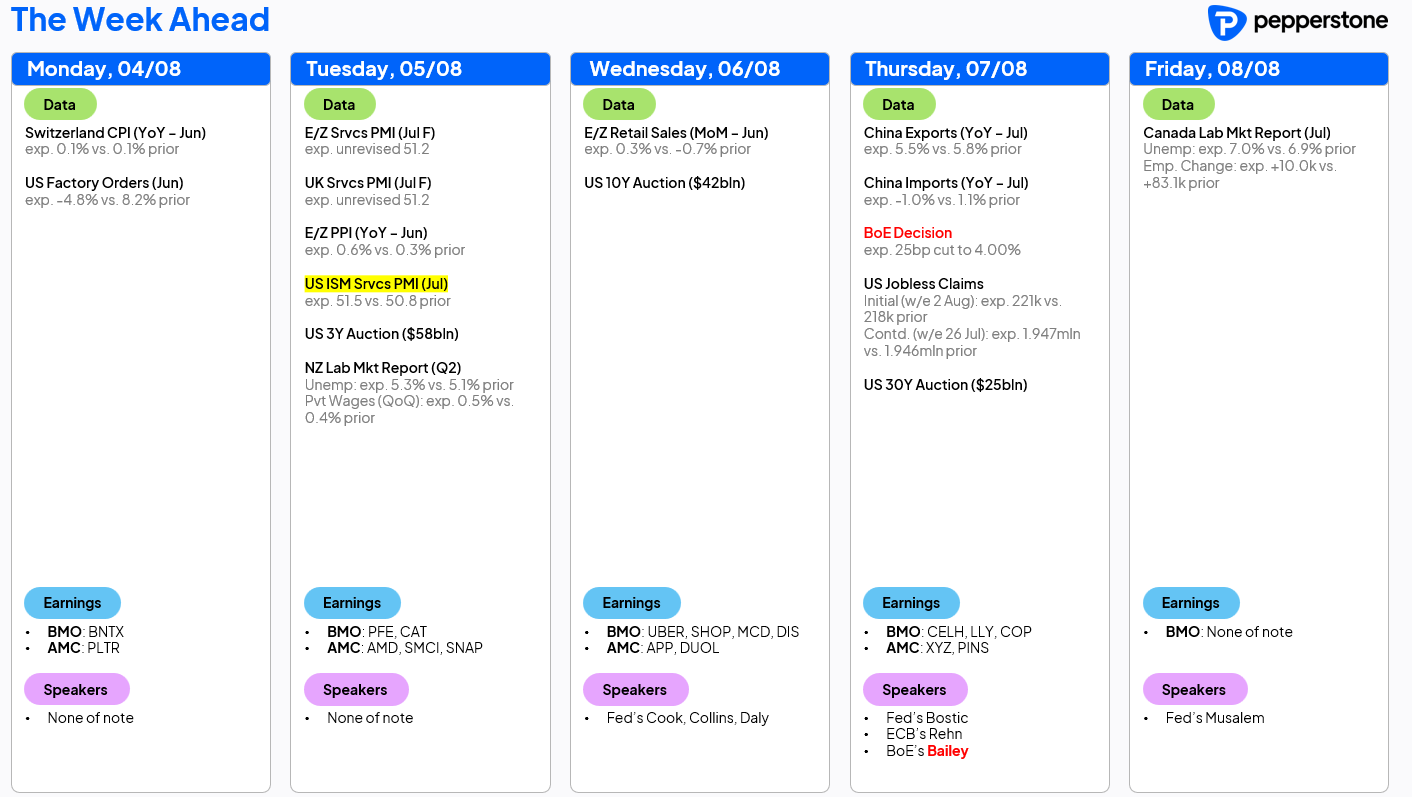

Given the chaotic nature of the last five trading days, I’m somewhat reluctant to try and predict what the next five may hold. Still, the macro calendar is considerably lighter than that of last week.

In any case, at least in terms of scheduled events, Tuesday’s ISM services survey stands as the most notable release. Though the index is seen rising to 51.5, from a prior 50.8, any downside surprises here are likely to be punished relatively severely, especially considering the rather fragile backdrop that Friday’s jobs report also pointed to. In a similar vein, the weekly US jobless claims stats will likely attract more attention than normal, after that dismal NFP print.

On the policy front, the Bank of England will deliver their third 25bp cut this year on Thursday, taking Bank Rate to 4.00%, though the MPC are likely to be split once more on the appropriate course of action. External member Dhingra will likely dissent in favour of a larger 50bp cut, while fellow external member Mann may dissent in favour of holding rates steady. Despite those divides, the MPC will reiterate that a ‘gradual and careful’ approach to policy easing remains appropriate, as the Bank’s updated forecasts point to higher inflation, and slower growth, in the short-term.

Elsewhere, a chunky week of Treasury supply lies ahead, with 3-, 10- and 30-year auctions on deck. Earnings season, meanwhile also continues, even if the bulk of corporate reports are now out of the way, with the next most notable report to come from Nvidia (NVDA) at the end of the month.

Of course, amid all that, developments on the trade front will also remain in focus, as will geopolitical headlines, and any reporting as to who Trump may pick to fill Kugler’s vacant spot on the Fed Board.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.