Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

We’ve moved past Trump’s China speech without the market hearing anything that will upset China too greatly and promote an immediate reaction. The fact HK has lost its special trading status (with the US) could impact HK, but one questions whether it will really anger the CCP.

China PMI (released Sunday) was a touch weaker on the manufacturing side, and strong on the services read, but there has been limited reaction on the FX open, although we’re seeing S&P 500 and NAS futures finding a few sellers on open and this may weigh on the Asian equity open.

US equities moved through the Trump speech with ease, with USDCNH selling off hard putting a bid in equities and risk FX, with strong gains in the BRL, NOK and AUD. The NAS100, despite today’s open, just looks so bullish on the daily or weekly timeframe, and at this risk of giving the index the kiss of death, new all-time highs seem a reasonable bet. The US500 also looks strong, and as long as it can build on the move through 3037 then I hold a bullish bias. Interestingly, despite the US benchmark being -5.8% YTD, we can still see close to 40% of index constitutions lower by 20% or more YTD, so breadth continues to be a consideration.

The US bond market holds the key

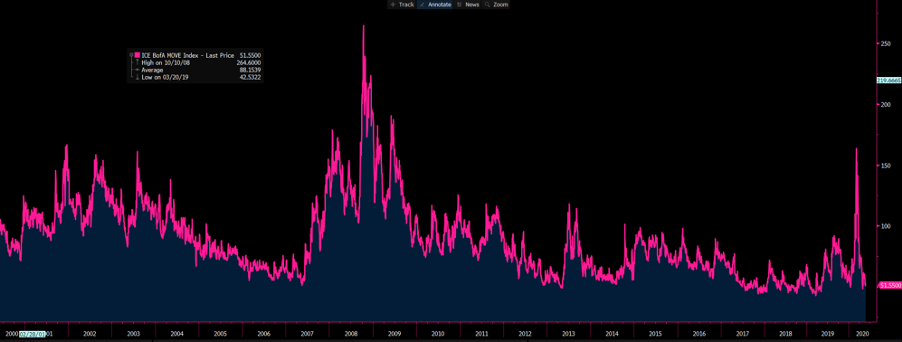

I find it hard not to focus on the US bond market as a major influence of risk here. The fact that implied volatility (vol) in the US Treasury curve is not too far off its all-time low (set back on March 2019) paints a story that few participants expect dramatic moves, and the fact the Fed is talking about yield curve control is clearly suppressing Treasury vol. A calm bond market is a risk-friendly backdrop for equity appreciation, especially growth stocks, while risk FX and high carry (income) currencies will also do nicely.

(US Treasury vol – the MOVE index)

(Source: Bloomberg)

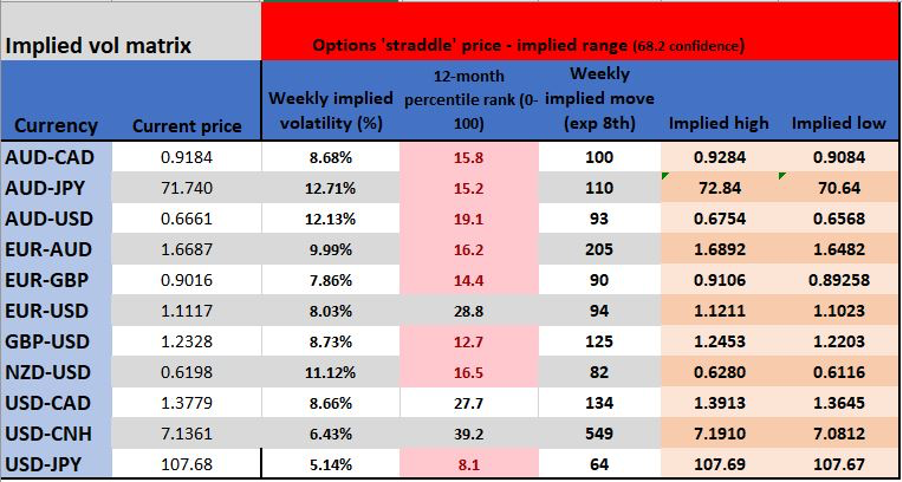

AUDUSD and AUDJPY have been my default equity proxies, but I quite like the look on CADJPY and if this can build on its break of 77.86 then I’ll be looking for upside here, raising conviction levels on a close through 78.49. Trading this pair doesn’t come without risk though, especially with the BoC meeting on Thursday and the possibility of more stimulus. So, as always, it feels prudent to start with a small position, even if CAD 1-week implied volatility is low, where I’ll add as price moves in the intended direction.

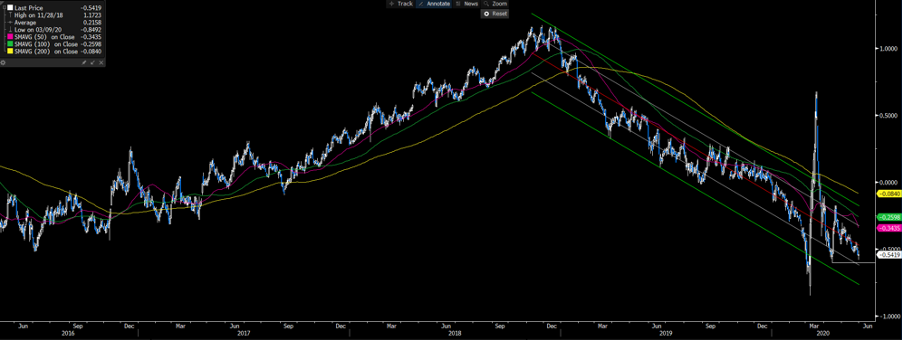

Another major consideration from US bond markets is the trend in ‘real’ expected yields. The fact is that when we subtract the yield on offer in the US Treasury market, or any global DM bond market for that matter, by inflation expectations we see ever deeper negative ‘real’ yields. If yields go lower, and inflation expectations either start to rise or fall at a slower pace (than nominal bond yields) then equity becomes more attractive and people will be ‘happy’ to pay outrageous valuations. The concept of T.I.N.A (There is no Alternative) rings true here.

I guess we can also argue that the equity market is pricing a solid recovery from 2H20 and into 2021, which one hopes will play out but seems optimistic.

(US 5yr real yields)

(Source: Bloomberg)

US politics starting to impact markets

We have seen greater unrest in the US over the weekend, but whether this has an impact on economics is a point of debate. The protests and anger in the US are a political consideration though, and there is no doubt that investors are starting to consider Biden’s prospects for taking the White House, especially if he has an able running mate in Kamala Harris. Certainly, if it were down to a popular vote then Biden would be confident, but under the electoral college system, Trump would still be small favourite but its close. Let’s also not forget the race for the Senate, and if Biden can get the WH the DEM’s need three seats to then take the Senate.

Whether a Biden win would be a vol event is yet to be seen, but he is considered to be more hawkish on taxes and we’re seeing those companies that performed well post 2016, and the sizeable tax bump that boosted the bottom line, now underperforming.

A focus on data?

Politics and geopolitics aside, it is a massive week for data. There is a human angle to economics which must not get lost, but I want to say data has been largely irrelevant for markets. That notion will be brought to the test this week, where better data could be fodder for the bulls who need validation, even this early on, that the economy is going the way portrayed in valuation.

Here are the weekly implied moves derived from 1-week options. It offers a sense of expected movement after assessing what’s on the radar.

US

- ISM manufacturing (00:00 AEST tonight), expected to lift from 41.5 to 43.7. Risks are skewed to the upside in my opinion and markets want validation of their projected recovery.

- NFP’s (Friday 22:30 AEST) – 8 million jobs are expected to be lost, with the unemployment rate to rise to 19.6%. If ever there was a data point that showed the disconnect between stocks and the economy this is it. Yet, it could be the declining pace of job losses that the bulls cling to.

China

- Not so much data, but FX traders are watching the PBoC’s daily CNY ‘fix’ (takes place at 11:15 AEST). There has been a consistent trend from the PBoC to fix the mid-point (of USDCNY) at lower levels than analysts’ models had anticipated. This has been taken as bullish for risk, as it shows China has little interest in weaponising the yuan

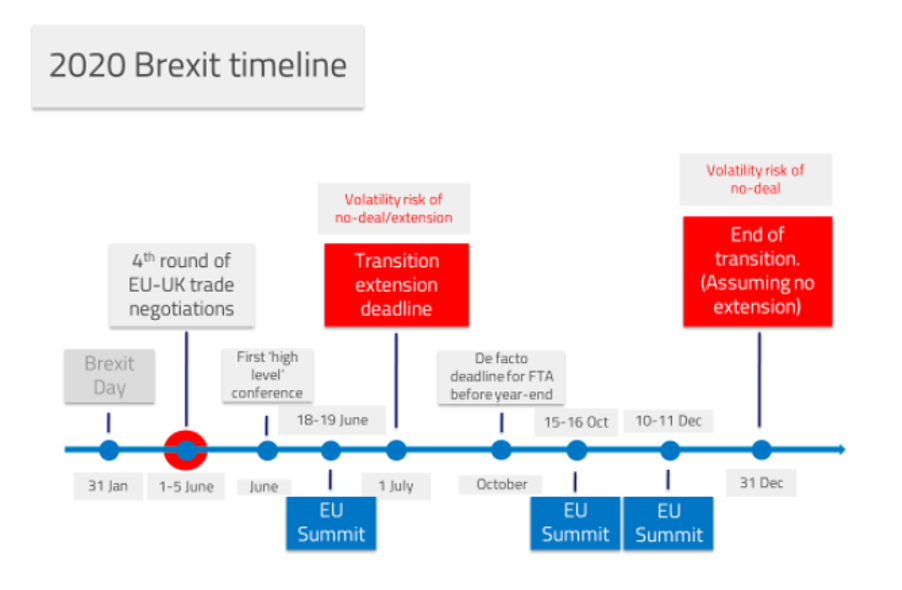

UK

- Aside from the data flow, we see the next round of the Brexit negotiations starting today, with both the UK and EU some way apart. My own base is for no extension, which is probably priced but keeps me bearish on the GBP fundamentally. EURGBP looks good for further upside here in my view.

EUR

- June ECB meeting (Thursday 21:45 AEST). The EUR has seen a wave of short-covering, specifically from leveraged accounts who have reduced their net EUR (futures) short position from -146k to -30k contracts. Peripheral yield spreads have come in vs bunds and we can see EURUSD 1-month risk reversal trade to +0.20, now showing a premium for EURUSD 1m call vol over put vol. This weeks ECB meeting is the key event for the week with expectations the PEPP (Pandemic Emergency Purchase Program) will increase by E350B to E750B, with the duration of the program extended through the German Court deadline.

Canada

- Bank of Canada meeting (Thursday 00:00 AEST)

- May employment report (Friday 22:30 AEST) – The market expects 500,000 jobs lost, with the unemployment rate expected to lift to 14.7%.

Australia

- RBA meeting (Tuesday at 14:30 AEST)

- Q1 GDP (Wed 11:30 AEST) – Consensus expects -0.4% QoQ, 1.4% YoY

- Retail sales (Thursday at 11:30 AEST) – consensus -17.9%

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.