Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 80% de las cuentas de inversores minoristas pierden dinero al operar CFDs con este proveedor. Debes considerar si comprendes cómo funcionan los CFDs y si puedes permitirte asumir el alto riesgo de perder tu dinero.

- Español

- English

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- Português

- لغة عربية

Adding technology to your portfolio through the TECL ETF

The aim is to magnify your position with daily 3x leverage. The ETF is not aimed at long-term investors, but short-term daily returns.

What does the TECL invest in

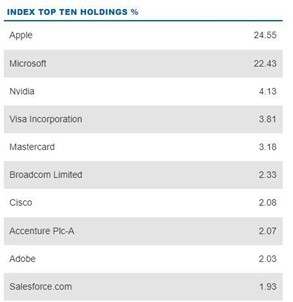

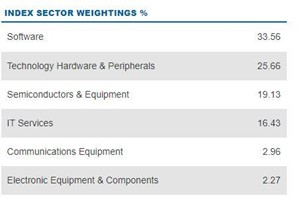

The Technology Select Sector Index (IXTTR) is the target index. It is provided by S&P Dow Jones Indices and covers various companies from the technology sector. It is heavily weighted in Apple and Microsoft. It should be noted that you cannot directly trade the index.

Figure 2 direxion sector weighting

Net expense ratio

This includes management fees. This is the annual fee payable to the issuer. As of the 17th of October 2022, the fees stood at 0.94%

*What is leverage?

Leverage is the ability to borrow funds to increase your exposure in the market. Leverage can exponentially increase your profits as well as your losses so it's crucial that traders take care when using leverage. The larger your position size, the larger your point value will be and therefore, the greater the impact on your profit/loss (P/L).

Trading Hours

The TECL (or TECS) do not offer 24 hr trading. The open and close is in line with the US stock market.

Figure 3 Trading View TECL trading hours

A look from a technical perspective

As the TECL is a technology long (buy) fund, it makes sense that it will underperform when the US technology sector is under pressure. It also makes sense that, because the fund uses leverage, the losses are compounded compared to the underlying sector. In the chart below we can see that the Nasdaq100 has fallen -21.57% since the 15th of August 2022. The TECL (long technology fund) has devalued -56.94% as of October 16th 2022.

Figure 4 Trading View TECL performance

It also makes sense that the TECS fund (short only fund) has outperformed in this bear market with a gain of 99.48% over the same period.

Figure 5 Trading View TECS performance

Related articles

Pepperstone no representa que el material proporcionado aquí sea exacto, actual o completo y por lo tanto no debe ser considerado como tal. La información aquí proporcionada, ya sea por un tercero o no, no debe interpretarse como una recomendación, una oferta de compra o venta, la solicitud de una oferta de compra o venta de cualquier valor, producto o instrumento financiero o la recomendación de participar en una estrategia de trading en particular. Recomendamos que todos los lectores de este contenido se informen de forma independiente. La reproducción o redistribución de esta información no está permitida sin la aprobación de Pepperstone.