- Français

- English

- Español

- Italiano

Copper is up +1.5%, crude +3.8%, sugar +3.3%, coffee +4.5%, along with cotton and lumber. Chinese equities were sold 3.1% yesterday and require attention today. The bond market is on offer again, notably yesterday in Australia where the RBA disappointed and brought just A$1b in three-year bonds causing ripples across the curve, with the 10-year closing +17bp at 1.6% - that’s a 4 standard deviation move.

It’s no wonder the AUD is once again the superstar in major currencies as Aussie rates markets are pricing in a far more active RBA in two years’ time. As suggested yesterday EURAUD shorts look good on the thematic of buying future rate hike candidates against future funding currencies. However, a simple look at the Aussie swaps curve and we see that the market believes the RBA is going to be pretty active from 2-3 years’ time.

Certainly, crude is getting good attention as banks like Morgan Stanley and Goldman revise their Brent forecasts higher. This comes amid calls of tighter supply, a weaker USD and a focus on the OPEC meeting on the 3 March. One to watch as we look to take out last week’s high in WTI and Brent and the moves resulting in solid buying in energy equities, with the S&P 500 energy sector +3.5% - a punchy move given the S&P 500 closed -0.8%.

We see the USDX -0.3% and eyeing a break of the 90.00 level - we’ve taken out key support at 90.15, with EURUSD eyeing a break of 1.2169 and this may get attention on the floors should this play out.

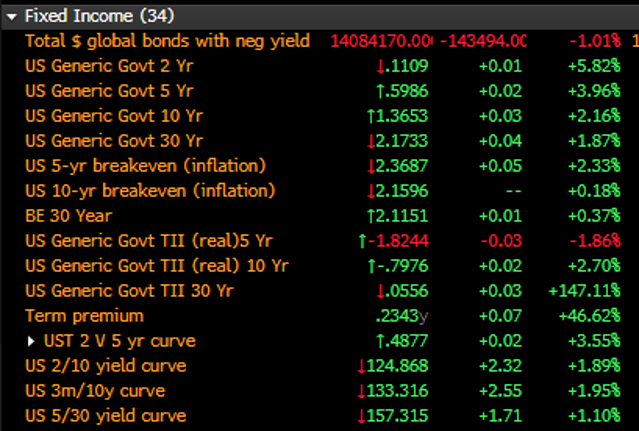

Still all the talk is centred on the bond and rates markets and all other markets are generally derivates of this. The long end still gets the attention with US 10s +3bp to 1.36% and 30s +4bp to 2.16%, naturally causing a further steepening versus short-term rates. Inflation expectations or ‘breakevens’ have pushed higher, with 5-year breakevens +5bp and 10s +1bp, so it’s a mixed picture with 5-year real rates -3bp and 10-yr +2bp.

(Source: Bloomberg)

Choose your timeframe when we look at real yields and the true cost of capital, but the fact that the NAS100 is -2.6% suggest the bond market has finally hit home as the discount rate rises and the present value of the business falls. This is the essence of what we have seen through the low-rate environment, and we must always consider our opportunity costs.

Looking at Goldman’s non-profitable tech index – this once red-hot space was clobbered 5.4%, as a rising rates environment means earnings and cash flow actually matter – the same is true of Tesla (closing -8.4%), which took out the 50-day MA and the short-sellers would be honing in.

It's all fine until the market starts to question the resolve of central banks and then many of the bets that have been put on for a low-rate world get questioned. Consider the Fed’s guidance is that rates are on hold until the end of 2023. However, if we look at the eurodollar interest rate (not the FX pair) market, we can see the market is testing the resolve of the Fed, where the market sees lift-off closer to early 2023. In fact, we see the terminal rate of 2% is expected to be hit by September 2026, which is a decent move from the 1.3% pricing we saw at the start of the year.

Let's see what Fed chair Powell says in the upcoming US trade (2am AEDT). There is limited upside in doing anything but offer a dovish view which may cause some buying in rates and bonds. But there's greater forces at work and the way tech has traded suggests traders see higher yields not just through the repricing of inflation expectations and central bank action but also hedging from mortgage banks. Let’s see but given these dynamics its all eyes on Jay Powell and the bond market. Ready to trade the opportunity?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.