Les CFD sont des instruments complexes et présentent un risque élevé de perte rapide en capital en raison de l’effet de levier. 72.2% des comptes d’investisseurs particuliers perdent de l’argent lorsqu’ils investissent sur les CFD. Vous devez vous assurer que vous comprenez le fonctionnement des CFD et que vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.

- Français

- English

- Español

- Italiano

BoJ policy review - a potential major catalyst for the JPY and JPN225

It seems fair as life is often uneventful in Japan, specifically if we look at the markets through the prisms of economics, where markets rarely move on any Japanese domestic data. The JPY is largely a vehicle to express a view on risk and given what we’re seeing in volatility, with USDJPY 1-month implied vol at a subdued 5.27%, amid a backdrop of positively trending equity markets, then the JPY is the primary currency on offer.

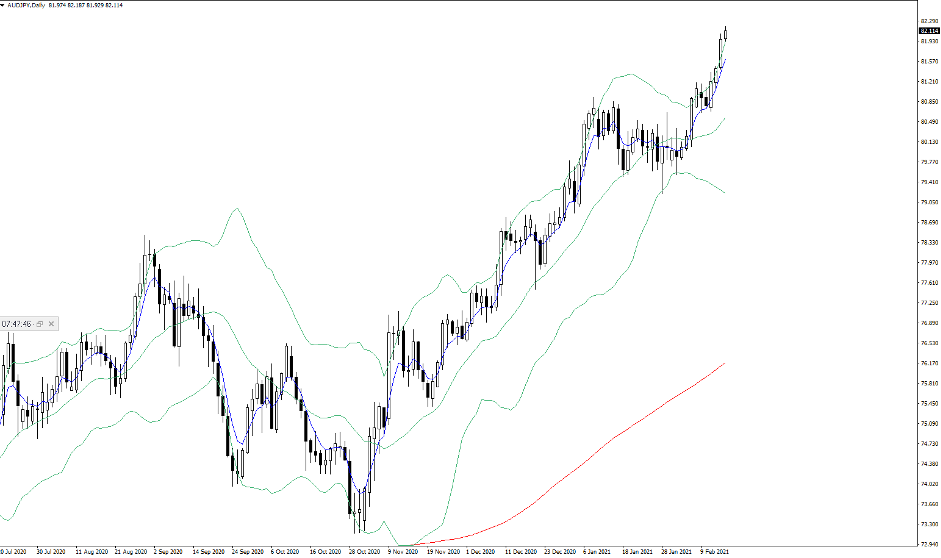

(AUDJPY daily)

It’s no surprise then that the JPY is the weakest currency in G10 FX this year, with NOKJPY gaining 4.6% and smashing 12.5000 and the highest since July 2019 - this is the momentum play. GBPJPY is exploding to the upside as the UK vaccine rollout inspires GBP longs, while AUDJPY and ZARJPY have broken out too. In our universe of equity indices after moves seen in the CN50 and HK50, the JPN225 is the best performer. With a gain of 9.6% YTD and with plenty of attention to the fact the index has reclaimed the 30,000.

(Source: Bloomberg)

In this backdrop of reflation and positive risk dynamics, there's not many reasons to want to own the JPY. We can buy JPY as a quasi-portfolio hedge, but more traditional hedges such as equity index puts are becoming ‘cheap’ and shorting stocks offers alternatives. Given moves in the FX funding markets, Japanese funds are still incentivised to hedge US Treasury holdings. However, one questions how much of that has already played out and hedging ratios are likely set.

Japanese inflation expectations while still incredibly low, are moving higher and subsequently 10-year real JGBs have turned lower. Which is a JPY negative at the margin.

(Upper pane – 3m v 10yr JGB curve, lower – 2yr vs 10yr JGB curve)

(Source: Bloomberg)

If we focus on the Japanese bond market, we can see the 10-year JGB at 8bp which is incredibly low when we compare the move higher in US Treasuries. However, small moves resonate in this market. When we look at the steepening in the 3-month vs 10-yr curve and 2s vs 10s JGB curve (see above), we see the global reflation trade is taking all prisoners and Japan has been included in this core thematic vibe. So, consider that Japanese pension funds have been incredible overweight JGBs and it’s not hard to believe they have been reducing their bonds holdings and rotating into domestic equities. Notably Japanese financials which are the beneficiaries of the steeper JGB curve.

We also consider the outcome of the BoJ’s policy review due for release in March. The review could genuinely surprise and we know that when it comes to creative thinking on monetary policy, the BoJ wear the crown when it comes to unconventional. Local publication Asahi does a good job of listing what could be revealed but it’s clear to me that the market is anticipating measures that could pulldown short-term rates deeper into negative territory while allowing longer-term interest rates to lift – subsequently the risk is skewed to a steeper JGB curve. This would in theory make for a more profitable financial sector and potentially result in the velocity of money increasing which feedback into price pressures.

While the BoJ would be adopting a stealth tapering of its bond-buying program, a JPY positive - by lowering short-term rates - should ultimately offset this and result in a weaker JPY. The effect should also be positive for Japanese equities. So, while all the talk is around US policy, let's not forget that under the radar we have some big announcements due from the BoJ that are largely not being talked about and where we already see the JPY trending lower and at the lowest levels since February 2020. While the move is mature the risk is still for a weaker JPY and higher JPN225.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.