- Français

- English

- Español

- Italiano

Didi IPO: Trade it with Pepperstone

Didi, a major competitor to the likes of Uber, Grab and Ola in the global ride-share and gig economy, is set to list on the New York Stock Exchange this week. It joins a growing list of Chinese companies listing at valuations greater than $1 billion, so-called “unicorn” companies.

This represents a massive opportunity to get involved in the post-IPO action, and you can do just that with Pepperstone. We’ve had a lot of client interest in this listing, and so we’ll be offering Share CFDs on DIDI on the list date. Long or short, you can use leverage to take advantage of any major sell-off or serious bidding action that ensues.

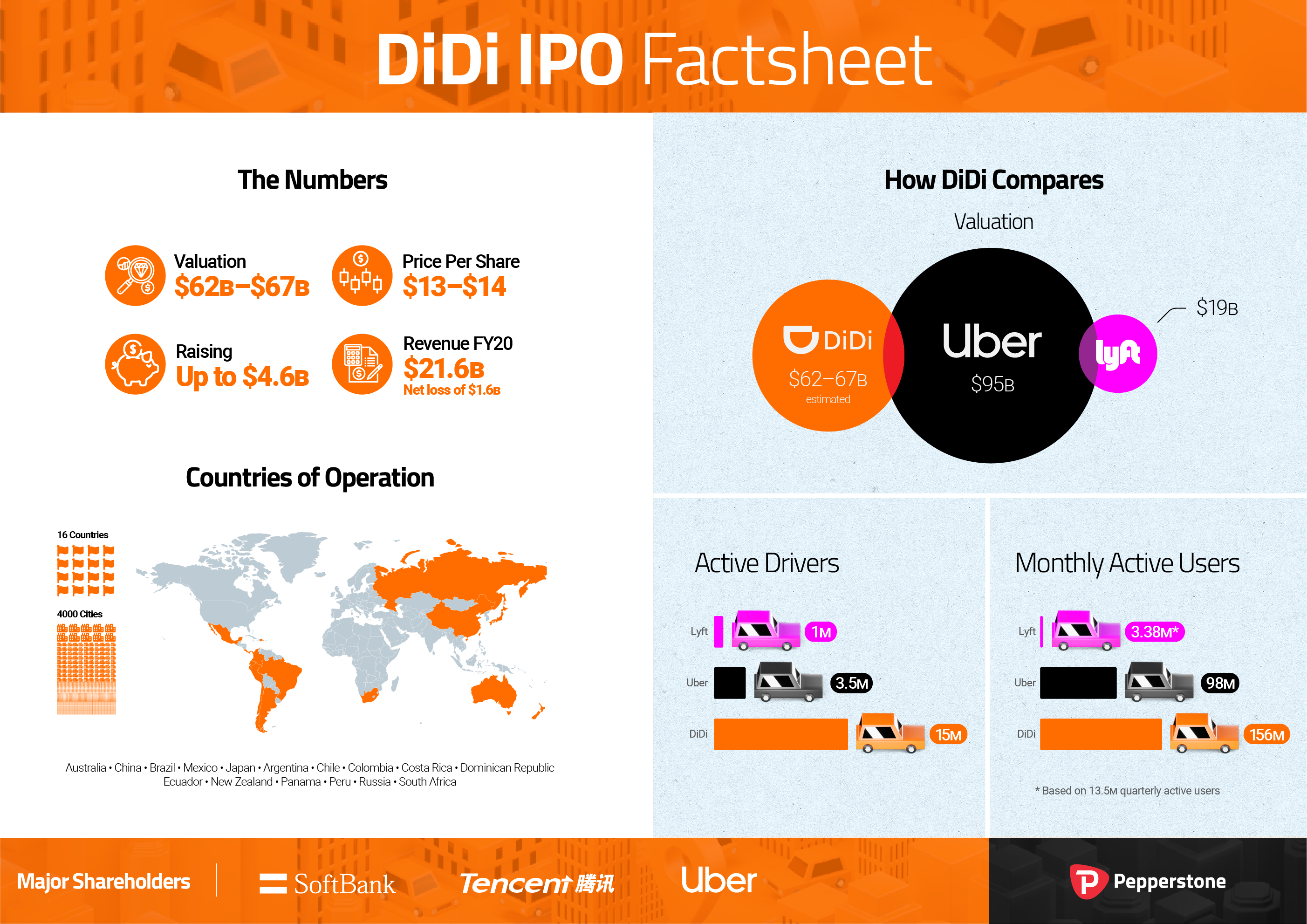

They’re hoping to raise up to $4.6 billion for global expansion and investments in tech, setting itself up for a valuation of $62-67 billion at a price per share of $13-$14. The new valuation is considerably less than the $100 billion it was seeking earlier in the year.

If you haven’t come across Didi before, they’re a dominant force in the Chinese mobility market, controlling almost 90% of the ride-share economy there. Their app offers users private cars, taxis, bikes, carpooling and food deliveries, but it's venturing into a range of other markets including electric vehicle charging and car servicing. Didi’s SEC filing claims it operates in almost 4000 cities, and 16 countries, with a major presence in the South East Asian markets.

With 500 odd million active users and 15 million drivers globally, Didi is set to be the largest Chinese IPO on US soil since Alibaba in 2014. It’s yet to turn a profit on an annualised basis, but that doesn’t make it any less interesting. In the last quarter it raked in $837 million in net income, a positive sign after 2020 revenues declined 8.4% amidst the numerous COVID-induced global shutdowns.

But it’s not without investor concerns, which increases potential shorting opportunities. The company is staring down the barrel of:

- Regulatory pressure: Chinese authorities are digging into its potential antitrust law violations amid a tech company crackdown. They’re also looking into the transparency of its pricing for core ride-sharing services.

- Growth rate impediments: with high market share in its key markets and ever increasing pressure from smaller rivals, it’s hard to see current Didi growth rates persisting much longer.

All this uncertainty means one thing for traders; opportunity. Trade it with Pepperstone. More info to come...