- Français

- English

- Español

- Italiano

The insatiable bid in commodities and what it means for the AUD

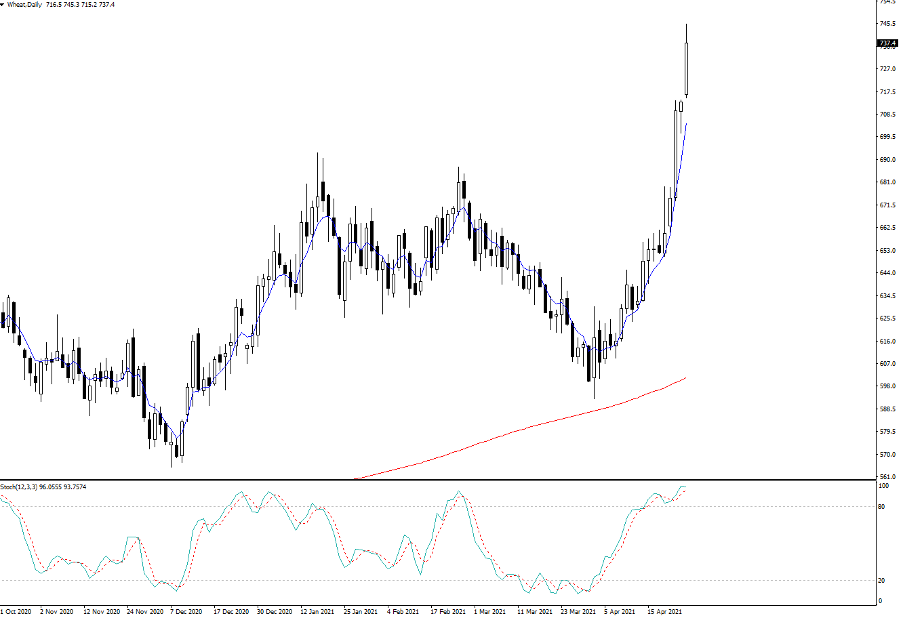

Gold and crude are consolidating, but Copper is flying (new highs seen in the Copper and Gold ratio). Iron ore futures are pushing to new highs and Lumber is in beast mode. Head to the softs and we see Wheat, Soybeans, Coffee, Cotton and to a lesser extent Cocoa, all pushing higher. Housing too. The trends in some of these markets, while mature, have been telling and we’re hearing about it from many US corporates through reporting season – many of whom are having to wear the input cost into margins. Some are passing it on, but this is the very essence of price pressures and inflation.

These sorts of explosive moves offer fantastic opportunities for trend traders and more so now, mean reversion focused traders. Will these moves spill over into a bid in Gold as inflationary pressure rise? At this point we’re not seeing that flow.

(Source: Tradingview)

What's clear is combination of higher copper and iron ore and the S&P 500 is great for commodity currencies. The bulls would like a better bid in Chinese equities and a breakdown in USDCNH, but as we see on the daily, AUDUSD is pulling out of the consolidation range. Ready to trade the opportunity?

Copper vs AUDUSD (orange line)

(Source: Tradingview)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.