Les CFD sont des instruments complexes et présentent un risque élevé de perte rapide en capital en raison de l’effet de levier. 72.2% des comptes d’investisseurs particuliers perdent de l’argent lorsqu’ils investissent sur les CFD. Vous devez vous assurer que vous comprenez le fonctionnement des CFD et que vous pouvez vous permettre de prendre le risque élevé de perdre votre argent.

- Français

- English

- Español

- Italiano

Views on equity indices and single stocks

This is also true of the US30 and US500 and I quite like the moves in the NAS100, with price mean-reverting (into the 20-day MA) and bouncing – the bulls would have liked a close above 15127 (yesterday’s cash session high) and this may be one to range trade, but let's see how price reacts should it push into the upper Bollinger Band at 15,306.

There is a beautiful trend in the AUS200 too and the Aussie index is up 0.7% this week and we should see an open in the ASX 200 cash above 7610 – there are some interesting moves on the stock side – on my ‘strong stocks’ scan (logic = price > 5- and 20-day MA, and price at 52-week high) I find the following names, and certainly, Macquarie looks interesting on the breakout.

(Source: Bloomberg)

On the downside, RIO has been savaged of late, and as a key China play that may attract further short selling interest in the near term. CSL has also found sellers and seems to be hugging the 50-day MA. AGL is trending lower and has come up on my ‘weak stocks’ scan (the opposite logic to strong stocks).

Still, at an index level, it’s all about rotation within sectors, but the consensus view is to be long quality (strong balance sheets, high return on equity). That said when we look at credit, government bonds and low vol and it’s not hard to see why they cry, “there is no alternative!” Whatever the situation - whether it's Northern Summer markets, earnings/margin growth, the world waits for a pullback, and it doesn’t come. Melt up and chase returns.

Just look at the intra-day cash move in the S&P 500, textbook bids all day, although turnover was 17% below the 30-day average. S&P 500 10-day realised volatility is crazy low, while the VIX – if we look at what’s implied – sits now at 15.59%. Calm and order are here, for now.

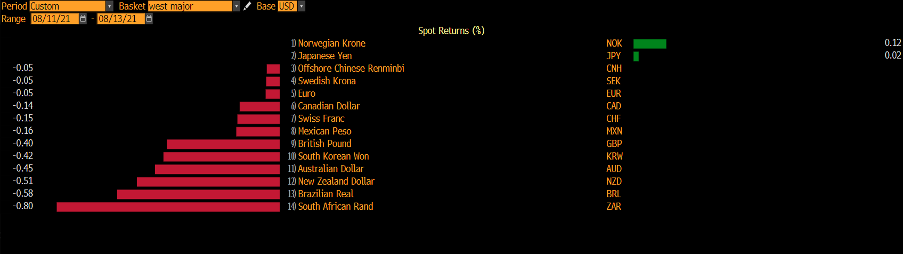

FX markets are also calm – the USDX has found small buyers and yesterday’s bearish outside day saw no follow-through and price has held the low – an inside day, so we watch for the price action to reveal itself. We’ve recent seen the USDX fail to cleanly break above 93, but a sustained push back above here in the near-term should get the USD bulls fired up at a time when some braver souls are saying we’ve seen the low in US Treasury yields.

AUDUSD has been well traded and appears to be headed to the bottom of its recent range of 0.7400 to 0.7320 – the lower Bollinger band may curb the downside today at 0.7316, but the risks are it will be tested. USDJPY has seen some interest, but on the 4-hour we see good bids coming in at 110.30, is this now the platform for a move back to 110.70? If this gives way, I’ll look for shorts into 110.20 and the figure.

(Source: Bloomberg)

The performance we’ve seen in the major FX complex seems to offer a slightly negative vibe, which is in fitting with the outperformance of defensive stocks in the S&P 500. Facebook delaying the date by which employees return to work has enforced a notion that the reopening trade has been pushed back a touch, marrying with the IEA cutting its crude demand forecast. A big upside beat in US PPI showed that corporates are seeing input costs rising, which perhaps wasn’t shared to the same magnitude by the consumer in the CPI print – we’ve seen the gap between PPI and CPI blow out in China, but in the US the spread is 1.9ppt and the widest since 2011 – can US corps hold back from passing this on to the consumer?

Commodity focus

In the commodities world, Gold has traded a tight 1758 to 1741 range, and there was no conviction at all to push price above Monday’s liquidation high, with price oscillating the 5-day EMA. It's kind of wait and see with gold here, at least on the high timeframes, and price really needs to make a move to compel. Crude is down smalls, while copper and iron ore continue to fall. For those who like it a little more exotic wheat is seeing some big moves, up 4% on the day, where we saw wheat futures hit the highest level since 2013 – a downgrade to Russian harvest numbers from the USDA has put real tailwinds behind the move and falling wheat supply should see pullbacks limited for now.

(Source: Tradingview)

There’s been good interest in Crypto – Ethereum was on the radar yesterday for a break and close above 3200, but again the supply came in and the sellers have won the battle on the day. Consolidation after a huge move is still in play, but if price can break, close and hold 3200 then we could see this trend again – one for the radar.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.