- Français

- English

- Español

- Italiano

One could argue that because equity has failed to show any real concerns around the increase in interest rate expectations – with a full rate hike now priced in for 2022 and four for 2023 – it suggests that equity is still attractive. Then consider that high yield credit has reduced to the tightest spread over US Treasuries since 2007, the VIX index is back to 17% and pre-pandemic volatility levels. Subsequently, lower equity volatility is pulling in further capital into stocks.

From a somewhat cynical view, because so few are looking at earnings, perhaps therefore we should be looking at the numbers and the outlooks from corporate CEOs’ and CFOs could prove to be a stealth catalyst.

Earnings do matter for stock prices, certainly over a longer-term period, but this reporting season gives us a chance to mark-to-market whether the consensus estimates for earnings are too low (or high) and if the earnings multiple is due to re-rate further. So, we should consider earnings as a possible catalyst not just for single stocks but for the broader index too – while we look at bond markets, perhaps the next leg up in US indices comes from lower volatility and better signs of cash flow, dividends, and earnings.

Q1 earnings expectations

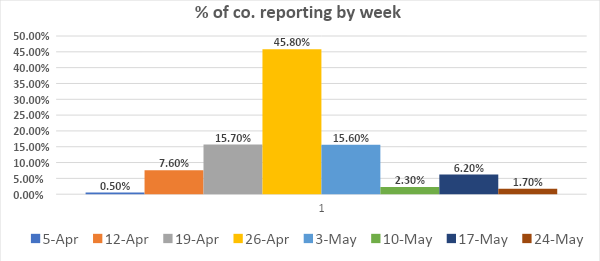

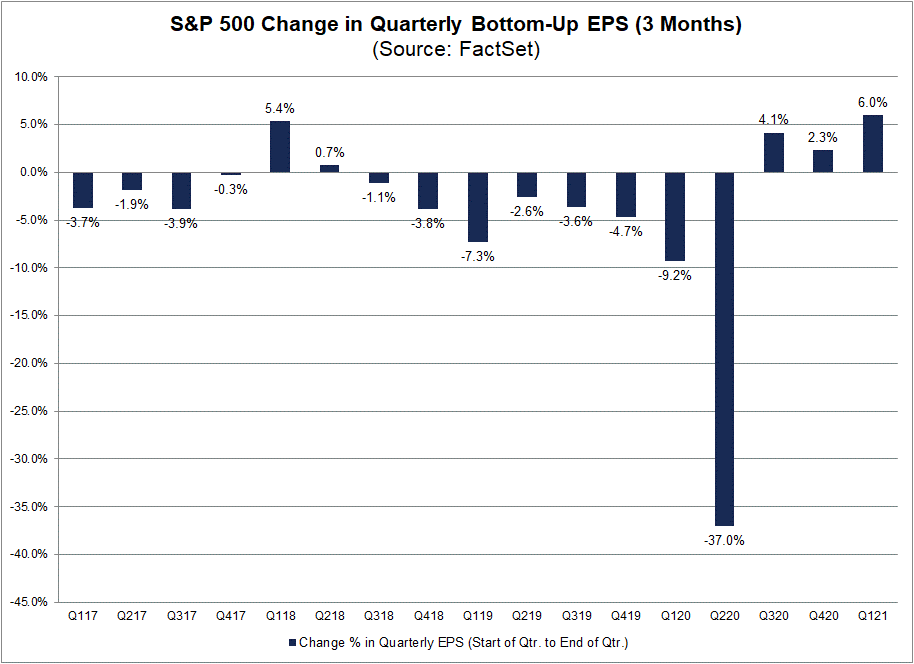

The signs are indeed promising. So far this quarter aggregate Earnings-Per-Share (EPS) estimates have increased by 6% to $39.86. This is the largest quarterly increase since Factset compiled earnings estimates. Its worthy of note, that 61 corporates have issued positive guidance, which is not only the highest number ever, but is 75% higher than the 5-year average. Tech leads the way here with positive guidance, with close to 50% of the upgrades coming in this space.

In the lead-up to the 14 April (JP Morgan report), we’ve seen the ratio of companies issuing negative to positive guidance at a 25-year low – so the trend has been that if you have something to announce it has been better skewed towards positive guidance. One could argue this has subsequently shown up in the extent to the earnings re-rating from analysts. On a year-on-year basis, Q1 earnings for the S&P500 are expected to grow over 20% and granted it’s coming off a low base due to the 2020 COVID restrictions, but this is still a solid expansion. At a sector level consumer discretionary, materials and tech is where we should see the growth.

Outlooks are key

We look forward in markets and here we see the consensus calling for close to 50% YoY earnings growth in Q2. For the 2021 full-year EPS estimate the market has revised its call to $173 (representing a 41% YoY gain) and for the 2022 EPS estimate of $199 (a 15% increase from 2021 numbers). So, will the outlooks we hear, and the guidance suggest these numbers are too conservative? Recall, the analyst community typically put out low-ball estimate, so it wouldn’t surprise to see more than 70% of S&P500 companies beating on earnings and 60% on sales.

What will CEO’s say about:

- The move in interest rates – specifically the financial institutions who will soon start paying out increased dividends again. What will we see from the level of provisions for future non-performing loans? This will be a telling sign on the very entities tasked with lending credit to the real economy.

- The US economy is expected to grow above 7% in 2021, with unemployment due to fall towards 4% - will this change be reflected in the tone of communication especially from cyclical names with high sales receipts in the US?

- Inflation is the buzz word, and some feel we could get an overshoot leading to the Fed having to taper its QE program later this year – what will hear about price pressures and the ability for businesses to either absorb these costs or pass them on to the consumer?

- Commodity prices have had a strong run – any outlook around demand, specifically from China could be important.

- US crude has held a range of $57.50 to $62.50 of late as the perception of demand increases - will we hear of plans from US energy names to increase supply – likely meaning a higher rig count?

Trade Q1 earnings with Pepperstone

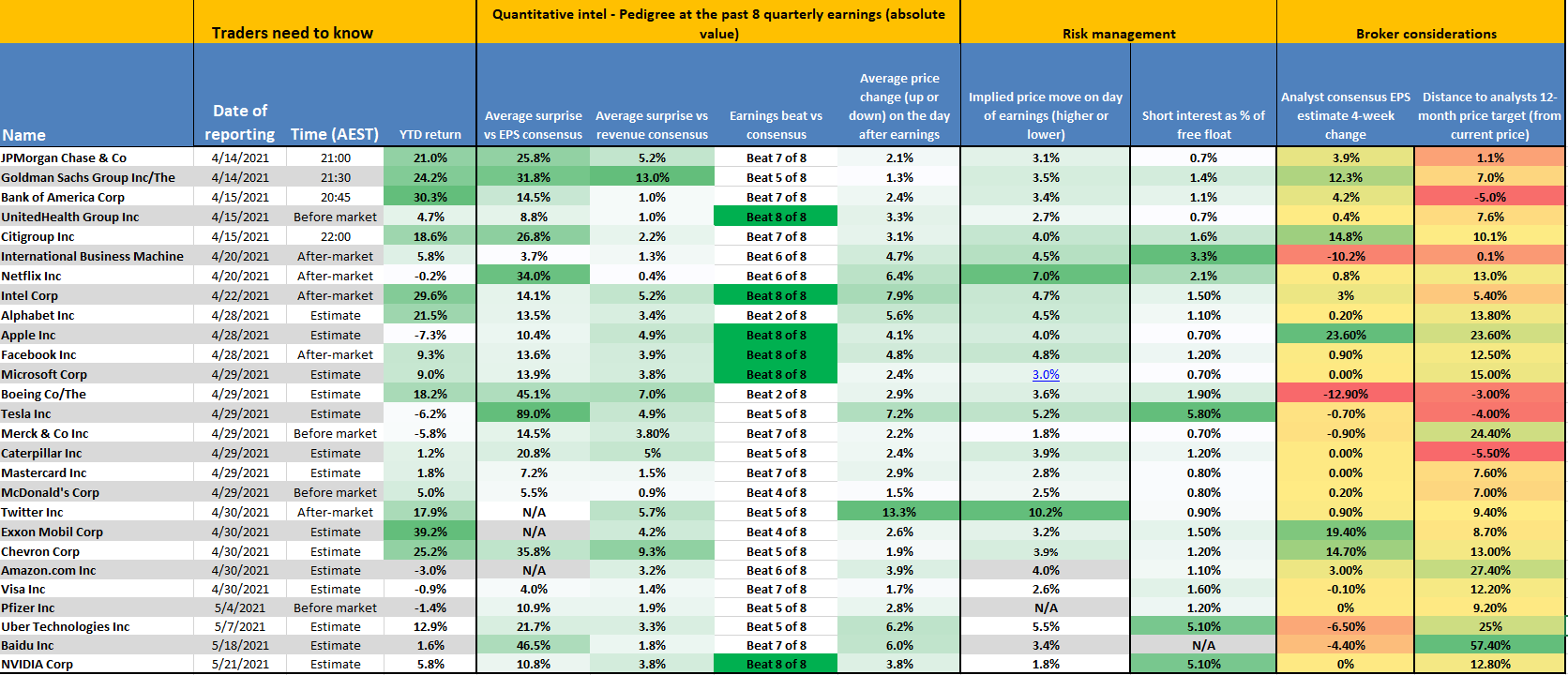

While the range of stocks we offer is vaster than in the matrix, I have put together this matrix of names that I feel will get more attention than others. I have looked at a number of earnings variables to understand not just the pedigree around quarterly earnings, but the implied move and short interest. It may help to guide not just risk but trading decisions.

Certainly, given the upgrades of late, some of the tech names will be interesting trades through earnings.

The ability to capture the opportunity and trade US share CFDs, real-time and as news breaks is fundamental to our offering. With many of the large- and mega-cap companies reporting in the after-hours market,

Pepperstone offers both the pre- and post-market trading sessions. This results in trading opportunities in single stock names for 16 hours a day, along with competitive pricing and an extensive range of risk management tools.

Clients can already take advantage of our almost unparalleled 24-hour pricing on US indices, and with US earnings in play, the ability to trade single stocks from the MT5 platform further increases the possibilities.

How to trade US Share CFDs with Pepperstone

Why trade US earnings season with us?

- Trade a wide range of forex pairs with us on ultra-tight spreads.

- Trade the US30, US500 and NAS100 with fast execution speeds.

- Go long or short on US stocks after hours with our US Share CFDs.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.