- Italiano

- English

- Español

- Français

That continues to be the case and at this juncture price sits below the 5-day EMA and rallies seem to be sold into this short-term average.

Tactically, I feel there may be some more favourable times ahead for the yellow metal. However, until the flow of capital starts to become more constructive I would shy away from long positions.

As always, let price guide. However, I've gold on high watch and I'm keenly awaiting the signal to pull the trigger. Starting small and adding into any continued strength, which would be driven by trend-following hedge funds increasing their exposures. The rising trend support drawn from the May 2019 low seems like the make or break zone for gold and look out below if this gives way.

The current investment case is lacking

As detailed before, the investment case for gold longs is lacking – for a sustained bull run, the market wants to see either an appetite for the Fed to use its balance sheet to cap long-end bond yields, an inflation scare, or a lasting period of disinflationary forces which drives down real (i.e. adjusted for expected inflation) Treasury yields. Not one of those factors are present at this point and while the Fed has welcomed higher bond yields, it's critically importantly to understand that the group have become galvanised in their messaging – there's no descent or appetite to cap yields.

With gold displaying a poor negative correlation to stocks, gold as a portfolio hedge just isn't there either and being long a yield-less asset means there is an opportunity cost for owning gold, at least in the short to medium-term. The best hedge for portfolio's right now is seemingly the USD.

That said, within this investment thematic we can still find compelling trading opportunities. That time could be coming but it requires Treasury yields to consolidate and inflation expectations to rise, resulting in lower real Treasury yields and until we see this dynamic play out then the USD is the flavour du jour and gold rallies will be sold.

So how to play?

We start with a focus on sentiment towards gold which is shot to pieces. Everyone is on one side of the boat and that boat could easily tip.

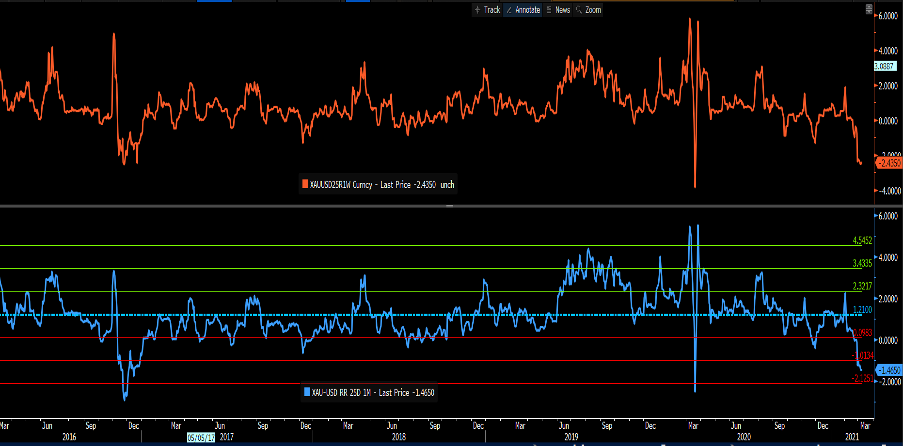

1-week and 1-month risk reversals (call volatility minus put volatility)

(Source: Bloomberg)

In the options world, 1-week and 1-month risk reversals are deeply negative showing a huge preference for put volatility over calls. The 14-day RSI sits at 26 – the lowest since 2018. Positioning is perhaps not as alarming, but gold is clearly oversold and may stay oversold, but as always we look for the drivers.

So aside from being a whisker away for huge support and by way of a bullish catalyst, I think we need to look ahead to the 17 March FOMC meeting. The Fed’s unified message is that they've welcomed a steeper yield curve, as they see it as a sign the market sees believes in their policy mix and share the view that positive economics are coming.

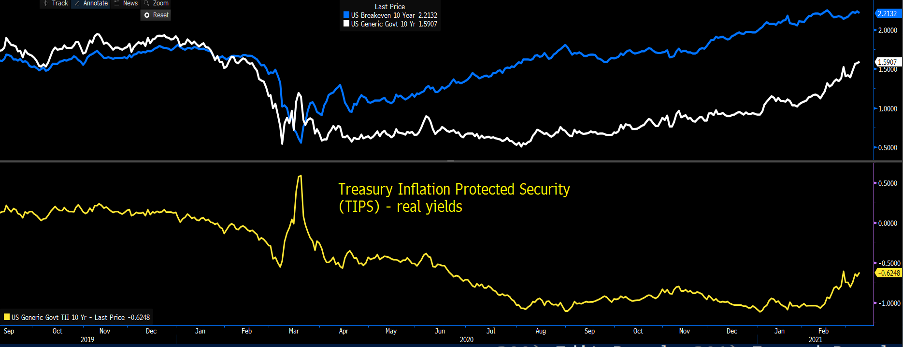

(Blue - inflation expectations, white – nominal 10yr Treasury, yellow – 10yr real Treasuries)

(Source: Bloomberg)

The Fed has made it clear they will worry when financial conditions deteriorate. However, one key catalyst for gold is whether the Fed are happy with the market pricing in over three hikes by end-2023. They may be ok with the move higher in real Treasury yields, but they wouldn't be pleased that it’s been driven by a plateau in inflation expectations (see chart above). With higher real yields we’re now seeing a far better bid in the USD.

The question for the gold market then is whether the Fed influence inflation expectations. The best way to do this would be to push back on rate hike pricing by leaving the so-called dots plot projection unchanged in the 17 March FOMC meeting, while significantly upgrading its growth and inflation forecasts. When it comes to rates, a reinforced stance towards lower for longer, amid economic prosperity should result in higher inflation expectations and lower real yields.

Consider the market isn't even talking about tapering the QE program anymore and they’ve gone straight on to debating the date of lift-off on rates. The rates market is rich and calls to start adding duration into bond portfolios is growing. If the Fed can push back on rates pricing while holding and not shocking the market, and changing its optimistic feel, this should boost inflation expectation and gold should fly.

However, as always wait for the flow of capital to promote the trade, as we can see the catalyst, we can see it oversold, the bulls just need to see lower real rates. Ready to trade the opportunity?

Related articles

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.