- Italiano

- English

- Español

- Français

The US debt ceiling - A path to inevitable market volatility

Understand the debt ceiling – see our explainer here

It is incredibly painful for all market participants, but it can radically alter our trading environment and reverse the low volatility regime, we have found ourselves in recently.

Like most of the traders I speak to we know the debt limit will be lifted; it must be – the question is when we get the volatility, and what will be the duration and to what extent.

Understand the ‘X-date’

The issues at hand are incredibly complex – most public policy experts and economists when they work together struggle to have any conviction on forging an exact date around when the US Treasury’s funds will be so depleted that they must prioritise essential outgoing payments – these include social security, Medicare, Medicaid, veteran payments, and its debt obligations.

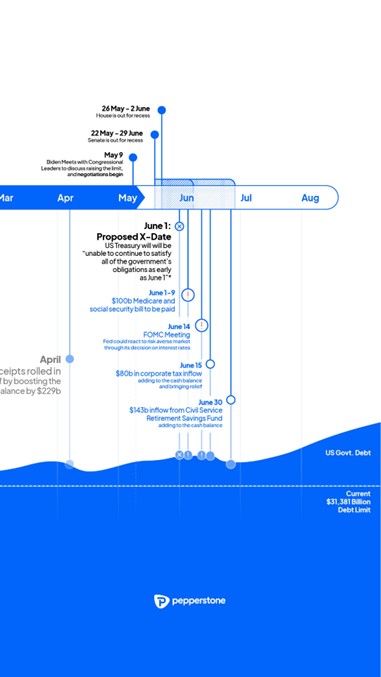

This ‘X-date’ is critical in our ability to time debt ceiling trades (and hedges) and as it stands both Treasury Secretary Janet Yellen and the non-partisan CBO have said it's early June. The sell-off in US Treasury bills maturing over this date suggests the market puts faith in this call.

What the market is looking at closely is the Treasury’s daily cash balances, which can be found here . As it stands, the US Treasury (UST) Department has $215b in the kitty, but this will be drawn down as we head to June and perhaps even below $50b.

This would be worryingly low, especially as in the first two weeks of June we understand that the UST must make a $80-100b payment for social security and Medicare. You’ll hear a lot about ‘prioritisation’ in the coming weeks and this is where the UST must make choices on which payments to make – it is highly political. There will be a huge hit to confidence if 58m Americans don’t get their social security and both the Democrats and Republicans will be keen to avoid that at all costs.

Can Treasury make it to 15 June?

If the UST can make it to 15 June, then they will receive a boost from corporate tax inflows and then a chunky maturity from a maturing investment fund in late June. I guess if we still haven’t seen an agreement by then, they then draw down on these funds and we start to consider what payments may be missed and the impact on economics through July.

The big issue, in a word – ‘growth’. Either certain payments are missed and that significantly impacts consumer and business confidence, at a time when US economics is already fragile and the US is headed towards recession. Or we see an agreement, that despite the Democrat's strong disdain for spending cuts, includes measures which could be a drag on growth.

What happens in a technical default?

The idea that we may see the UST miss a payment on its bond obligations is the elephant in the room. The UST will look to defend this above all else – Biden has even stated he will use the 14th Amendment and strong arm a lift in the debt ceiling – an extreme measure and one that will see conservative Republicans taking legal action. He made talk of it in the prior session, so we know it's on the table.

If it even looks like a technical default, or best coined as a deferred payment, is on the cards – then markets will light up – I’d say the markets are pricing this possibility at around 4-5% at this stage.

UST bills are already showing stress and Treasury auctions of late have been poor – no none is buying T-bills that mature in June and why would they? If you hold this paper and the UST can't pay on maturity you need that cash – US bills are the highest form of collateral and the knock-on effects through markets would be huge.

Fitch has already said they will downgrade the US credit rating and as we saw in 2011 most of the risk aversion came after S&P downgraded the US rating to AA+.

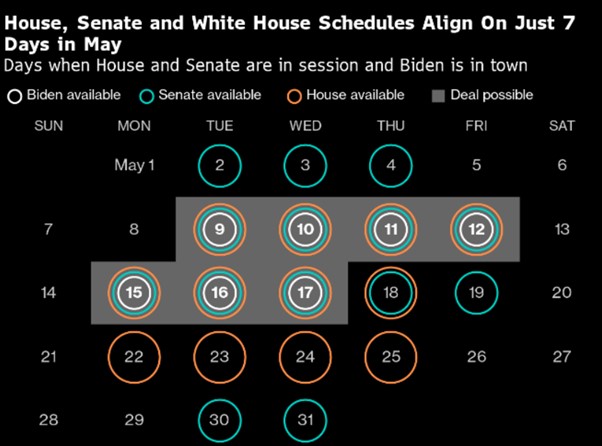

Making matters worse is the fact there is that the path to negotiate is so tight – with the recess calendar for the Senate, House and Biden’s own schedule, there are JUST 7 days to get this down. Knowing the REP’s have a 4-seat advantage in the House gives them very little room to and if a bill is put to the floor, it will fail if 4 of the 222 REP votes against it – it will be shot down straight away.

(Source: Bloomberg)

A rabbit needs to be pulled out of the hat. I see 5 actions playing out:

- Congress agrees on a short-term extension to raise the debt limit to Sept or Oct.

- We see an agreement to raise the debt ceiling on the X date, potentially extending for 2 to 3 years.

- We hit the X date with no agreement and depending on cash on hand, Treasury may have to prioritise payments until 15 June, potentially impacting economics.

- Treasury muddle through to July before cash levels deplete and must prioritise payments in July.

- If the US looks destined to miss a bond payment the President uses the 14th Amendment to solve the Debt Ceiling.

I am seeing some signs of hedging activity in S&P500 options, with S&P 1-month put/call implied vol ‘skew’ on the rise. Some have focused on a spike in US credit default swaps (CDS), and we’ve seen UST bills blowing up, but our core markets are yet to react – it’s still too early to buy JPY, CHF or gold just yet.

In 2011 – which is our best-case study – the JPY, CHF and gold were the best hedges, with traders piling into short US bank exposures. I see those working well this time around too, but with the Fed having 5.25% to play around with on the fed funds rate and QT still in play, if we start to head past the ‘X date’ without signs of reconciliation and the USD will be taken down.

Like everyone else we know the debt ceiling will be raised – it must be – but it doesn’t mean we can’t have a solid bit of volatility in between.