Os CFDs são instrumentos complexos e apresentam um alto risco de perda rápida de dinheiro devido à alavancagem. 80% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com esse provedor. Você deve considerar se entende como os CFDs funcionam e que pode correr o alto risco de perder seu dinheiro.

- Português

- English

- Español

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- لغة عربية

Examining Where The Path Of Least Resistance Leads

For equities, this is apparently a relatively easy question to answer – higher. All three major US benchmarks – the S&P 500, Nasdaq 100, and Dow Industrials – closed at a record high on Friday, with the post-payrolls dip being aggressively bought, and a post-earnings rally in tech behemoths Amazon and Meta helping to support sentiment.

As often stated, there are few more bullish signs for a market than printing fresh record highs. While some may point to poor breadth, with only two S&P sectors – technology and industrials – having hit all-time highs along with the index, the speed and aggressiveness with which bulls bought the dip last Friday speaks volumes. For the first time in a while, the post-NFP reaction in risk assets suggests that we may be moving to a ‘good news is good news’ environment, where strong economic prints are treated as a positive for equities, rather than a headwind owing to hawkish policy implications.

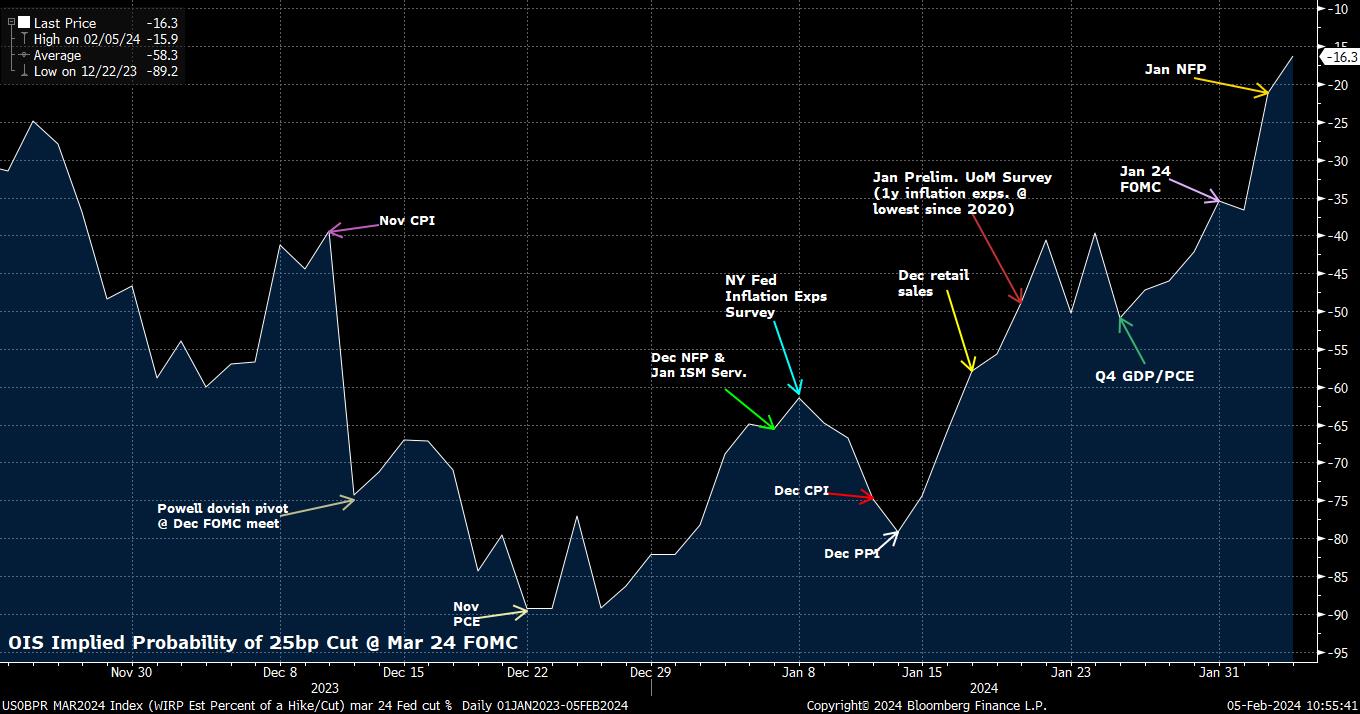

On that note, markets have now all-but-certainly waved goodbye to the chances of a 25bp Fed cut in March; the combination of Powell’s ‘not the base case’ pushback at Wednesday’s press conference, and the blowout jobs report, put paid to the doves’ hopes there.

While stocks have managed to shrug off this hawkish repricing, it has had a notable impact in the G10 NDFS de Pares de Moeda space. The greenback kicks off the week at fresh YTD highs, per the DXY, with the index trading north of the 104 figure, and within touching distance of its 100-day moving average.

Having now notched 5 consecutive weekly gains, the longest such run since Q3 23, there is little to suggest that the greenback won’t notch a sixth, particularly as the ‘goldilocks’ macro narrative persists, and a ‘soft landing’ for the US economy becomes increasingly assured. A relatively crude overlay with the front-end and belly of the Treasury curve also shows little sign of the buck’s gains having become over-extended thus far.

_d_2024-02-05_10-54-26.jpg)

Of course, this bout of US economic optimism comes at a time when other DMs continue to face headwinds.

The final January PMI surveys pointed to a continued contraction in the eurozone – which faces intensifying downside growth/upside inflation risks from ongoing geopolitical tensions – while the China outlook remains dour, particularly after a rather vague weekend commitment from regulators to ‘stabilise’ markets lacked any detail whatsoever, and with investors continuing to await a ‘shock and awe’ fiscal stimulus package which seems unlikely to be forthcoming for now.

This is, unsurprisingly, also pressuring the AUD and the NZD, which continue to display a high-beta to developments in the world’s second largest economy. Frankly, a brief cross-check of the macro environment suggests little of any attractiveness besides the USD; perhaps, maybe, the JPY if one sees the BoJ standing as a hawkish outlier among G10 central banks, and expects Treasuries to rally over the medium-term.

While the fundamental outlook continues to point to further USD upside, particularly if the residual 4bp of easing priced for the March FOMC is priced out, the technical outlook is singing from a similar hymn sheet. Most G10 NDFS de Pares de Moeda peers have, or are very close to, slipping beneath their respective 200-day moving averages, a classic and key gauge of longer-run momentum in the foreign exchange space.

_2024-02-05_10-53-58.jpg)

In a quiet week, like the one we have coming up, there will likely be little to derail the prevailing trend. In fact, further breaks of those fabled yellow lines on the above chart are likely to entice more trend-following dollar bulls to enter the fray, further extending recent moves.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.