Os CFDs são instrumentos complexos e apresentam um alto risco de perda rápida de dinheiro devido à alavancagem. 80% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com esse provedor. Você deve considerar se entende como os CFDs funcionam e que pode correr o alto risco de perder seu dinheiro.

- Português

- English

- Español

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- لغة عربية

US CPI preview - a playbook on the worlds most important data point

The market expects US headline CPI inflation to drop from 8.3% YoY to 8.2%, with core inflation expected at 5.9% (from 6.2%). On headline CPI, the distribution of economist’s calls range from 8.5% to 8.0%, so we can devise a basic playbook on the potential market reaction from this – a move into 8%, and certainly below 8%, and we should see the USD under pressure, notably vs the AUD, NZD, and CAD, likely driven by a push higher in high growth equities.

USDJPY could trade into Wednesday’s low of 132.57. In my view gold would actually find buyers in a low-ball CPI print and looking at the daily chart something needs to spur the gold market into life as price action is trading in an increasingly tight range and neither the bulls nor the bears are prepared to make a move – a bit of life in the gold market would be welcomed.

Daily gold chart:

(Source: Tradingview - Past performance is not indicative of future performance.)

A move into 8.4% and above and we should see anticipated rate hikes increasing, with long USDJPY the most simplistic play in G10 FX, with a retest of 134.26 on the cards on this outcome.

The complication with devising a playbook is that in the past 10 CPI releases nine of those have come in above expectations – subsequently, the form guide clearly favours an above-consensus CPI reading. However, if we look at the moves and market reactions in the following five minutes after the CPI drops, we’ve seen the USD actually fall 60% of the time. The US500 has rallied 60% of the time (in the 5 mins after the news), as has gold. The point is, while we can take the time frame in further, while CPI has form of beating market consensus, what we think the market should do and what transpires can be wholly different.

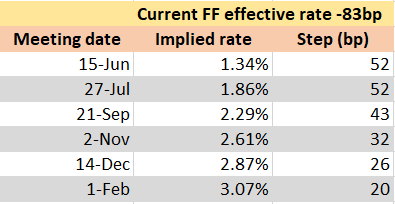

Market pricing on upcoming FOMC meetings:

This time may be different of course and we may get a far more simplistic reaction – that being a strong CPI read and the USD rallies, while equities trade lower. For this we turn to interest rate pricing - In the lead up we see the markets suggesting the Fed is effectively on autopilot in the next two FOMC meetings, with back-to-back 50bp hikes. We then head to the Jackson Hole symposium in August and a chance for the Fed (and other key central banks) to offer a new sense of how things are tracking, with the fed funds target rate sitting around 2%.

A pause in September?

There is some debate whether they go 50bp again in September, but with the labour market so strong, PMIs in solid expansion and the corporate landscape in form, it feels unlikely the Fed pause and they should hike by another 50bp, with the market aligned and pricing 43bp of hikes here – so, unless we see the May CPI print below 8%, which would cause come doubt, they should hike by 50bp again in September with an idea of getting the fed funds rate to the estimated neutral rate (eyed at 2.5%) by November.

So, the importance of this data point can’t be understated – either it misses badly to the downside, and we have some belief they pause in September, or it comes in at 8.2% or above and they should continue to push on with its hiking cycle – this should see USDJPY supported and keep risk assets from rallying too hard.

Related articles

Pronto para operar?

É rápido e fácil começar. Inscreva-se em minutos com nosso simples processo de inscrição.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)