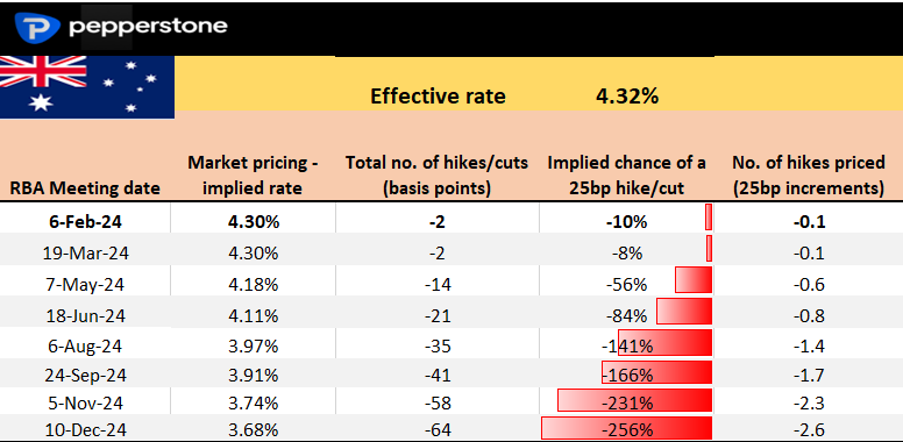

Like the aforementioned central banks, the timing and the extent of RBA rate cuts are the subject of much debate among local market participants - all with fairly strong and dispersed views on when the first cut plays out.

What is more important to drive the reaction in the AUD or AUS200 are market expectations and what is being priced. The best way to measure these expectations is through the Aus 30-day interest rate futures, and these are the first derivative by which other markets (such as the AUD) will react to.

As we from the table the central view from rates traders is there is very little chance of a 25bp cut at this meeting or the March meeting. The May RBA meeting is considered to be ‘live’ and while this pricing will move dynamically with supply and demand from market participants, there is currently a 56% probability of easing here, with June almost fully priced for a cut. I sit more in the June camp myself.

By December ‘24 the market is torn between two or three 25bp cuts, with 64bp of easing priced.

Another factor is the pricing of the trough in the cash rate, as this offers a sense of where the collective sees a neutral setting. Here we can look at the forward rates market and see this currently set between 3.50% and 3.25% in 2 years’ time. A 3.5% floor in the cash rate would be conditional on the economy avoiding a recession, where a recessionary environment would require a more accommodative stance and the cash rate likely pulled below 2%.

The reaction in the AUD

While the RBA won't cut the cash rate at this meeting, the reaction in markets will come from the tone of the RBA statement and any change in the wording that gives a sense of whether there is any appetite to ease from May or June.

While cumulative pricing in Aussie rates is certainly nowhere near as aggressive as what we see in the tradable US or EUR interest rate markets, if the market sees no tangible evidence the bank is prepared to cut then May rate cut pricing will be pared back and the AUD should spike higher.

Positioning, specifically from fast money leverage funds (e.g. hedge funds), will also play a critical role in the extent of the move to the tone of the statement, and flow reports from investment banks suggest these players running a sizeable AUD short position, albeit not at extreme levels.

Given the trend in both headline and core inflation, along with subdued growth and stalling house price momentum, the RBA will almost certainly lose its hawkish bias in the meeting statement. However, they will likely be non-committal and adopt a clear wait-and-see bias. This should loosely put a cut on the table as early as May, but it will be highly conditional on the outcome of the following data points:

Wage price index (21 Feb), monthly CPI reports (28 Feb, 27 March), Q1 CPI (24 April), employment reports (15 Feb, 21 March, 18 April) and Q4 GDP (6 March).

Certainly, the Q1 CPI is the marquee data point that could decide a May cut, and the RBA would want to see inflation falling below 3.5%. The RBA would also require an unemployment rate above 4% (currently 3.9%) and trending higher to ease.

A big day for the AUD

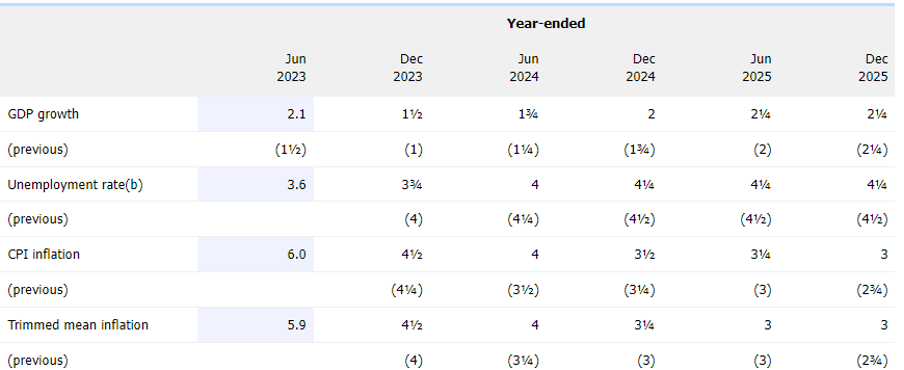

It's worth considering that as well as the RBA statement we get the SoMP (Statement on Monetary policy) at the same time, and there will likely be changes to the bank's economic projections – that could put the market on notice.

The RBAs Nov SoMP – economic projections

Also, an hour later (15:30 AEDT) RBA Governor Bullock will hold a press conference – this will be important for traders to react to. Gov Bullock will be probed on the broad appetite to cut and once again the reaction in the AUD and AUS200 will be driven by nuance and her urgency to normalize relative to the rates pricing.

In theory, the meeting should be a low-volatility affair, with the bank moving to a more neutral setting and welcoming the moves lower in inflation but refraining from saying their work is done. It is still an obvious risk though for AUD exposures, so do consider position sizing over the event and consider where you see the skew in risk.

As we move into the meeting AUDUSD is tracking a range of 0.6625 to 0.6550 – a break of this range could be quite powerful. Sentiment towards global risk assets is a contributing factor but as I say, around the meeting how the RBA are seeing things relative to market pricing will likely be the driving factor.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。