First things first: can you trade gold on MetaTrader 4?

Yes, you can – in fact, it’s one of traders’ most beloved markets with all traders.

While MetaTrader 4 is mostly associated with forex and was designed with currency trading in mind, there are many other assets offered by the MT4 platform.

Using CFDs, you can trade a whole host of financial markets, including cryptocurrencies, indices and many of the most popular commodities – like gold, other precious metals and oils.

Head analyst, Chris Weston, says CFDs are the instrument of choice for playing the gold market. Find out why in this article.

Why trade gold with MT4?

Gold is one of those rare safe haven assets that tends to go up in value during a wide range of economic hard times. When financial crisis dominates the markets, when a gruelling bear cycle sets in or when central banks raise interest rates… in all of these, gold often outperforms the stock market and various other asset classes. The demand for gold is ever-present, so it’s often seen as a hedge against inflation and a safe-haven instrument – even a disruption in the gold supply itself can up the gold price!

However, owning physical gold bullion or gold ETFs is expensive, impractical to store and can pose legal challenges – which is why trading gold is so popular. This allows you to speculate on the price of gold without having to own any. And unlike investors, who can only profit off of gold and gold ETFs after the gold price has gone up and they’ve undertaken the whole process of selling, you can go either long or short depending on what you think the gold market will do.

MetaTrader 4 is the place to be when you’re speculating on gold for many traders – and it’s easy to see why. MetaTrader 4 is one of the most used trading platforms in the world, with millions of loyal fans, thanks to its beginner-friendly versatility and the enormous number of indicators and tools available on MT4.

How to trade gold on MT4

- Open and fund a MetaTrader 4 trading account with a trusted MT4 broker – like us, voted the Best MetaTrader 4 Forex Broker by Compare Forex Brokers

- Download the MetaTrader 4 platform, following our prompts

- Open the MetaTrader 4 app or platform

- Connect your MT4 to your Pepperstone trading account

- Find the gold trading symbol on MT4 and open the gold chart you want to speculate on

- Study the market

- Set a clear trading plan, deciding on the level of profit to aim for and a level of loss you’d be comfortable with

- Place your first gold order

- Set up stop loss and take profit orders to enhance your risk management

- Monitor your position and close when you’re ready

1. Opening a MetaTrader 4 gold trading account

MetaTrader 4 is the platform, but in order to use it safely, you need a trusted and properly regulated broker. Due to the immense popularity of MetaQuotes platforms, we offer both MT4 and MT5 among our platforms that Pepperstone clients can trade. So, in order to trade gold on MT4, all you need to do is open an account with a trusted MetaTrader broker – like us!

2. Download the MT4 platform

Once you’ve created a Pepperstone account, you’ll go to our MetaTrader 4 platform page and download MT4 – either onto your computer, or via the app store for mobile trading on your phone.

3. Open MetaTrader 4

It’s then time to open MT4 on either your desktop or your mobile phone and learn exactly how MetaTrader works – which takes some getting used to. Although MT4 is very easy to use once you know how, it is older software that requires support to get to know the basics.

Luckily, MT4 is so popular that there are a whole host of tutorials, videos, ebooks, webinars and pages all over the internet on this exact topic. In a hurry to get trading? Learn everything you need to know in one place with our Getting Started with MetaTrader 4 course.

4. Connect your MT4 account to Pepperstone

So, you’ve downloaded MT4 from your secure client area. You'll then be prompted through the download process, and once your platform has loaded, you’ll be asked for your account number, password and server name.

5. Find the gold trading symbol on MT4 and open the gold chart you want to speculate on

If you’ve spent any amount of time on the MT4 platform, you’ll know that the different markets offered each have an associated symbol or ‘ticker’. While some of these are really intuitively named (‘USDX’ is the symbol for the US Dollar Index, for example) gold isn’t one of them, unless you know your chemistry.

The gold symbol on MetaTrader 4 is ‘XAU’. While the ‘X’ is the platform’s shorthand for an index, the rest comes from gold’s ‘Au’ symbol on the periodic table.

So, to find the gold symbol on MT4, you’ll simply go to your Market Watch tab, select ‘show all’ and find the markets beginning with ‘XAU’.

6. Study the market

Here, it becomes handy to know exactly which of MT4’s gold markets you want to trade. Should you want to speculate on the gold price versus the US dollar, you’ll click on ‘XAUUSD’ to add that to your main trading window, or else simply drag it from the Market Watch list onto your main screen.

If you don’t yet know which gold market to trade or study, the standard gold one is a good place to start. This is the closest you’ll get to trading gold itself – and it’s the XAUUSD, which is the price of gold as compared with the US dollar.

But isn’t that gold versus the US dollar? Yes, but since MT4 doesn’t offer physical gold to trade on, this is the closest you’re going to get to the live spot price of gold itself. That’s because the USD is what the gold price is actually measured against in real time.

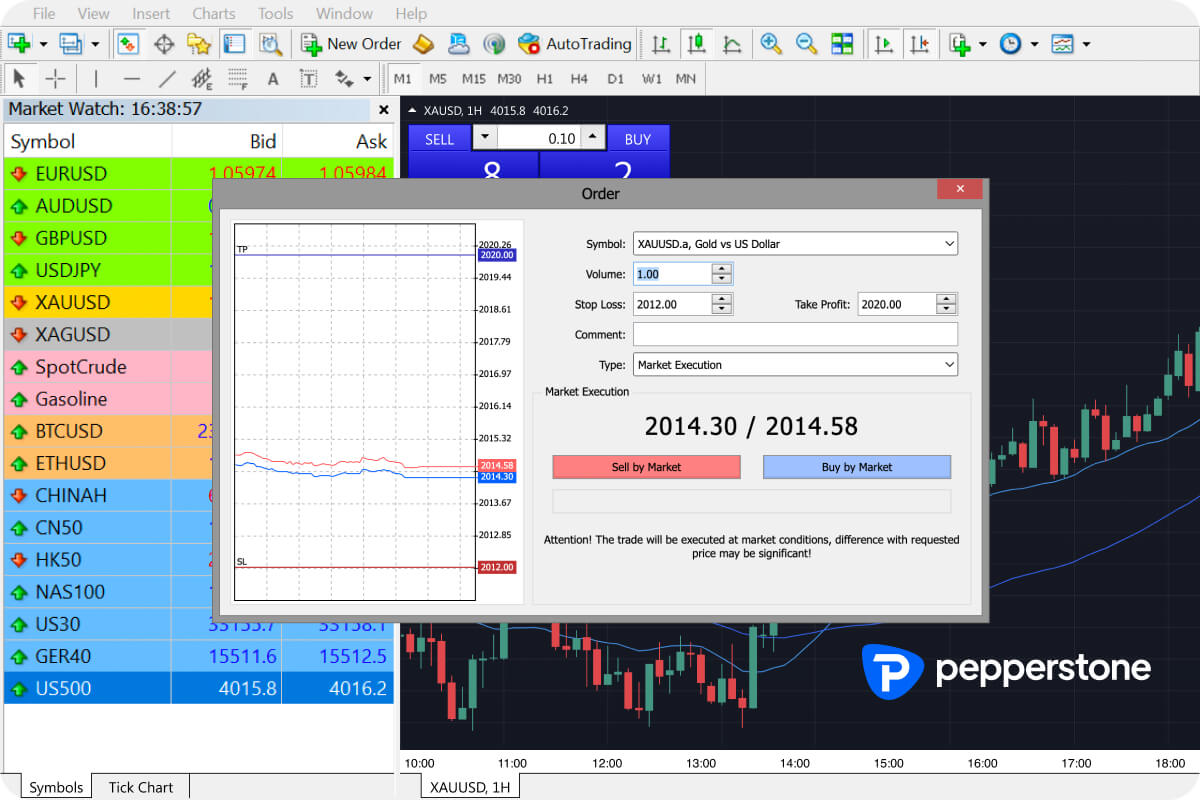

7. Place your first gold order

You should now have the chart of your gold market of choice displayed on the biggest part of your screen. Simply right click on that market and select ‘new order’ to place a trade.

Otherwise, if you want to see the live buy and sell prices easily, click on ‘Chart window’ in the Market Watch list to open that on your main screen. Thereafter, simply click on the buy or the sell icons on your screen to open your first gold position.

8. Set up stop loss and take profit orders to enhance your risk management

If you think that trading successfully is as simple as opening a position and waiting for money to fall into your lap, think again. There are vital risk management steps you need to take in order to secure any profits you might make and limit potential losses.

You can safeguard profit by placing a take profit order, which tells the platform to automatically close out your position when a certain market levels have been reached. Similarly, you’d set up a stop loss order so that any trades you have open are automatically closed if the market turns against you and you reach a level of loss beyond which you’re not comfortable. Once the price has reached your defined stop level, that trade will automatically close, limiting your losses (keep in mind that if the market moves too fast , you may experience more loss than anticipated).

Both stop loss and take profit orders are far easier to master, and more convenient, than sitting glued to your screen watching the gold price all day.

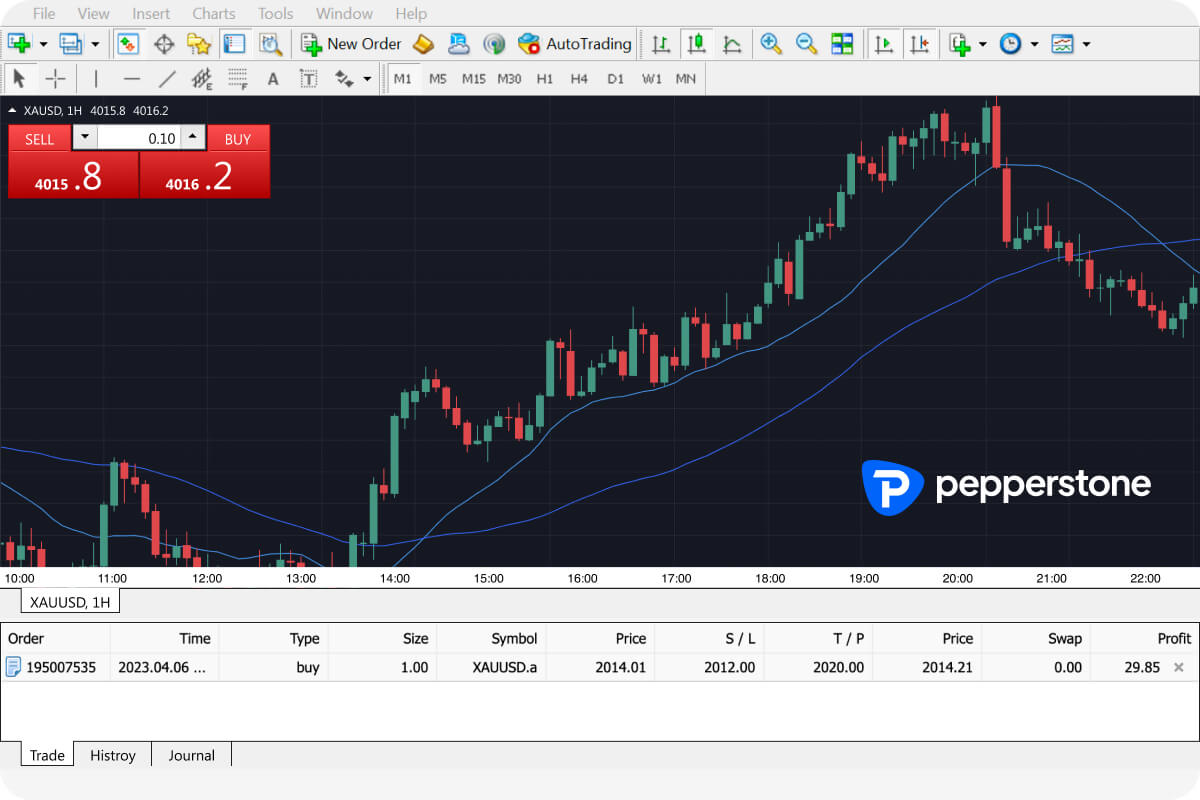

9. Monitor and close your position when you’re ready

With us, you’ll be trading the gold spot price. This means that, if you keep the gold market you’re trading open on your screen, you should be able to watch how you do on your first gold trade live.

Once you’re satisfied with the amount of profit you’ve made or want to limit the amount of loss you’re making) you’ll right click on the chart itself and select ‘close order’ or close the position in your open trade’s deal ticket at the bottom of the screen.

If you have set a stop loss or a take profit order on your trade, these may close your position for you automatically without you having to do anything. This is helpful, as you’re able to lock in profits and limit potential losses without having to watch your position constantly.

Getting started trading gold on MetaTrader 4: things to know

When you trade gold on MT4, you’ll be using something called Contracts for Difference (CFDs) to do so. Gold CFD trading enables you to speculate on the price rising or falling. However much the underlying asset’s price rises or drops – in other words, the difference in the price between when you open your position and close it – will be made by you as either a profit or a loss.

Find out more about CFD trading

CFDs are leveraged. This means that, instead of paying the full value of your position upfront, you’ll put down a kind of deposit, called margin, which is only worth a fraction of the position. However, both your profits and losses will be calculated based on the full position’s size.

Let’s look at an example. Say you want to trade on XAUUSD, the gold price versus the US dollar. You want to open a trade worth £200 but, because you’re trading with gold CFDs and the margin amount is 10%, you’ll only need to put down £20 to open a £200 trade. However, both profits and losses will be calculated off of the full £200 amount, not the £20 margin.

Many traders appreciate leverage’s ability to potentially make bigger profits out of smaller upfront amounts – but the reverse is true as well. Because of the nature of leverage, losses as well as profits can significantly outweigh your margin, so much so that you can easily lose your entire deposit – and more – when you predict incorrectly.

Maximising your chances of trading gold successfully

Gold is a sophisticated, complex asset to understand and trading well on MT4 takes practise. Nevertheless, there are a few things you can do to maximise your chances of being successful when you trade gold on MT4:

- Study your chart of choice, its patterns and reactions to market events, as much as you can

- Familiarise yourself with MetaTrader 4’s many tools

- Ensure that you set a stop loss to prevent making losses up to a certain point

- Also set a take profit order, so that you can reap any profits made before the market shifts

- Have a clear, considered risk management plan for your trading

- Try out gold trading on a free demo account and learn as much as you can there before using your own money to trade

- Practise! The more you trade, for example on a demo account, the better you’ll know your market, which is key to successful trading

FAQs

Can I trade gold on MetaTrader 4?

Yes, you can. Although MT4 is more often associated with forex trading, you can trade gold here too. In fact, it’s actually one of traders’ most popular MT4 markets.

Can I trade gold on other platforms besides MT4?

You can do that as well. We offer gold trading on all of our platforms. This means that you can open a gold position on TradingView, C-Trader and MetaTrader 5, which MetaQuotes designed to be an upgrade of MT4.

What is the gold symbol on MT4?

The symbol or ticker for gold on MT4 is ‘XAU’.

Is gold the same as XAUUSD on MT4?

Not quite – but sort of. All the gold markets on MT4 begin with ‘XAU’ in the Market Watch list. XAU itself would, in theory, represent physical gold itself in this case – which MT4 doesn’t offer.

The closest you’ll get to trading gold itself is XAUUSD, which is the price of gold as compared with the US dollar. Since the USD is what the gold price is actually measured against, this is the live spot price of gold and how you’d speculate on that with MT4 – even though, technically, it’s really speculating on gold vs the dollar.

There are also other symbols for trading gold on MT4, such as XAUAUD for example – gold versus the Australian dollar – if you’d like to speculate on gold’s relationship with other currencies or markets.

Is trading gold on MetaTrader4 good for beginners?

Trading gold on MT4 could be good for beginners – it all depends on how much work you’re willing to put in. Gold as a market requires research and study to understand, in order to know its mannerisms, patterns and correctly predict how it’ll behave in any scenario – which is key to making money when you trade gold on MetaTrader.

However, markets are unpredictable, with past performance not necessarily being a reliable indicator of what may or may not work in the future – so it’s impossible to make a blanket recommendation of any platform for ‘all beginners’.

That being said, MT4 itself as a trading platform is generally be easy to navigate and use for beginners too – but this, too, requires some getting used to. We’d recommend speeding up the process by watching our Getting Started with MetaTrader 4 course.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。