差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。80% 的散户投资者在于该提供商进行差价合约交易时账户亏损。 您应该考虑自己是否了解差价合约的原理,以及是否有承受资金损失的高风险的能力。

EURUSD was on fire through EU trade stopping just shy of 1.0500 – talk of month-end flows predictably doing the rounds, but then it’s been all USD buyers taking us into session lows. The wash-up is an ominous set-up on the EURUSD daily, with a big rejection candle coming off a major supply zone and resistance above 1.0400 – we’ve even seen EUR sellers in US trade vs the AUD and NOK – so it puts emphasis on the view that we’d be seeing EUR month-end flows but these abated and traders faded EUR strength.

EURUSD daily

The focus turns to EU CPI

One of the key event risks this week and a big piece of the macro jigsaw will be the EU inflation data this week – it starts today with German regional CPI prints – notably the North Rhine CPI print is due at 17:30 AEDT (no consensus), and represents a decent chunk of German GDP – this will be followed by the German national CPI print at 00:00 AEDT, where the market expects inflation to remain unchanged at 10.4%, although falling modestly to 11.3% (from 11.6%) on EU harmonized basis.

Following the German CPI print, we see France’s CPI out tomorrow at 18:45 AEDT (consensus 6.1% from 6.2%), before culminating in the Eurozone aggregate CPI inflation print at 21:00 AEDT – The consensus here is for headline inflation to drop from 10.6% to 10.4% - not a huge fall, but it would represent the first decline in EU CPI since August 2020. We can also study the form guide and see that EU CPI has come out topside of analysts’ consensus expectations in each of the past 19 EU CPI reports (although 3 have come in line).

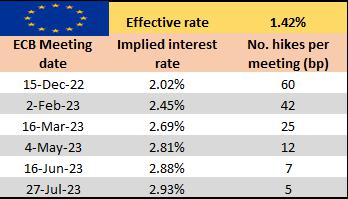

Rates Review – eyeing market pricing for the ECB meeting and the step up into future meetings

The significance of the CPI print is that it could go some way to shaping the outcome of the ECB meeting on 15 Dec – currently, we see the market pricing 60bp of hikes for the Dec ECB meeting which equates to a 40% chance of a 75bp hike – typically when we see a split like this, we can get rates volatility which spills over into increased FX movement. Using this pricing, a 50bp hike is still the base case, but that could be swayed if we don’t see the expected fall in price pressures.

An overly simplistic playbook would suggest if EU CPI prints at 10.6%, and certainly above, then the odds of a 75bp hike from the ECB move above 50% and becomes the market's base case – in theory, a EUR positive vs the crosses. A CPI print below 10.2% should see 50bp become the strong default position.

We can cast our minds back to last week and recall speeches from ECB executive board member Isabel Schnabel, as well as ECB members Lane and Muller – Schnabel’s comments – effectively calling for a further 75bp hike - have been supportive of the current rates pricing and we’ve seen hawkish commentary from President Lagarde in today’s session – again, it emphasises this CPI data could go some way to influencing this rate debate.

We should also consider that there are some positive factors humming way in Europe – or at least less bad – we’ve seen EU NG prices crater, where Europe seems to have LNG all over the shop - stabilisation in energy prices which should help European corporate profitability – while in contraction we’ve seen EU PMI’s come in above expectations, while German IFO survey and GDP have improved. There are some signs of positivity if you look hard enough and this helps EU asset work to the upside – China remains the big unknown and could impact EU assets, just as it could broader global risk sentiment.

Trading the EU CPI print

Playing the EU CPI print suggests taking a closer focus on the EU FX cross rates – the USD is just so sensitive to market sentiment and risk on/risk off dynamics – Long EURCAD has been a big trend play of late, and a big EU CPI print and I’d be focused on this cross, with EURCHF pushing back towards 0.9900. A weak print, which takes pricing firmly to 50bp, and EURJPY shorts would be where I would be looking and another test of the 11 Nov lows.

Naturally, the GER40 and EU equity markets would find better buyers on a low CPI print as real household incomes increase and rate hikes are priced out – the equity bulls could use some additional fodder given price has been consolidating and is starting to look vulnerable for better shorting opportunities – no sell signal on a swing timeframe but watching closely.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。