差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。80% 的散户投资者在于该提供商进行差价合约交易时账户亏损。 您应该考虑自己是否了解差价合约的原理,以及是否有承受资金损失的高风险的能力。

Headlines that the Hang Seng and H-Shares had entered a technical bear market – having fallen 20% since the January highs – have only increased client interest. Where the reasons for the sell-off through February and again from mid-April have been widely discussed, these factors include:

- Since mid-April, China’s economic data has consistently missed market expectations – notably, manufacturing PMIs, fixed asset investment, import demand, industrial profits, and underwhelming new home sales.

- Old-school concerns around potential defaults from property developers have resurfaced.

- Headlines on a souring of US-China relations, with China labelling Micron’s memory chip a national security risk

- The Chinese government cut the issuance of special-purpose bonds by 50% in May – much of this capital is used to fund infrastructure investment. The market sees less fiscal support.

- A weaker yuan – we see outflows from China’s markets, but funds also get paid to be long USDCNH given the attractive carry and interest rate differentials.

- Opportunity cost – while Chinese/HK stocks fell out of favour, we’ve seen US mega-cap tech and global A.I names on a blistering run. Outside the US, we’ve seen strong rallies in the JPN225 and the Kospi. International managers have repositioned holdings geographically.

- Tencent – which holds a 10% weight on the HK50 index - fell from $416 to $306. The 200-day MA is supporting the price for now.

The Heart Of The Issue

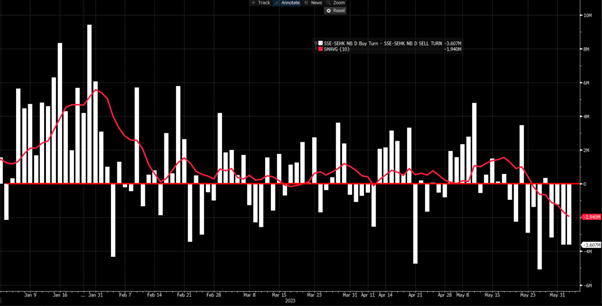

At the heart of the issue have been positioning and capital flows, where throughout January and February, we saw a record amount of foreign capital moving through the Northbound HK-Shanghai ‘connect’. International money managers were attracted to the surprisingly rapid re-opening and positioned portfolios in Chinese and HK stocks to capture the earnings lift that came from the release of pent-up demand.

For the reasons mentioned above, that investment flow has partially reversed, and we’ve seen consistent outflows through the Northbound ‘connect’, averaging $1.94b for the past ten days. These outflows have also resonated in a weaker CNH (offshore yuan), where notably, the PBOC has refrained from pushing back on the currency weakness - FX traders have therefore been only too happy to stay long this cross for the carry.

The Risk-To-Reward Trade-Off

One consideration is that Chinese/HK markets are already unloved, and we can see the market internals reaching extreme levels. On Wednesday, we saw 70% of stocks trade at a 4-week low (the most since March 2022), while only 5% of HK50 stocks were above the 50-day MA. 40% of index constituents have an RSI below 30.

Another factor that is starting to skew the risk-to-reward trade-off is potential policy support, and this may be one reason why Pepperstone clients are now currently positioned for a short-term bounce, with 3 in every 4 open positions held long.

Given the clear loss of economic momentum, there is an elevated expectation that the PBoC will ease the bank's reverse ratio requirement, allowing banks to free up capital and allow increased levels of credit into the economy. Other measures around relaxing rules on home purchases have also been talked about.

Next week's China data flow could be key to sentiment. We see May trade data, CPI/PPI, and new yuan loan data. If this comes in weak vs expectations, it may initially weigh on stocks, but it would also accelerate the need for stimulus.

We continue to focus on the daily Connect flow data as a key guide on sentiment. However, the rising risk of policy support (both fiscal and monetary) amid a market that is grossly unloved suggests a tradeable rally could be underway, and while the technicals suggest this is aggressive, longs are preferred on a tactical basis. Tencent remains critical to the HK50, and any upside moves in the HK50 to 19,600 will require Tencent to push towards $350.

The Technical Picture Suggests Caution Is Warranted

The technical setup, however, needs work, especially on the daily timeframe, and a one-day rally needs follow-through, so with the trend currently lower, my technical view remains biased short. On the higher timeframes, a simple 3 & 8-day EMA study shapes the directional bias, and I’m yet to get an exit signal from short bias. With the tactical view in mind, a bullish EMA crossover is a growing risk, and I would have a far greater conviction of sustained outperformance from the HK50 upon this development.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。