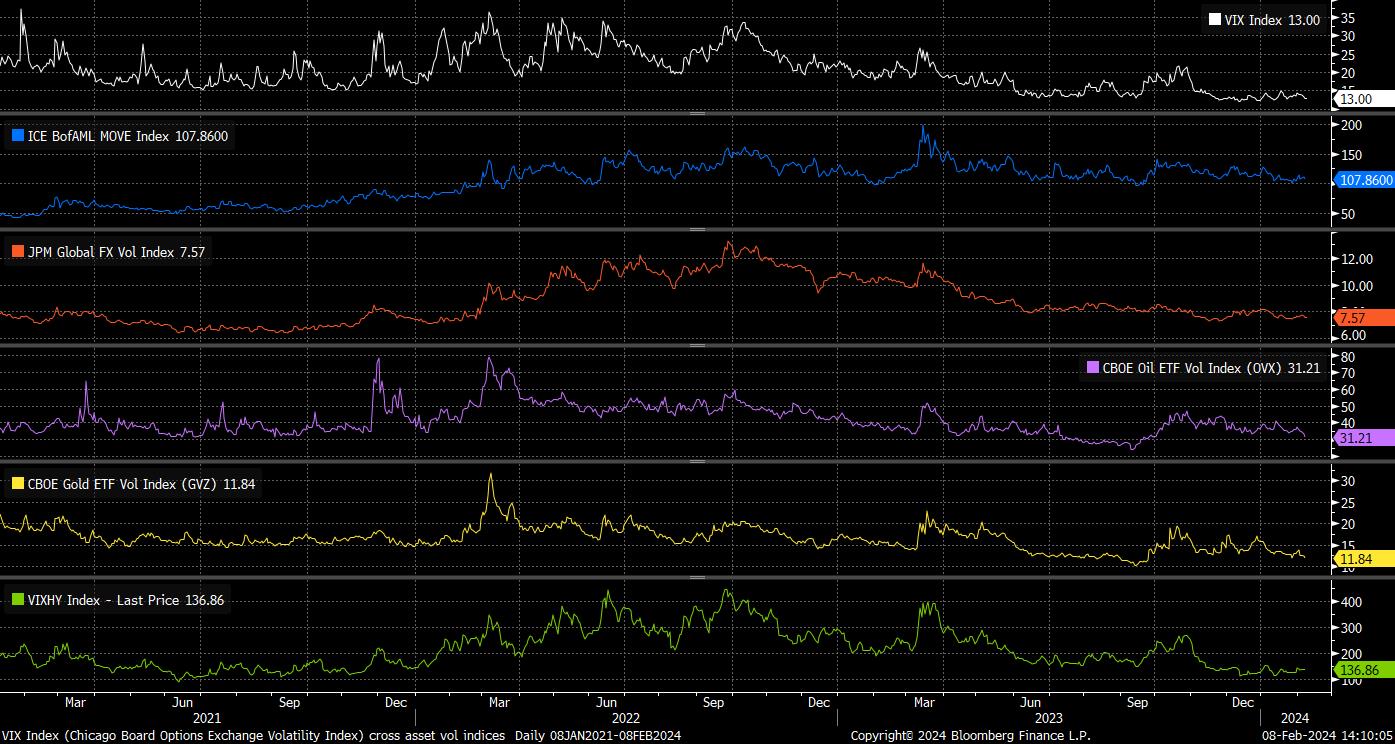

Before discussing that, a look at various gauges of implied vol is probably worthwhile, see chart. As is relatively obvious, cross-asset vol has continued to decline since the turn of the year, particularly in the commodities space, while the VIX remains close to post-covid lows, and BofA’s MOVE index is planted at the bottom of the range that has been in place since the FOMC began their tightening cycle in early-2022.

A similar trend is in evidence in the FX space, with JPMorgan’s proprietary gauge of global FX volatility, covering 27 DM & EM USD pairs, having recently slipped to its lowest level since the fourth quarter of 2023. Anecdotally, as most G10 FX traders can probably attest to, the DM FX space has been particularly subdued of late, and at times akin to watching paint dry.

This lack of movement, and subsequent lack of discounting any fresh risks facing the market, begs the question as to whether markets are ‘priced to perfection’, or whether there are potential tail risks (both left & right) that have not yet been adequately priced.

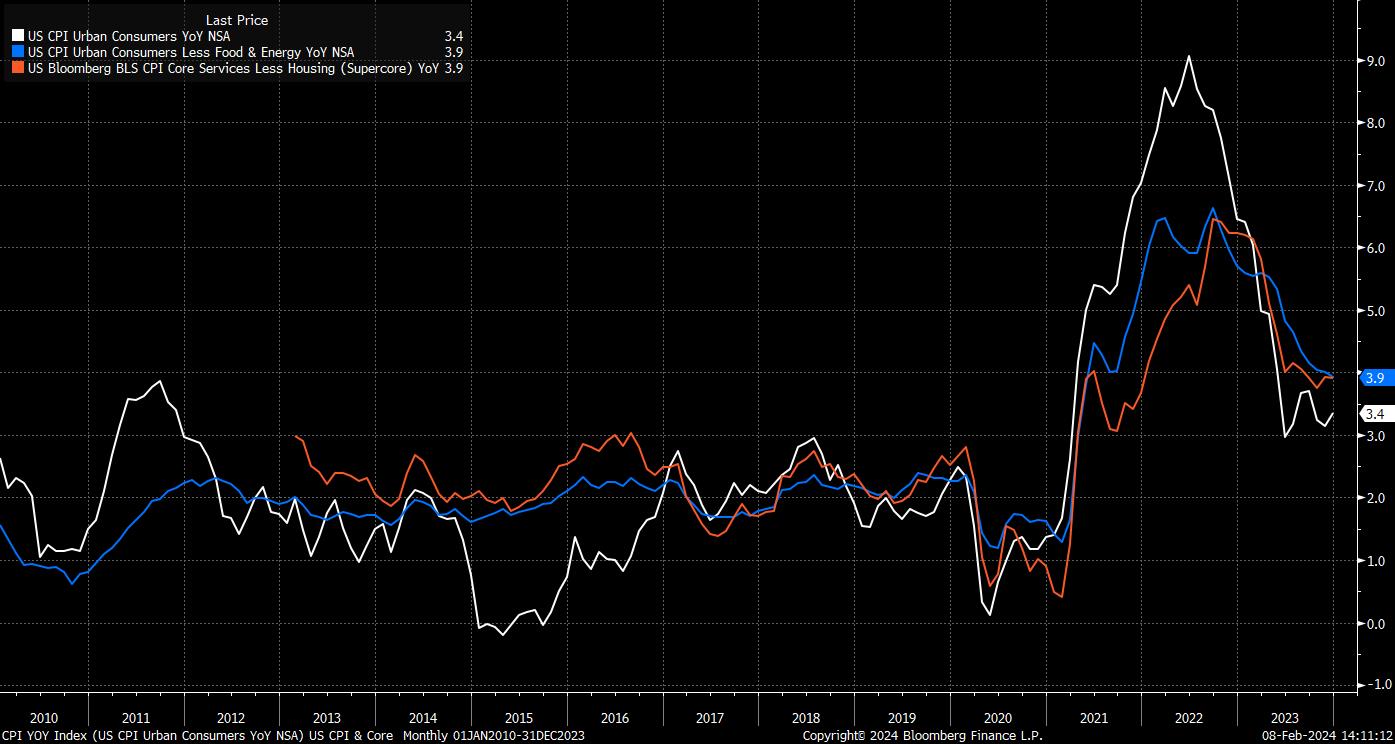

On the one hand, and the camp that I tend to subscribe to at the moment, is the idea that the drop-off in, and continued low levels of, vol is justified. The most obvious rationale for this is that, across developed markets, ‘immaculate disinflation’ appears poised to continue, with headline price gauges set to return steadily towards 2% as the year progresses, and the US economy – in particular – on track for a ‘soft landing’.

While downside growth risks are more prevalent elsewhere, most notably in the eurozone, and of course in China, this backdrop does mean that the global monetary policy outlook, at presents, points to most DM central banks embarking on relatively synchronised, and steady, easing cycles, with money markets fully pricing the first Fed and ECB cuts for June, and the first 25bp cut from the BoE in July. There is a similar degree of commonality around the degree of total easing that markets price by the end of the year.

There is also, of course, the relatively barren spell that markets are currently passing through in terms of major data catalysts. After the blowout January NFP print, there is little of any particular interest on the calendar until next Tuesday’s CPI report; after that, we then look toward earnings from NVDA – the darling of the ‘magnificent seven’ – on 21st February, before focus then turns to the PCE report a the end of the month.

All that said, the economic outlook portrayed above is conditioned on a number of assumptions, chief among which being that the continued lagged effects of the tightening cycle don’t bear down more heavily on economic activity, and that the ‘last mile’ of returning inflation to target proceeds as smoothly as the journey has done thus far. Sticky services prices seem the greatest risk here.

There are, of course, numerous additional risks in the longer-run that markets must remain cognisant of, though which we are probably too far away from at present to be tradeable themes.

Elections in the UK and US, along with 38 other democracies across the globe, are likely to play an increasing role in influencing traders’ psyche as the year progresses, particularly in terms of any fiscal promises – most likely increased spending/lower taxes – that the campaigns for each are likely to bring. It will be of particular interest to see how market participants weigh up a loosening of monetary and fiscal policy at the same time, and how any additional liquidity may provide a tailwind for risk.

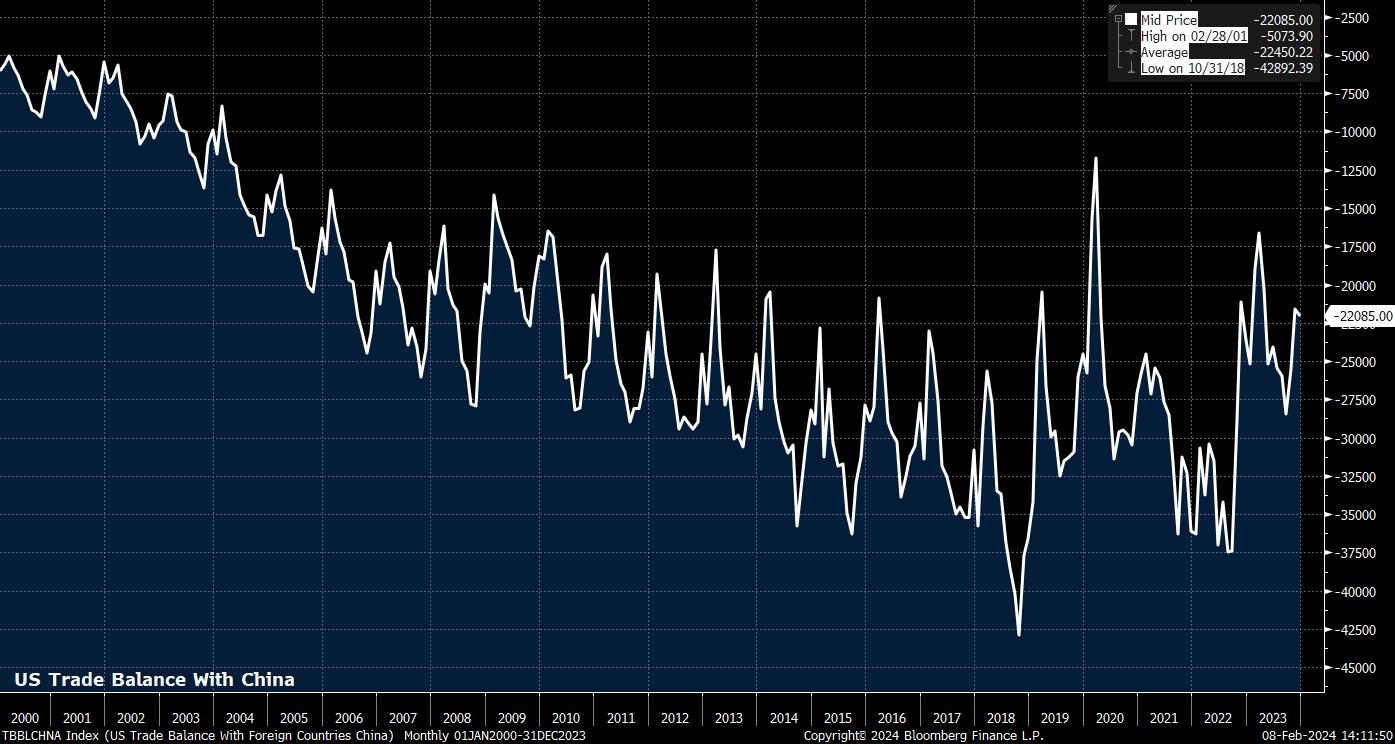

Geopolitical developments of course also remain front and centre, with tensions remaining elevated in Ukraine, the Middle East, and Taiwan, the latter being of particular importance given that competing with China, and ensuring fairer trade, is one of few issues that unites figures on both sides of the political aisle in DC.

In any case, these are longer-run catalysts. For now, it would appear that the ‘path of least resistance’ will continue to lead higher for equities (particularly on Wall St), and to the upside for the USD, though equity upside is likely to be more broad-based across sectors than seen last year. Low vol, then, seems justified, for now.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。