差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。80% 的散户投资者在于该提供商进行差价合约交易时账户亏损。 您应该考虑自己是否了解差价合约的原理,以及是否有承受资金损失的高风险的能力。

As of the 14th of October 2022, The NAV (Net Asset Value) is £497.44. This is the price of one share based on the price of the underlying investments.The fund is invested in 2,083 stocks, a highly diversified fund. There is no fee payable on entering and exiting the fund. The ongoing charge is the fee payable over a year.The risk factor is 5 out of scale of 1-7. 1 being low risk and 7 being high.

Figure 1 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund

Objective

The FTSE Developed World ex-UK is an index that is composed of medium to large cap companies from developed markets excluding the United Kingdom. The fund looks to track the index by replicating the same investments as the weighted capital of the index. The fund will remain fully invested except in extraordinary markets/circumstances.

Statistics

- The launch of the fund was the 23

- FTSE Developed World ex-U.K. Equity Index Fund has share class assets of £10.9 billion.

- The fund is run by Vanguard Global Advisors, LLC., Europe Equity Index Team.

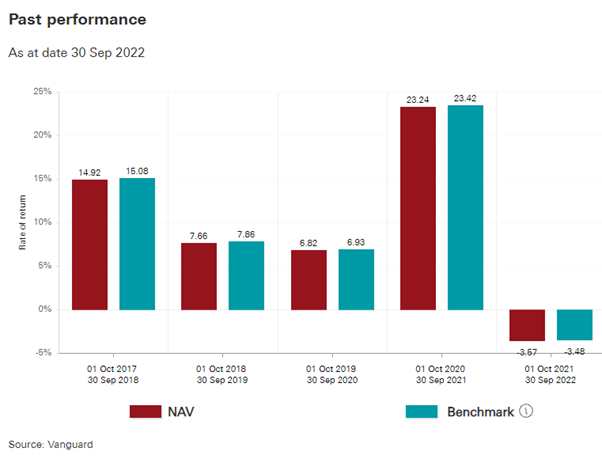

Past performance

The fund has posted net gains for four of the last five years.

Figure 2 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund 5-year performance

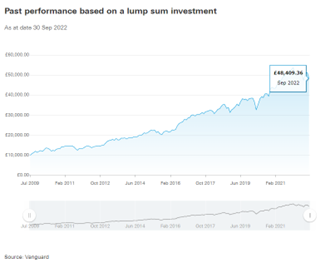

A £10,000 investment at inception (June 2009) would be worth £48,409.36 as of September 2022.

Figure 3 vanguard investor FTSE Developed World ex-U.K. Equity Index Fund £10,000 invested

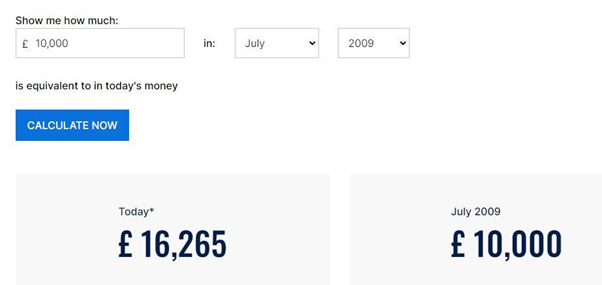

This greatly outstrips the rate of inflation according to the Hargreaves Lansdown Inflation Calculator. The cost of goods over this period would have grown by 62.7% with an annual average of 3.8%. This is compared to the fund increase of 384.09% over the same period.

Figure 3 Hargreaves Lansdown inflation calculator

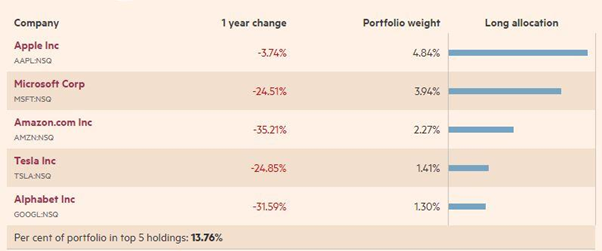

Invested stocks (top 5)

Figure 4 markets.ft.com top 5 stocks

For more information about the US FAANG stock, click here

Invested Regions

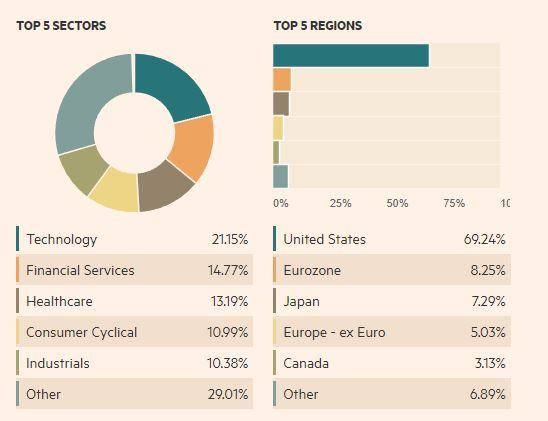

The fund is weighted towards the United States with the top 5 stocks being in the American technology sector.

Figure 5 markets.ft.com invested sectors

Conclusion

If your portfolio is heavily invested in the United Kingdom, you might consider a weighted investment in theFTSE Developed World ex-U.K. Equity Index Fund.This would offer diversification to some of the world's heavyweights, especially in the US technology sector.

For more information about available Pepperstone CFD ETFs (Exchange Traded Funds), click here.

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。