Time – 5am AEDT / 6PM GMT (Jay Powell speaks at 05:30 AEDT)

Central bank meetings are just so important to sentiment and market structure – when we’re trading a major market theme, such as inflation and rising interest rates, this is the market’s chance to mark-to-market policy changes and how the collective in the bank guide our expectations for future meetings ahead.

For traders, notably for those who have exposures sensitive to policy changes, they simply must assess the potential for big volatility, which could affect their positions – our job is to recognise the propensity for sizeable movement, the skew in the outcome distribution and if our stop placement is too close/far from the market.

Do we reduce, exit or in some cases even initiate positions?

For others, the central bank meeting will shape the trading environment and the market structure they work in - not just for that trading session, but for the following days ahead.

Consider day traders who work within a specific timeframe and need to assess if price action constitutes a trending day, and therefore they look more closely at momentum strategies. Or is it more of a choppy, sideways, range-bound day, and therefore looking more readily at intra-day mean reversion strategies?

‘Environment recognition’ is key for day traders and scalpers and edge comes from being able to identify the regime we’re in – perhaps through the application of market profile, VWAP, Bollinger Band strategies (to name a few), as well as good old fashion price action.

An overview of the November FOMC meeting

As we know event risk seldom gets more important than an FOMC meeting, so this is a risk we need to manage. Trading these tier 1 events takes skill like no other – we must react to the statement, but then 30 minutes later we react to individual words and nuance in the press conference from chair Jay Powell. It’s always the high frequency algo’s that recognise the keywords first and we mortals are left trying to react according.

Even once the presser has finished and the dust has settled, quite often we see the ensuing Fed members speaking over the coming week giving their own personal view, and often when we’ve seen violent moves on the day, they will walk back any extreme reaction. The first move is not always the right move.

To some, this lively backdrop, especially when we consider reduced liquidity can be nirvana-type conditions. To others, this is the environment where they have no edge and see it best to stand aside and let price do its thing.

A hawkish ‘step down’ on the cards

We’ve been treated to a roller coaster in Fed ‘pivot’ expectations - Ranging from a WSJ article of an impending ‘step down’ in the pace of hikes starting at the December meeting. To dovish turns from the RBA, ECB and BoC – however, the Fed are their own boss and they see US labour market data that has been solid (as donated by the Employment Cost Index and JOLTS report) – US 5-year inflation expectations are rising and next week’s US core CPI print will likely be close to unchanged at 6.6% YoY - it seems highly unlikely that the Fed will want to promote a positive reaction in risky assets, and the risks to markets in my mind are skewed to a hawkish reaction – equity up, bond yields and the USD lower.

In the Fed’s view, putting the US into a recession is still a lesser evil than not tackling entrenched price pressures.

While traders would fall off their chair if the Fed didn’t hike by 75bp at this meeting, it’s the guidance for future meetings which is where we get a reaction in markets.

We are likely to hear that the pace of hikes in the future will fall to a more conventional pace – this is the ‘step down’ many have focused on. But this narrative will be accompanied by strong conditionality, and the statement will be about giving the Fed maximum flexibility and optionality for the December meeting – that call will be fully data-dependent.

So, consider there is a lot of information between now and the 14 December FOMC meeting – we have 2 non-farm payrolls reports, the Oct CPI print (11 Oct) and the midterm elections. It’s no wonder the market is pricing 62bp of hikes for that meeting and hedging their bets of a 50 or 75bp hike – it's this pricing for the Dec FOMC meeting which I think is key for markets.

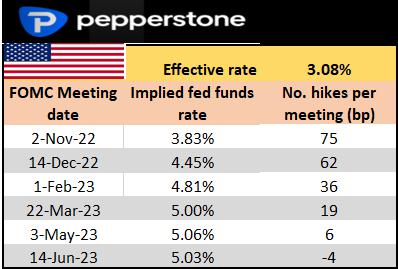

Rates Review – we see market pricing for the Nov FOMC meeting at 75bp – then a step to 62bp in the Dec meeting.

The holy trinity – the three markets to drive cross-asset volatility

Pricing for the December FOMC meeting

So part of the reaction will be seen in the pricing for the Dec FOMC meeting which currently sits at 4.41% – traders can see this on TradingView by typing ‘100-ZQF2023’ into the navigator. A dovish reaction would be to see this headed below 4.4%, where we would expect the USD to sell off and gold and equities to rally. A push towards 4.50% would see USDJPY push towards 150 and EURUSD through 0.9800.

Terminal fed funds rates pricing

We also look at the terminal rates pricing – this is the peak of market expectations for where the Fed can take rates, which currently sit in the May to June 2023 period at 5% – we can type in ‘100-ZQK2023’ into the navigator. A firm break above 5% would send risk lower.

US 2-year Treasury

I also look at US real rates and 2yr Treasuries (US02Y) closely as a driver for risk assets – If yields rise then we should see the NAS100 and gold fall and the USD spike, especially if we take out the 21 Oct high of 4.63% – conversely if yields fall/price rise then the USD will likely fall.

As always around key events, the reaction in markets is a function of:

- The outcome vs expectationS

- Positioning

- Hedging activity

- Liquidity

My own view is the risks are skewed for a hawkish reaction – USD higher, but I will recognise the moves in rates suggests the market is largely positioned for this outcome.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求准备,因此被视为市场沟通之用途。虽然在传播投资研究之前不受任何禁止交易的限制,但我们不会在将其提供给我们的客户之前寻求利用任何优势。

Pepperstone 并不表示此处提供的材料是准确、最新或完整的,因此不应依赖于此。该信息,无论是否来自第三方,都不应被视为推荐;或买卖要约;或征求购买或出售任何证券、金融产品或工具的要约;或参与任何特定的交易策略。它没有考虑读者的财务状况或投资目标。我们建议此内容的任何读者寻求自己的建议。未经 Pepperstone 批准,不得复制或重新分发此信息。