分析

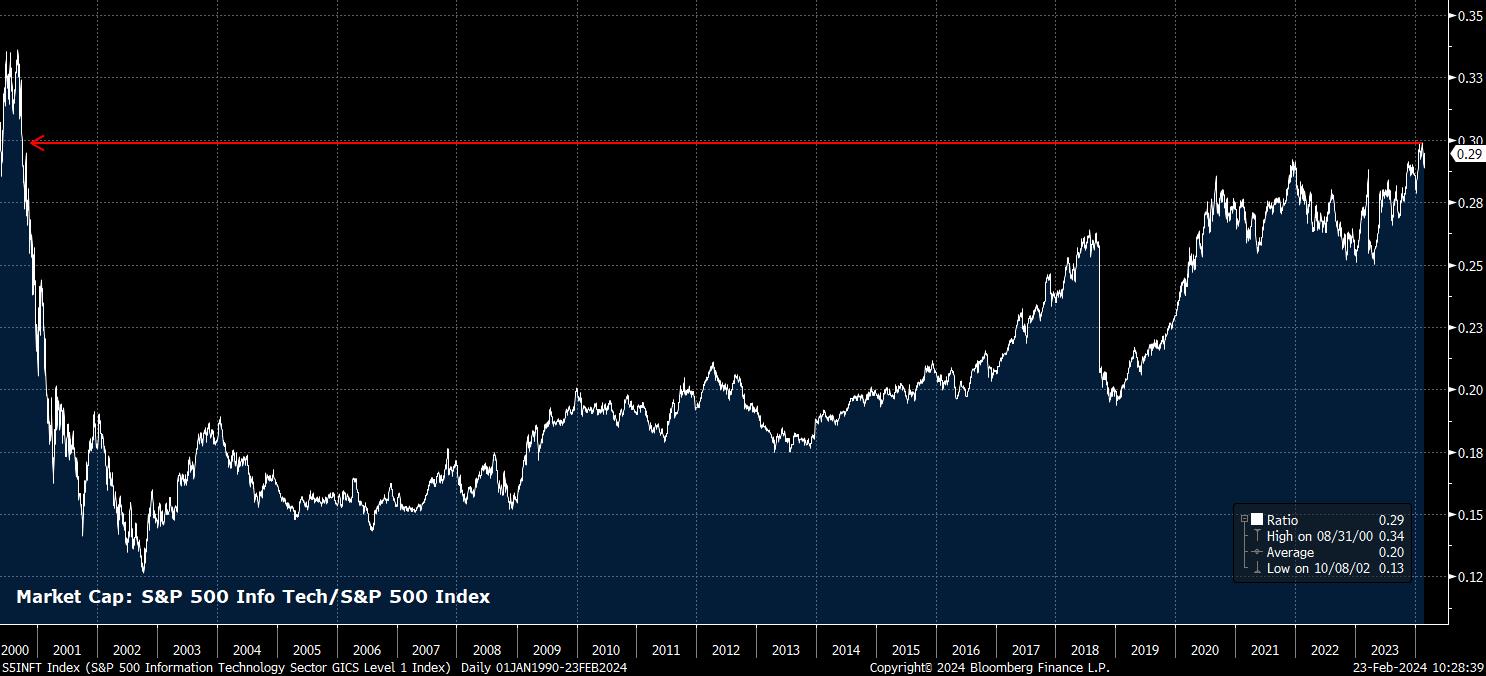

Setting Prince’s lyrical genius to one side – and don’t bother knockin’ on my door if you wish to complain about the puns – it’s worth examining why the landscape for the tech sector, particularly as the S&P 500 becomes increasingly concentrated, as shown below.

Of course, this concentration has been no bad thing for broader indices thus far, with the vast outperformance of the ‘magnificent seven’ having powered the majority of the gains seen in 2023, and continuing to underpin the market in the early part of 2024, with Nvidia and Meta remaining the standout performers of the bunch.

Naturally, as with any market that moves a long way in a short period of time, this begs the question as to whether moves have become overextended, and whether a retracement is likely. In this instance, I would argue that it is not, for numerous reasons.

Firstly, within the ‘magnificent seven’ in particular, there is actually a surprisingly diverse range of sectors and industries represented. While easy to slap the ‘tech’ label on all seven stocks and be done with it, this masks the true story – Meta are, at this point, effectively a marketing firm, with advertising revenue making up the bulk of income; Amazon, recently included in the Dow, are a retailer; Tesla, obviously, are an automaker; Alphabet, officially, operates in the Communication Services sector; leaving just Apple, Microsoft, and Nvidia as the ‘pure’ tech plays of the bunch.

This diversification is, clearly, in stark contrast to those firms – many of which are no longer with us, or are a shadow of their former selves – which dominated the market during the ‘dotcom bubble’, which were, as the name would suggest, almost entirely and squarely focused on the internet, during its infancy.

On this note, not only are the ‘magnificent seven’ more diversified than the biggest stocks during the ‘dotcom’ era, they also all play a substantially more important role in the broader economy. Clearly, the internet is no longer a new and unknown technology, and plays an integral role in day-to-day life. What the market is presently discounting is that the usage of new technologies, such as AI, which per NVDA’s earnings has reached a ‘tipping point’ towards mass adoption, will continue to grow at, or in excess of, the current pace.

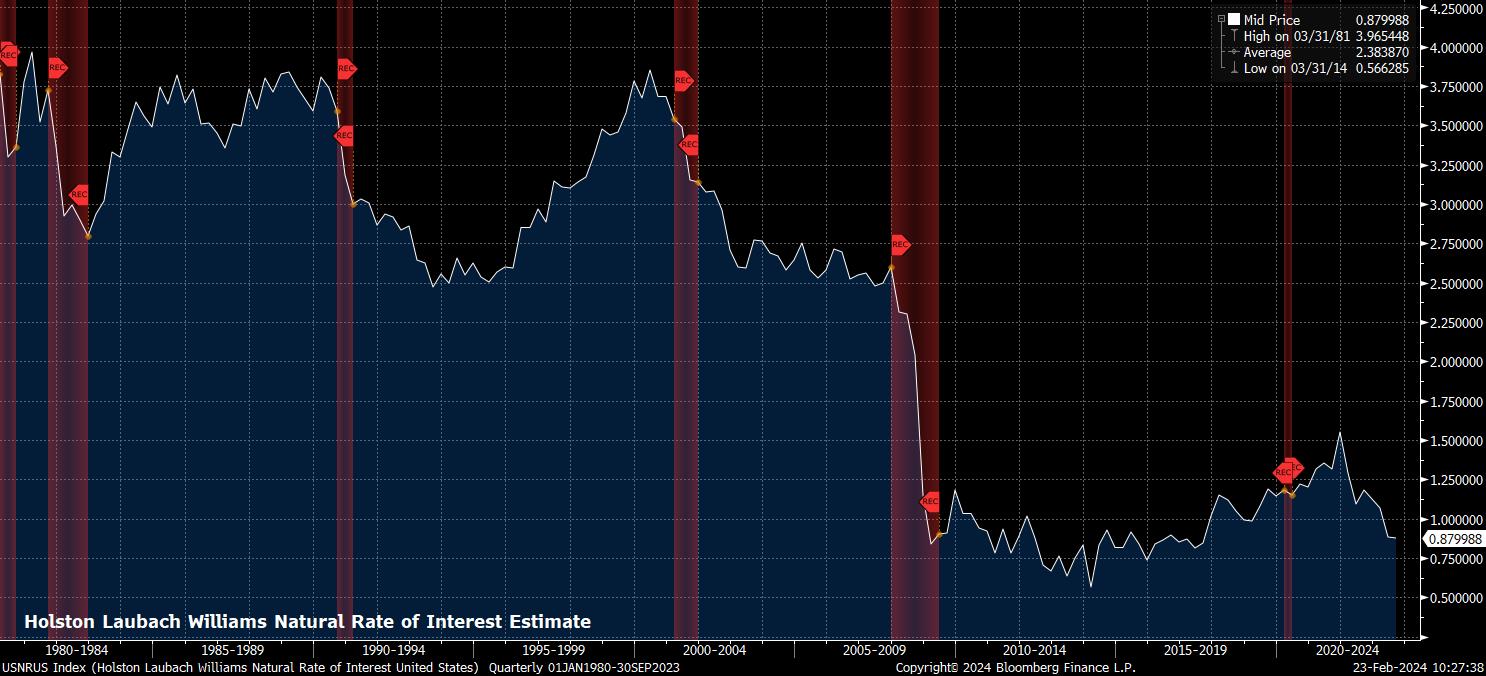

Of course, there is a macro theme here too, if that were indeed to take place. The productivity improvements that increased AI usage may bring across the global economy could, in the longer-run, have a significant impact, potentially resulting in a higher level of r* in the future, all else being equal.

As for shorter-term considerations, particularly with the tech sector having become somewhat decoupled from interest rates of late, both from a price perspective, and in terms of the firms’ ability to deliver consistent revenues regardless of the interest rate environment, the path of least resistance for the sector looks set to continue leading to the upside.

Not only will this continue to support the handful of stocks in question, it is also likely to provide a tailwind to the US market more broadly. Hence, this should see the US continue to outperform DM equity peers, particularly in Europe, where the concentration of tech names is substantially lower and, in some cases such as London, near non-existent.

_Daily_2024-02-23_10-25-59.jpg)

Related articles

此處提供的材料並未按照旨在促進投資研究獨立性的法律要求準備,因此被視為市場溝通之用途。雖然在傳播投資研究之前不受任何禁止交易的限製,但我們不會在將其提供給我們的客戶之前尋求利用任何優勢。

Pepperstone 並不表示此處提供的材料是準確、最新或完整的,因此不應依賴於此。該信息,無論是否來自第三方,都不應被視為推薦;或買賣要約;或征求購買或出售任何證券、金融產品或工具的要約;或參與任何特定的交易策略。它沒有考慮讀者的財務狀況或投資目標。我們建議此內容的任何讀者尋求自己的建議。未經 Pepperstone 批準,不得復製或重新分發此信息。